Market Closes Flat: Insights on Potential Movements for December 27

Tomorrow Nifty Prediction

Indian Indices End Flat, Prediction for December 27 Amid FII Selling Pressure and Narrow Trading Range

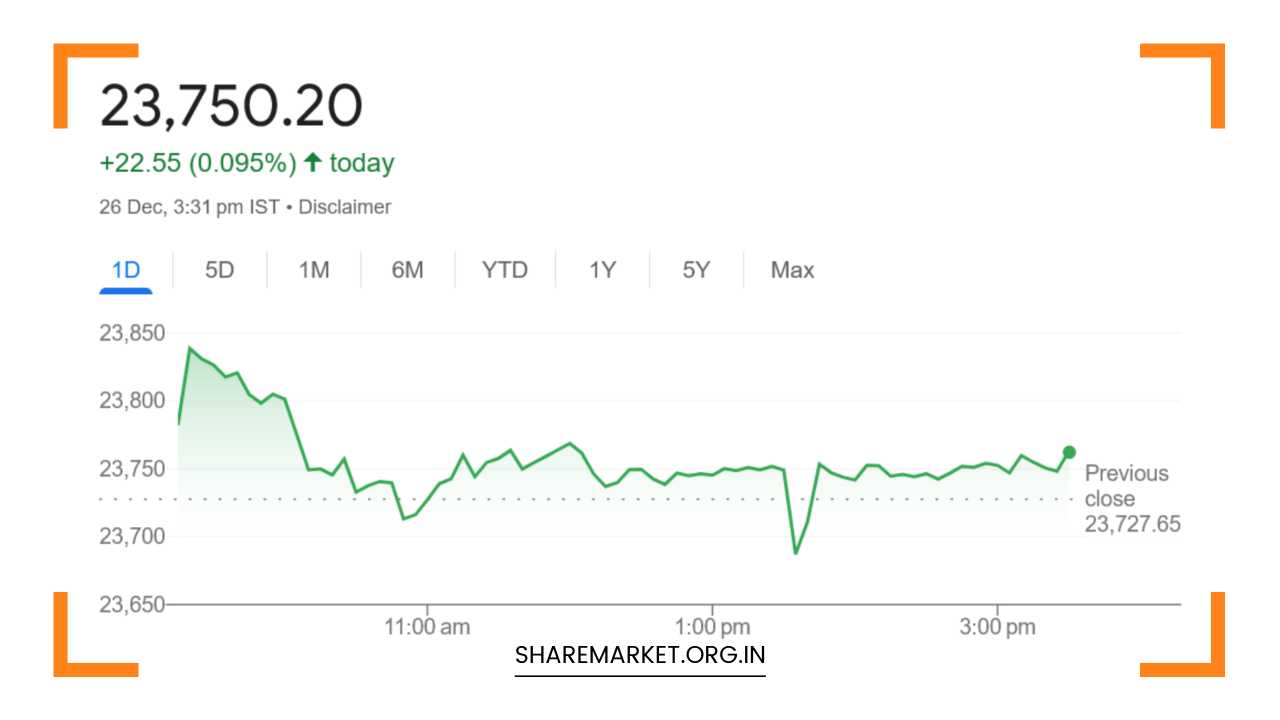

Market Overview: On December 26, Indian equity markets exhibited another volatile trading session, closing with minimal movement.

After a turbulent day, the Nifty managed to close slightly higher, while the Sensex finished marginally lower.

The Nifty ended the day at 23,750.20, up by 22.55 points or 0.10%, while the Sensex closed at 78,472.48, dropping a mere 0.39 points.

The market had initially shown some promise but later faced pressure, reflecting an ongoing period of consolidation and indecision.

The leadership on the day was seen in the auto, pharma, and energy sectors, with stocks from these segments leading the gains.

However, broader indices such as the BSE Midcap and Smallcap remained largely flat, indicating a lack of strong direction in the broader market.

Despite this subdued performance, there were key factors at play influencing market movements, including Foreign Institutional Investors’ (FII) selling pressure, sectoral rotations, and a narrow trading range.

The Nifty managed to hold above the crucial 23,750 level, but it remains to be seen whether the index can maintain this support or if further volatility will take hold in the coming days.

Key Sectoral Performance

The sectoral indices reflected mixed trends, as buying and selling activity were not uniform across the board. Among the sectors that gained traction, auto, pharma, energy, and PSU banks saw positive movements.

These sectors have generally been supported by strong fundamentals, stable earnings growth, and positive sentiment due to policy initiatives or global demand trends.

Conversely, sectors such as metal, FMCG, and media were on the weaker side, with significant selling pressure visible in stocks across these segments.

The FMCG sector, in particular, has been under strain amid rising inflationary pressures and challenges related to consumption patterns, while the metal sector has been impacted by global price fluctuations.

Among individual stocks, some standout performers included Adani Ports, Shriram Finance, M&M, Maruti Suzuki, and SBI Life Insurance, which were the top gainers on the Nifty.

Conversely, Titan Company, Asian Paints, Nestle, JSW Steel, and Grasim Industries were among the top losers.

The broader market also showed signs of sluggishness, as the BSE Midcap and Smallcap indices remained largely unchanged.

This flat performance in the smaller stocks suggests a wait-and-watch approach by investors, possibly due to a lack of clear market direction.

Expert Insights on Market Direction

According to Aditya Gaggar, Director at Progressive Shares, the bulls are finding it difficult to overcome the immediate hurdle of 23,850 on the Nifty.

Gaggar highlighted that after a strong start, banking stocks led the charge in pushing the index higher.

However, the uptrend quickly lost momentum, and the absence of fresh triggers caused the market to settle into a narrow range, with the Nifty closing just 22.55 points higher at 23,750.20.

Gaggar also pointed out that a breakout from the range of 23,650-23,850 is essential to establish a clearer direction for the market.

Until such a breakout occurs, the market is likely to remain in a consolidation phase, with indecision prevailing among investors.

He emphasized that the performance of the auto and pharma sectors, which led the gains on December 26, would continue to play a pivotal role in market sentiment.

Chandan Taparia, a technical analyst at Motilal Oswal, echoed similar views, noting that the Nifty has been trading within a narrow 300-point range this week. On the upside, the index has struggled to break past 23,870, while on the downside, it has found support around 23,600.

This tug-of-war between bulls and bears has created a pattern of doji candles and inside bars on the daily charts, signaling market indecision.

Taparia also noted that the Nifty is trading near its 200-day exponential moving average (EMA), which is typically considered a key indicator of long-term trend direction.

The index’s position below its short-term moving averages suggests limited upside potential in the near term, especially given the market’s failure to break out of its current range.

FII Selling Pressure and Market Prediction

A noteworthy factor influencing the market’s recent performance is the declining long-short ratio, which has dropped to 23%, signaling a rise in selling pressure from Foreign Institutional Investors (FIIs).

This decline in the ratio indicates that FIIs have been more inclined to sell than buy in recent sessions, contributing to the market’s subdued performance.

While this selling pressure could lead to further downside in the short term, there is also a view that the market may remain resilient as long as the Nifty continues to trade above the 23,600-23,650 support zone.

According to market experts, as long as the Nifty holds above the 24,500 mark, the overall bull market trend remains intact.

However, investors should brace for volatility, with potential downside risks if the index breaks below these key support levels.

Options Data and Trading Range

From an options perspective, the maximum Call Open Interest (OI) is concentrated at the 24,000 and 25,000 strike prices, while the maximum Put OI is observed at the 23,800 and 23,000 strike prices.

The presence of heavy call writing at 23,800 and 24,000 levels suggests that these levels could act as strong resistance in the near term.

Conversely, Put writing at 23,800 and 23,000 suggests that traders are betting on the Nifty holding these support levels.

Options data indicates a potential trading range between 23,200 and 24,200, with immediate resistance at 23,800 and support near 23,500.

Given the current options data, it appears that the market is bracing for a wide range of price movements in the coming days.

However, the narrow range observed in recent sessions implies that investors may be waiting for a decisive catalyst—whether economic data, corporate earnings results, or global developments—that could trigger a breakout from the current trading range.

Looking Ahead to December 27

As we move into December 27, the market is likely to continue facing volatility, particularly amid the backdrop of FII selling pressure and sectoral rotation.

Investors should closely monitor whether the Nifty can break through the 23,850 resistance or if it will dip below the 23,600 support level, which would signal further downside potential.

In summary, the Indian equity market is currently in a consolidation phase, characterized by indecision and narrow trading ranges.

The outlook for the near term remains uncertain, and traders should be prepared for potential volatility. A breakout above 23,850 or a dip below 23,600 could set the stage for a more definitive move in either direction, providing clearer signals for the next phase of market movement.

Until then, market participants may continue to experience choppy trading conditions with limited upside.