HDFC Life Q2 Results: Exceeding Estimates with a 28% Surge in Premium Income

HDFC Life Q2 Results

In the September quarter, HDFC Life Insurance, a prominent private sector insurance company in India, demonstrated robust financial performance, exceeding market expectations and highlighting significant growth in its key financial metrics.

Stellar Growth in Net Premium Income

One of the standout achievements during the quarter was the substantial increase in net premium income.

HDFC Life reported an impressive 28% year-on-year growth in net premium income, which reached a substantial figure of Rs 14,755 crore, representing a significant upswing from the prior year’s Rs 11,479 crore.

This remarkable growth in premium income underlines the company’s ability to attract more policyholders and expand its insurance offerings effectively.

Exceeding Net Profit Expectations

Equally impressive was HDFC Life’s net profit performance for the quarter. The company reported a net profit of Rs 376 crore, showcasing a substantial 15% annual increase.

This growth exceeded market expectations, with analysts previously estimating a net profit of Rs 370 crore, indicating that HDFC Life not only met but exceeded these projections.

This strong profit growth reflects the company’s efficiency in managing its business operations and investments.

Value of New Business and VNB Margin

The value of new business (VNB) is a critical indicator of an insurance company’s financial health. In the September quarter, HDFC Life reported a VNB of Rs 801 crore, demonstrating steady growth compared to the Rs 770 crore reported in the same quarter of the previous year.

This highlights the company’s ability to generate value from new business initiatives and attract policyholders.

However, it’s essential to note that the VNB margin for the second quarter of 2023-24 was reported at 26.4%, slightly lower than the 27.1% margin in the same period the previous year.

While the margin saw a minor decline, it remains robust and indicates HDFC Life’s effective management of its new business initiatives.

Annualized Premium Equivalent (APE)

HDFC Life’s Annualized Premium Equivalent (APE) is another critical financial metric. During the second quarter of the current financial year, HDFC Life’s APE stood at Rs 3,045 crore, although this was slightly below market estimates.

Analysts had projected an APE of Rs 3,201 crore for this period, making the reported APE fall short of expectations.

Despite this, the company’s APE remains significant and demonstrates its ability to attract policyholders and generate long-term premium income.

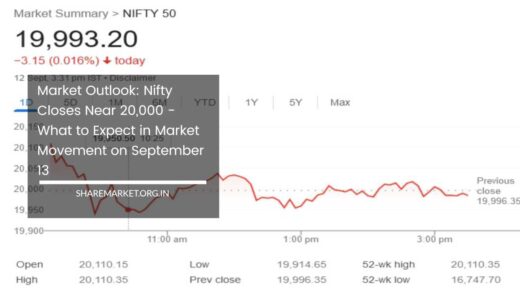

Market Performance

The market response to HDFC Life’s Q2 results was positive, with the company’s shares closing at 625.25 on the National Stock Exchange (NSE). This closing price represented a modest increase of 0.10% and indicated investor confidence in the company’s financial performance.

HDFC Life’s ability to meet or exceed market expectations is undoubtedly a factor contributing to this positive sentiment among investors.

Sales Channel Trends

While HDFC Life’s overall financial performance was commendable, there were some notable trends in its sales channels during the July-September quarter.

Sales through direct channels, brokers, and agencies declined in this period. The company sold a total of 4.76 lakh policies in the first half of FY 2023-24, compared to 4.34 lakh in the same period the previous year.

The decline in sales through these channels may be indicative of changing consumer preferences or competitive challenges in the insurance market.

It’s worth noting that the insurance industry is highly competitive, and companies must adapt to evolving customer behaviors and market dynamics.

In conclusion, HDFC Life Insurance’s Q2 results for the financial year 2023-24 have showcased the company’s ability to achieve remarkable growth in key financial metrics.

With a 28% increase in net premium income, a net profit that exceeded market expectations, and steady growth in the value of new business, HDFC Life has demonstrated its resilience and effectiveness in the dynamic insurance industry.

However, the company did fall slightly short of market estimates in terms of its Annualized Premium Equivalent (APE), and there was a decline in sales through certain channels.

These factors indicate that while HDFC Life is on a growth trajectory, there may be areas where the company can further fine-tune its strategies to capture market opportunities and overcome challenges.

Investors and stakeholders will continue to closely monitor HDFC Life’s performance in subsequent quarters to gauge its ability to sustain and build upon its growth momentum.

As the insurance landscape evolves, adaptability and innovation will be key drivers of success, and HDFC Life’s ability to navigate these changes will be critical to its long-term prospects in the insurance sector.