Market Closes Flat: What to Expect on November 12

Nifty Prediction

Market Closes Flat Amid Volatility: What to Expect on November 12

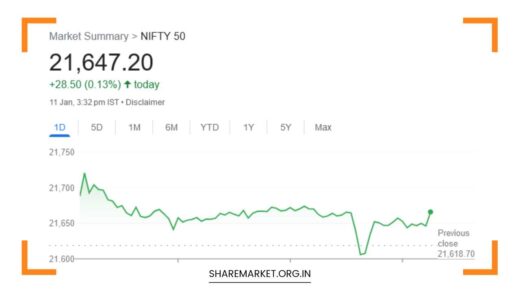

Market Summary: The Indian stock market ended the session on November 11 with mixed sentiment, reflecting high volatility and an indecisive mood among investors.

While the benchmark indices saw minimal changes, the broader market showed significant divergence. The Sensex managed to close marginally in the green, while the Nifty ended slightly lower.

Banking and IT stocks helped stabilize the indices, while the midcap and small-cap segments struggled, continuing their underperformance from previous sessions.

The day’s price action was marked by significant fluctuations in both directions, indicating uncertainty among market participants.

Despite some positive signs in specific sectors, particularly IT and banking, there are lingering concerns over weak performances in other sectors like media, metals, and FMCG, as well as ongoing weakness in mid and small-cap stocks.

Traders and investors are advised to tread carefully, as broader market direction remains unclear.

Key Market Highlights:

- Sensex Performance: The BSE Sensex closed 9.83 points higher (0.01%) at 79,496.15.

- Nifty Performance: The Nifty 50 index ended 6.90 points lower (0.03%) at 24,141.30.

- Market Breadth: A total of 1,446 stocks advanced, while 2,478 stocks declined, and 116 stocks remained unchanged.

- Sector Performance: The Banking and IT indices posted gains, while Auto, FMCG, Healthcare, Metal, Oil & Gas, and Media sectors saw declines in the range of 0.5% to 1%.

Sectoral Insights:

Banking Sector: The banking sector emerged as one of the key positive performers, as it gained 0.6% during the session.

The Nifty Bank index saw strength in key private-sector banks, with major names like HDFC Bank, ICICI Bank, and Axis Bank leading the charge.

This uptick in banking stocks helped the market hold up despite weakness in other areas. The strong performance of financial stocks raised hopes that the sector’s recovery could continue, especially amid positive sentiment around loan growth and stable asset quality.

IT Sector: The Information Technology sector also helped keep the market afloat, with the Nifty IT index gaining 1%. Stocks like Infosys, HCL Technologies, and Tech Mahindra were among the top gainers in the Nifty.

Investors seemed optimistic about the sector’s ability to maintain steady growth despite global challenges, such as rising inflation and geopolitical tensions.

The ongoing digital transformation in global enterprises continues to support strong earnings growth for Indian IT companies.

Mid and Small-Cap Stocks: While large-cap stocks in the banking and IT sectors showed resilience, the midcap and small-cap segments faced continued pressure.

The BSE Midcap index fell by 0.8%, and the Smallcap index saw a steeper decline of 1%. These declines reflect ongoing investor caution in riskier, less liquid stocks, particularly in the wake of mixed corporate earnings results and concerns about the broader economic environment.

The weak performance of mid and small-cap stocks suggests that investors remain wary of uncertainty in the global economy and domestic growth prospects.

Underperforming Sectors: The Auto, FMCG, Healthcare, Metal, Oil & Gas, and Media sectors were the worst-hit on November 11, with most of them registering losses in the range of 0.5% to 1%.

In particular, the media and metal sectors faced selling pressure as concerns around slowing global demand and domestic economic growth continued to weigh on investor sentiment.

The FMCG sector also came under pressure, as rising input costs and potential demand slowdowns raised concerns about margin pressures for companies in this space.

Stock-Specific Insights:

Top Gainers:

- Infosys, HCL Tech, and Tech Mahindra were among the top gainers on the Nifty, with each of them seeing a strong rally as investors bet on continued growth in the IT sector.

- Power Grid Corporation and Trent were also notable gainers, supported by positive sentiment in utilities and retail, respectively.

Top Losers:

- Asian Paints and Britannia were the top Nifty losers, reflecting concerns about high valuations and potential margin compression in the FMCG space due to rising input costs.

- Other notable losers included Apollo Hospitals, Cipla, and ONGC, which faced broad-based selling amid weakness in the healthcare and oil & gas sectors.

Market Technicals:

From a technical perspective, the Nifty index tested both resistance at 24,250 and support at 24,000 during the day.

This price action created a spinning top candlestick pattern, which indicates market indecision and a tug-of-war between buyers and sellers.

The formation of this pattern suggests that the market is at a crossroads, with no clear winner emerging between the bullish and bearish forces.

In the near term, traders will be closely watching for a breakout in either direction. A break above 24,250 could signal a potential move toward 24,500-24,600, while a break below 24,000 may open the door for further declines, potentially testing the 23,800-23,900 range.

Expert Opinions:

Aditya Gaggar, Director at Progressive Shares, commented that the Indian stock markets have had a slow start to the week, with mid and small-cap stocks continuing to drag the overall index lower.

However, he pointed out that the performance of banking and IT stocks has provided some relief, helping the Nifty recover from the early losses.

“Despite these sectoral gains, the overall market breadth remains weak, and the weakness in mid-cap and small-cap stocks is a concern,” he added.

Ajit Mishra, Vice President at Religare Broking, observed that the market had closed almost flat despite significant volatility, as banking and IT stocks saw strong buying interest.

“The rise in banking and IT stocks has fueled hopes of a recovery, but for a sustained rally, these sectors will need to maintain their momentum,” he said.

Mishra also cautioned that volatility could increase as the earnings season comes to a close and advised traders to adopt a hedged approach while focusing on selective stocks that show strength.

What to Expect on November 12:

Looking ahead, the market is likely to remain volatile, with uncertainty continuing to surround global economic growth, domestic earnings, and inflationary pressures.

As of now, the performance of the banking and IT sectors will be crucial in determining whether the market can maintain its upward momentum.

If these sectors can hold their ground and continue to show resilience, there may be a chance for a recovery.

However, if broader market weakness persists, particularly in mid-cap and small-cap stocks, the market could remain in a narrow trading range, with choppy price action across various sectors.

With the final phase of earnings season upon us, volatility is expected to rise. Traders should be cautious and consider adopting hedged strategies to navigate the potential swings in the market.

Focusing on stock selection in sectors with strong earnings visibility and robust growth potential—such as IT and banking—may help limit downside risk and position portfolios for potential upside.