Nifty Closed at 22,641; Nifty Prediction for Tomorrow

Nifty Prediction for Tomorrow

Indian Stock Market Update: A Tug-of-War Between Bullish Momentum and Profit Booking (April 9th, 2024)

Market Recap: A Fading Dream of Record Highs

The Indian stock market experienced a session defined by both ambition and caution on Tuesday, April 9th, 2024.

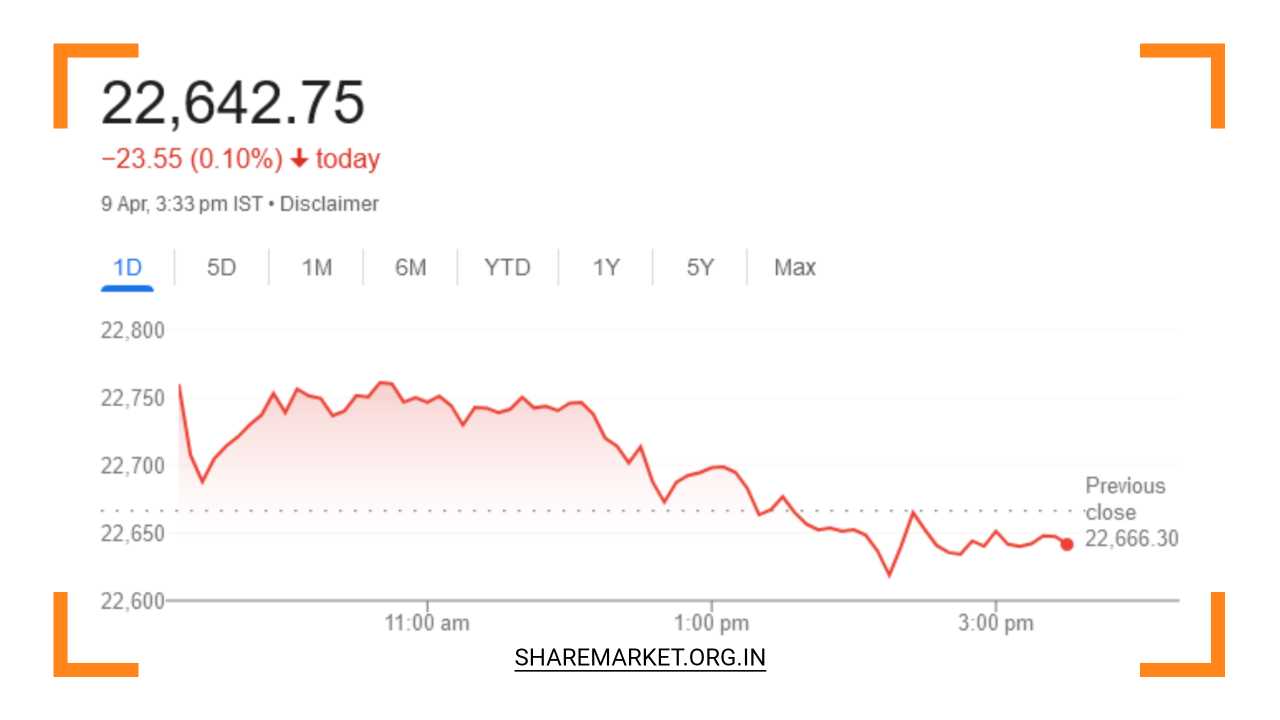

The benchmark indices, Sensex and Nifty, started the day chasing record highs but ultimately succumbed to profit booking, closing marginally lower. Sensex dipped 58.80 points (0.08%) to settle at 74,683.70, while Nifty retreated 24.50 points (0.11%) and closed at 22,641.80.

This retreat highlights the delicate balance between bullish momentum and investor caution in the current market climate.

Dissecting the Day’s Action: Sectoral Victories and Losses

The trading session displayed a mosaic of performance across different sectors, reflecting the market’s indecision.

- Victorious Sectors: Metal and realty emerged as the unlikely heroes, climbing over 0.5%. Companies like Apollo Hospitals, Hindalco Industries, ICICI Bank, Infosys, and Bajaj Finserv led the charge on the Nifty. Their gains suggest continued investor faith in these sectors’ growth prospects.

- Losers Face Reality: Media, auto, capital goods, and FMCG sectors witnessed a decline of 0.5-1 percent. Titan Company, Hero MotoCorp, Coal India, Reliance Industries, and Asian Paints found themselves among the top Nifty losers. This could be attributed to profit booking after recent gains or concerns about specific companies within these sectors.

Broader Market Participation: A Mixed Bag

The broader market mirrored the sentiment of the benchmark indices. The Smallcap index managed to eke out a gain, suggesting a more resilient spirit among smaller companies.

However, the Midcap index closed with a slight decline, indicating profit booking across a wider spectrum. While the daily chart formed a bearish candle, a temporary setback, analysts remain cautiously optimistic about the overall market trend.

Expert Insights: Navigating the Uncertain Path Forward

Aditya Gaggar of Progressive Shares provides a technical perspective:

- Nifty’s initial record high fizzled as the day progressed, settling into sideways movement during the morning session.

- Profit booking intensified in the second half, leading to the slight decline.

- Metal and realty sectors exhibited strong momentum, indicating potential buying interest.

- Support for Nifty lies at 22,530, with immediate resistance at 22,780. These levels are crucial for gauging the market’s direction.

- Any correction presents a potential buying opportunity for investors seeking well-performing stocks at lower prices.

Jatin Gedia of Sharekhan offers a fundamental analysis:

- Nifty faced selling pressure despite opening with gains, highlighting investor nervousness.

- Resistance encountered at the upper channel of 22740-22770 suggests a potential short-term ceiling for the index.

- The Hourly Momentum indicator’s negative crossover signals a potential slowdown in the market’s upward momentum.

- Consolidation is likely in the near future, offering a period of stabilization before the next leg up. However, the overall trend remains positive, suggesting the market might be due for a healthy correction before resuming its upward trajectory.

- Buying opportunities might emerge if Nifty falls towards the 22600-22580 zone.

- Bank Nifty may experience selling pressure but is likely to maintain its positive stance. Support for Bank Nifty sits at 48550-48500, presenting a potential buying zone for investors bullish on the banking sector. Resistance lies at 49250-49300, which could act as a hurdle for further gains.

Conclusion: A Market in Flux – Embracing Volatility

The Indian stock market’s performance on April 9th demonstrates the inherent volatility within the financial world. While record highs were within reach, profit booking and technical resistance ultimately caused a pullback.

However, this should not overshadow the underlying optimism that continues to fuel the market.

Investors should be prepared for volatility in the near future, with potential consolidation periods offering opportunities for strategic adjustments.

By following expert guidance, monitoring sector performance, and conducting thorough due diligence, investors can navigate this dynamic market environment and make informed investment decisions aligned with their financial goals.

Additional Considerations:

- This report is for informational purposes only and should not be considered financial advice.

- Investors are strongly encouraged to conduct their own research and consult with a financial advisor before making any investment decisions.

- Global events, economic factors, and company-specific news can significantly impact the stock market. Staying informed about these developments is crucial for successful investing.

By understanding the complex dynamics at play within the market, investors can position themselves to capitalize on potential opportunities and mitigate potential risks. Here are some additional points to consider:

Global Influences:

- The Indian stock market does not operate in isolation. Global events and economic factors can significantly impact its performance. Investors should stay informed about:

- Geopolitical tensions

- Interest rate hikes by major central banks

- Fluctuations in global crude oil prices

- Performance of other international stock markets

Company-Specific News:

- Individual company performance can significantly influence the broader market. Investors should be aware of:

- Upcoming earnings reports

- Major product launches or acquisitions

- Changes in company leadership

- Regulatory announcements or legal issues

Investment Strategies for the Current Market:

- Diversification: Spreading investments across different sectors and asset classes can help mitigate risk. Consider including stocks, bonds, mutual funds, and real estate in your portfolio.

- Long-Term Focus: Short-term volatility is inevitable. Maintain a long-term investment horizon to weather market fluctuations and benefit from potential long-term growth.

- Discipline and Patience: Avoid impulsive decisions based on market panic or euphoria. Stick to your investment strategy and remain patient to achieve your financial goals.

- Regular Review and Rebalancing: Periodically review your portfolio’s performance and rebalance it as needed to maintain your desired asset allocation.

By incorporating these insights, investors can navigate the intricacies of the Indian stock market and make informed decisions that align with their risk tolerance and financial objectives.

Remember, the market rewards those who are prepared, adaptable, and willing to learn from the ongoing market dialogue.