Sensex Down 167 Points, Nifty at 24,981; Tomorrow Nifty Prediction

Tomorrow Nifty Prediction

October 10 Market Predictions and Analysis

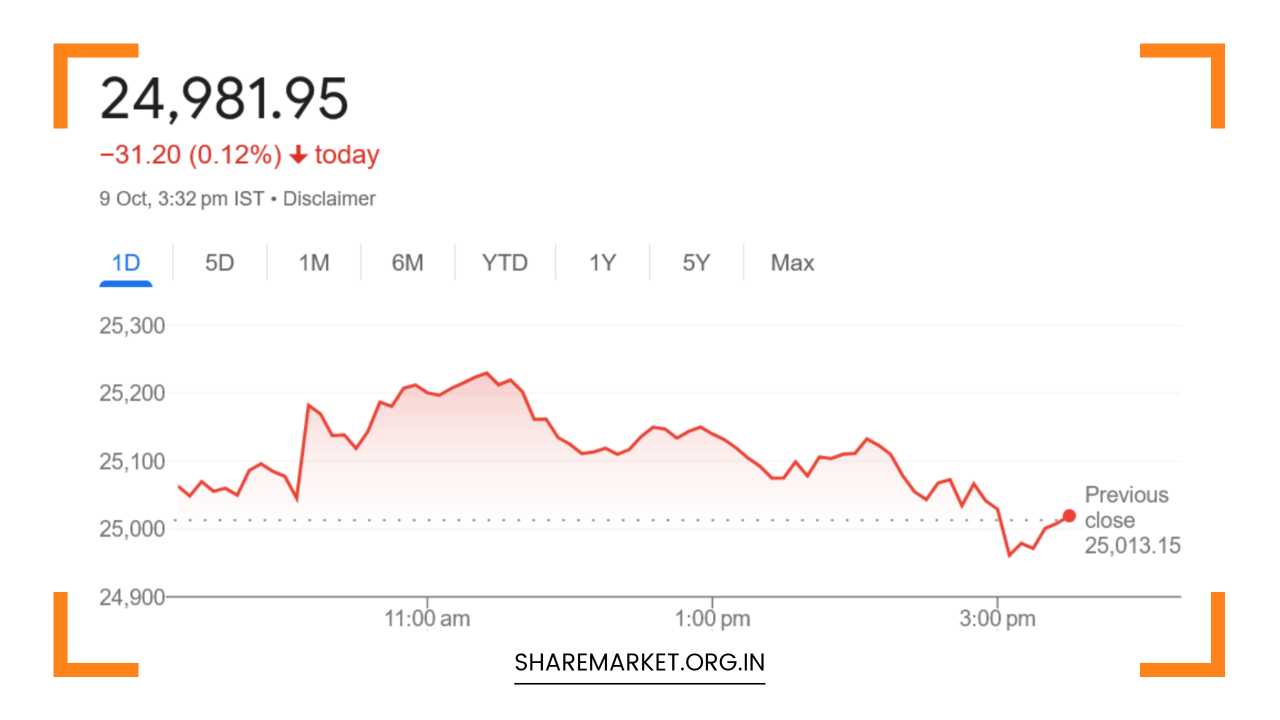

The Indian stock market faced a challenging day on October 9, with both the Sensex and Nifty indices closing in negative territory amid a volatile trading environment.

The Sensex concluded at 81,467.10, down 167.71 points or 0.21%, while the Nifty finished at 24,982, declining by 31.20 points or 0.12%.

After a promising start, market dynamics shifted in the latter part of the session, leading to a notable sell-off in key heavyweight stocks, which ultimately pulled the indices lower.

In terms of market breadth, approximately 2,580 stocks advanced while 1,201 declined, with 93 stocks remaining unchanged.

Among the major laggards in the Nifty index were ITC, Nestle, Reliance Industries, ONGC, and Hindustan Unilever (HUL).

In contrast, the biggest gainers included Trent, Cipla, Tata Motors, State Bank of India (SBI), and Maruti Suzuki, indicating a mix of sectoral performances within the market.

Sector Performance

The BSE Midcap and Smallcap indices demonstrated resilience, gaining over 1% during the session.

This suggests that smaller and mid-tier companies are drawing investor interest, often viewed as a sign of broader market confidence.

While most sectors managed to end positively, the Fast-Moving Consumer Goods (FMCG) sector faced a decline of 1.3%, highlighting ongoing challenges in consumer spending and market dynamics. The Oil & Gas sector also saw a minor drop of 0.6%.

On the positive side, sectors such as Pharmaceuticals, Power, and Realty exhibited gains between 1% and 2%.

The Pharma sector, in particular, has benefited from a steady demand for healthcare products, which has remained robust despite economic uncertainties.

Power and Realty sectors have also shown resilience, aided by government initiatives and infrastructure spending.

Technical Analysis

From a technical standpoint, the market exhibited some critical levels that investors should monitor closely.

Aditya Gaggar, Director at Progressive Shares, emphasized the importance of the resistance level at 25,200, which proved pivotal during the trading session.

After an initial strong performance, Nifty struggled to maintain its gains, and in the end, it closed at 24,981.95, down 31.20 points.

According to Gaggar, the current support level for Nifty is established at 24,750, while resistance is firmly positioned at 25,200.

The behavior of the index around these levels will be crucial for determining the market’s direction in the coming days.

A decisive breakout above the resistance level could signal a bullish trend, whereas a fall below the support level may trigger further corrections.

Rupak Dey from LKP Securities noted that while Nifty initially started with gains, it was unable to hold onto them, which raises concerns about potential weakness in the market.

He pointed out that the index closed slightly above the 20-day moving average, suggesting a positive short-term trend as long as Nifty remains above 24,940.

However, he cautioned that if the index falls below this level, it could lead to a correction towards 24,800 or even 24,700.

On the upside, surpassing the 25,100 mark may face further resistance, but could also indicate renewed bullish momentum.

Market Drivers

Several factors are influencing market sentiment as we move into October 10. Global cues, including international economic data, geopolitical tensions, and shifts in commodity prices, play a significant role in shaping investor sentiment.

Additionally, the ongoing earnings season is a critical focus for market participants, as quarterly results from major companies will provide insights into corporate performance amid fluctuating economic conditions.

Economic indicators, such as inflation rates, interest rate policies, and GDP growth forecasts, will also have a substantial impact on market direction.

Investors will be closely monitoring the Reserve Bank of India’s (RBI) stance on monetary policy, especially in light of recent inflationary pressures that could affect consumer spending and business investment.

Investor Sentiment

The current market environment reflects a cautious sentiment among investors. The mixed performance of various sectors suggests that market participants are selective, focusing on stocks and sectors that demonstrate strong fundamentals and growth potential.

This cautious approach may lead to increased volatility, as investors react to both domestic and global developments.

Long-term investors might view the recent pullback as an opportunity to accumulate quality stocks at attractive valuations.

In contrast, short-term traders may adopt a more tactical approach, aiming to capitalize on fluctuations in stock prices and market movements.

Looking Ahead

As we approach October 10, investors should remain vigilant and attentive to key levels of support and resistance.

The performance of the Nifty and other indices in relation to these levels will likely dictate market sentiment and direction.

A breakout above resistance could invite bullish momentum, while a drop below support may lead to further selling pressure.

Additionally, upcoming economic data releases, corporate earnings reports, and potential policy announcements will be critical in shaping market expectations.

Stakeholders should prepare for potential volatility as they navigate these developments.

In conclusion, the Indian stock market is at a crossroads, with critical resistance and support levels in play.

Market participants should remain alert and informed, as the interplay of global and domestic factors will continue to shape the landscape.

By closely monitoring technical indicators and sector performance, investors can position themselves strategically for the days ahead.