Sensex Down 824 Points, Nifty at 22,829; Nifty Prediction for Tomorrow

Nifty Prediction for Tomorrow

Indian Stock Market Closes with Significant Losses: What to Expect on January 28 and Beyond

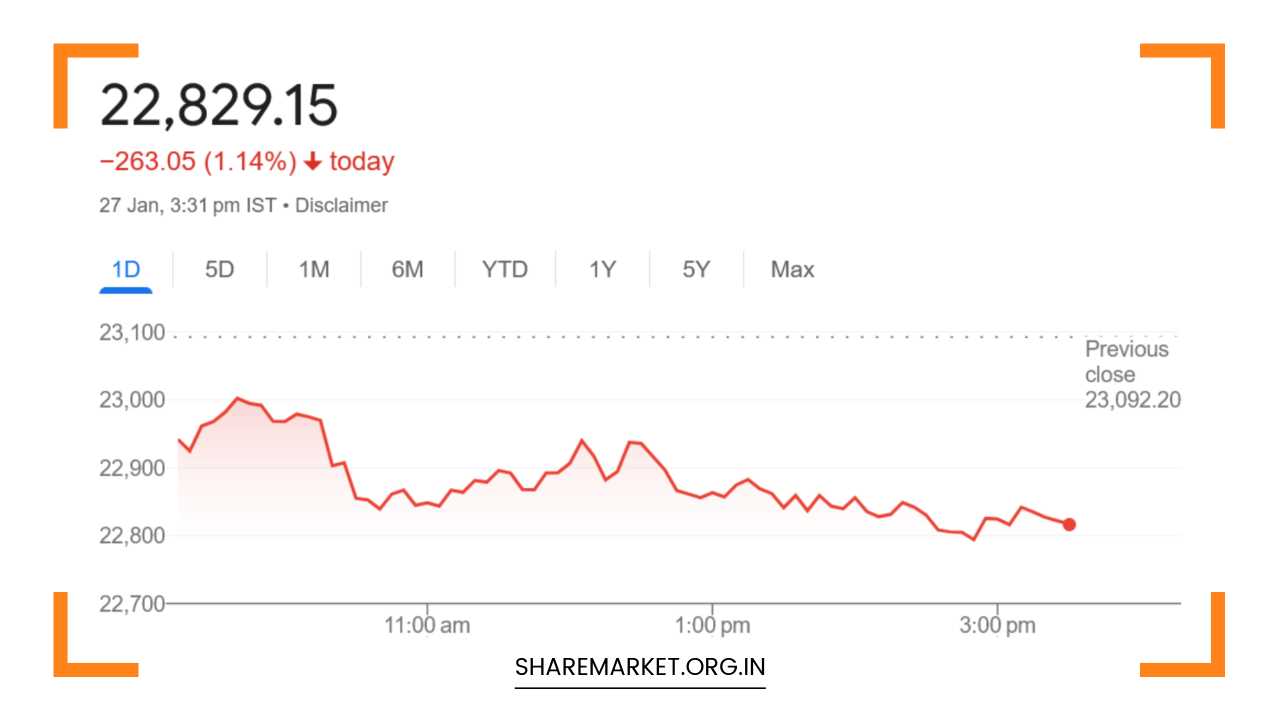

Market Overview: The Indian stock market closed on January 27 with a sharp decline, reflecting investor anxiety amidst rising global uncertainties and weak domestic cues.

Both the Sensex and Nifty indices fell considerably, continuing the trend of market weakness. The Sensex ended the session at 75,366.17, down by 824.29 points, or 1.08%.

Meanwhile, the Nifty dropped by 263.05 points, or 1.14%, closing at 22,829.15. Market breadth was overwhelmingly negative, with just 541 stocks advancing, compared to 3,399 stocks that declined. An additional 115 stocks remained unchanged by the close of the day.

Among the top losers on the Nifty were stocks from the IT and finance sectors, including HCL Technologies, Tech Mahindra, Wipro, Hindalco Industries, and Shriram Finance.

These companies have been underperforming in recent sessions, largely due to both global economic headwinds and company-specific challenges.

On the flip side, there were some gainers, such as ICICI Bank, Britannia Industries, M&M, Hindustan Unilever (HUL), and State Bank of India (SBI), though their gains were insufficient to counterbalance the widespread losses.

Sector-wise, the market was overwhelmingly negative. The BSE Midcap index fell 2.7%, while the Smallcap index witnessed a steeper decline of 3.5%.

Every sectoral index closed in the red, with the Media index suffering the most, down by 4.7%. Other sectors, including IT (-3.4%), Oil and Gas, Metals, Consumer Durables, Pharma, and Energy, each experienced a drop of around 2%.

The pervasive weakness across all sectors highlights a broader risk-off sentiment in the market, with investor concerns spanning multiple fronts, from global trade dynamics to domestic policy uncertainties.

Factors Contributing to the Market Decline:

The Indian stock market’s recent struggles are largely driven by a combination of internal and external factors, which have dampened investor sentiment and led to a lack of confidence.

A key factor contributing to the market’s decline is the global uncertainty surrounding US trade policies and the potential economic ramifications of new tariffs proposed by President Donald Trump.

These threats are creating ripples across the global economy, affecting investor sentiment worldwide.

VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, discussed the ongoing concerns over US trade policies, particularly the new threats issued by President Trump.

He pointed out that Trump recently warned of imposing a 25% tariff on Colombia due to the country’s refusal to accept illegal immigrants.

This warning adds to the mounting uncertainty surrounding global trade, especially considering the possibility that similar tariffs could be extended to other countries, including Canada and Mexico.

Furthermore, there are still lingering concerns over potential tariff increases on Chinese imports and other nations, all of which weigh heavily on global market sentiment.

Vijayakumar also underscored the broader implications of these tensions, noting that this could lead to heightened volatility in global markets.

Investors are particularly concerned about the potential long-term impacts on global trade relations, supply chains, and overall economic growth.

Given the interconnectedness of global markets, any significant disruption in one region can have a cascading effect on others, contributing to the prevailing market unease.

Domestic Concerns and Their Impact:

On the domestic front, India is facing its own set of challenges that are contributing to the market’s weaker performance.

The upcoming Indian Union Budget, slated to be announced in early February, is expected to play a pivotal role in shaping market sentiment.

Investors are awaiting key policy announcements, including fiscal measures, taxation policies, and any potential stimulus packages that could address the country’s economic slowdown.

However, there is also a heightened level of uncertainty regarding how the government will balance the need for growth-boosting measures with the fiscal constraints it faces.

Anand James, another market expert from Geojit Financial Services, pointed out the lack of risk appetite among investors, which has become evident in recent trading sessions.

He noted that, on January 27, approximately 50% of the stocks in the NSE 500 index experienced declines of at least 2% from their intraday highs.

This indicates a sharp fall in investor confidence and a reluctance to take risks in the current market environment.

James emphasized that a more sustained recovery in the market will require a strong uptick in investor sentiment, which appears unlikely unless there is a more substantial recovery in global and domestic conditions.

What Does the Future Hold for Indian Markets?

Looking ahead, experts are predicting that the Indian stock market could remain under pressure unless there is a clear sign of a recovery in global markets or a more significant boost from domestic policy announcements.

While some analysts believe that the market could experience a temporary rebound, others are more cautious, indicating that the ongoing volatility might persist for a while.

VK Vijayakumar suggested that the market could remain volatile in the short term due to multiple uncertainties, including the US Federal Reserve’s monetary policy decisions and the Indian government’s upcoming budget.

Both events are expected to have a significant impact on investor sentiment, either supporting or dampening market optimism depending on the outcomes.

In particular, the US Fed’s policy stance will be closely monitored, as any indication of changes in interest rates or liquidity measures could have far-reaching consequences for global markets, including emerging markets like India.

Additionally, any signs of further tightening of US monetary policy could lead to capital outflows from emerging markets, exerting additional downward pressure on Indian equities.

Meanwhile, the Indian government’s budget will be scrutinized for any signals of fiscal stimulus, reforms, or tax relief measures aimed at revitalizing the economy.

With the country grappling with slow economic growth, the budget presents an opportunity for the government to enact policies that could stimulate investment, boost consumption, and support key sectors.

However, any disappointing announcements or failure to address pressing economic challenges could lead to further market dismay.

Technical Outlook and Key Levels to Watch:

From a technical perspective, experts suggest that the Nifty needs to reclaim a key resistance level to signal a potential reversal of the current downtrend.

Anand James emphasized that the Nifty must move above the 23,211 mark to show strength and indicate that the market may be on the path to recovery.

If the Nifty fails to breach this level, there is a risk of further declines, with potential support levels in the range of 22,260 to 22,000.

In conclusion, while the market has been facing significant headwinds in recent sessions, much will depend on the global economic climate and domestic policy measures in the coming days.

The volatility is likely to continue, and investors should remain cautious, keeping a close watch on the upcoming developments in both global trade policies and India’s budget.

The market’s direction in the coming weeks will largely depend on how these factors play out.