All You Need to Know About Home Loan Foreclosure

Home Loan Foreclosure

All You Need to Know About Home Loan Foreclosure

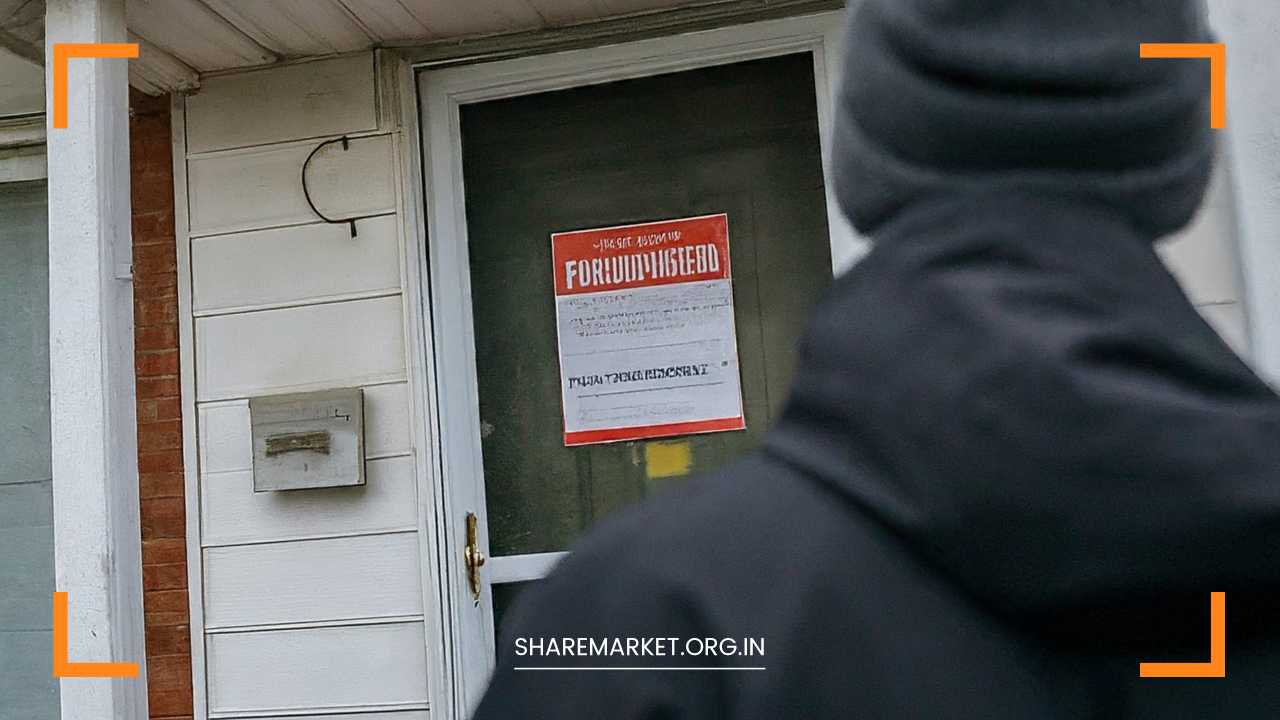

Understanding Home Loan Foreclosure

Home loan foreclosure is a legal process initiated by a lender when a borrower defaults on their mortgage payments. This situation is often complex and can have long-lasting financial implications.

This article provides an in-depth look into home loan foreclosure in India, including its causes, the foreclosure process, legal ramifications, and preventive measures.

What is Home Loan Foreclosure?

Foreclosure is essentially the legal right of a lender to reclaim ownership of a property when the borrower fails to meet the terms of the mortgage agreement. This typically occurs due to missed or delayed payments, but can also result from other breaches of the loan contract. The process allows the lender to recover the outstanding loan balance by selling the property.

Reasons for Home Loan Foreclosure

Several factors can lead to home loan foreclosure, each contributing to the borrower’s inability to continue making mortgage payments:

Financial Hardship

Unexpected financial difficulties, such as job loss, medical emergencies, or economic downturns, can disrupt a borrower’s income flow, making it challenging to meet mortgage payments. This is one of the most common reasons for foreclosure, as a sudden loss of income can severely impact one’s ability to maintain regular payments.

Over-Leveraging

Over-leveraging occurs when a borrower takes on more debt than they can reasonably manage with their current income. This situation often results in financial strain and increases the risk of defaulting on loan payments. Over-leveraging can be caused by taking out multiple loans or by increasing one’s debt-to-income ratio.

Rising Interest Rates

In a variable interest rate loan, an increase in interest rates can lead to higher monthly payments. This rise in payment amounts can become burdensome for borrowers, especially if their financial situation does not improve to match the new payment terms. As a result, the borrower may struggle to keep up with their mortgage payments.

Property Value Decline

A significant drop in property value can create negative equity, where the outstanding loan amount exceeds the property’s current market value. This situation makes it difficult for the borrower to sell the property for an amount sufficient to cover the loan balance, increasing the risk of foreclosure.

Natural Disasters

Damage to the property from natural disasters, such as floods, earthquakes, or hurricanes, can disrupt a borrower’s income and increase their expenses. If the property becomes uninhabitable or requires extensive repairs, the borrower might find it challenging to continue making mortgage payments.

The Foreclosure Process in India

The foreclosure process in India involves several legal and procedural steps. While the specifics may vary slightly by state, the general process typically includes:

Default

The foreclosure process begins when the borrower defaults on their mortgage payments. In India, this usually means missing payments for a period of 90 days. During this time, the lender may send reminders and notices to the borrower, urging them to rectify the situation.

Notice

Once the default period elapses, the lender sends a formal default notice to the borrower. This notice outlines the missed payments and demands immediate action to resolve the arrears. It is a critical step, as it officially informs the borrower of their breach of the mortgage agreement.

Acceleration Clause

Many mortgage agreements include an acceleration clause, which allows the lender to demand immediate repayment of the entire loan balance if the borrower defaults. This clause accelerates the debt, making the borrower liable for the full amount rather than just the overdue payments.

Legal Notice

If the borrower fails to respond to the default notice, the lender may issue a legal notice. This notice is a formal communication that outlines the lender’s intention to initiate legal proceedings if the borrower does not take corrective action. The legal notice provides a final opportunity for the borrower to address the default before further action is taken.

Legal Proceedings

Should the borrower continue to ignore the notices and fail to resolve the default, the lender can initiate legal proceedings to seek possession of the property. This step involves filing a suit in a court of law, where the lender will present their case for reclaiming the property.

Auction

If the court rules in favor of the lender, the property is then put up for auction. The auction process involves public bidding, where potential buyers offer bids for the property. The highest bidder wins the property, and the proceeds from the sale are used to recover the outstanding loan balance.

Possession

Once the property is auctioned, the highest bidder becomes the new owner. The borrower is then evicted from the property, and possession is transferred to the new owner. This step concludes the foreclosure process, and the borrower loses ownership of the property.

Legal Implications of Foreclosure

Foreclosure carries several significant legal and financial consequences for the borrower:

Loss of Property

The most immediate and evident consequence of foreclosure is the loss of the mortgaged property. The borrower is evicted, and ownership of the property is transferred to the new owner.

Credit Score Damage

Foreclosure has a severe impact on the borrower’s credit score. A foreclosure will significantly lower the borrower’s credit rating, making it difficult to secure future loans or credit. The negative mark on the credit report can last for several years, affecting the borrower’s financial stability and borrowing capacity.

Legal Costs

During the foreclosure process, the borrower may be responsible for legal fees incurred by the lender. These costs can include court fees, attorney fees, and other related expenses. The borrower’s financial situation can be further strained by these additional costs.

Deficiency Balance

If the proceeds from the auction sale do not cover the entire loan amount, the borrower may still owe the lender the remaining balance, known as the deficiency balance. This remaining debt can be pursued by the lender through additional legal actions or collection efforts.

Eviction

Foreclosure leads to eviction, which means the borrower and their family must vacate the property. This can be a stressful and disruptive experience, particularly if the borrower has invested significant time and resources into the property.

Preventing Foreclosure

Foreclosure is a serious issue, but there are proactive steps borrowers can take to prevent it. Early intervention and effective communication with the lender can help mitigate the situation and explore alternatives to foreclosure:

Early Communication

If a borrower is facing financial difficulties, it is crucial to contact the lender as soon as possible. Early communication can help the borrower discuss their situation and explore potential solutions before the situation escalates to foreclosure.

Loan Modification

Loan modification is a process where the borrower and lender agree to change the terms of the mortgage. Options may include extending the loan term, reducing the interest rate, or adjusting the payment schedule. Loan modification can make monthly payments more manageable and prevent foreclosure.

Forbearance

Forbearance is a temporary pause or reduction in mortgage payments granted by the lender. This option is typically available in cases of temporary financial hardship. Forbearance allows the borrower to get back on their feet without the immediate threat of foreclosure.

Refinancing

Refinancing involves taking out a new loan to pay off the existing mortgage. This can be an effective way to obtain a lower interest rate or reduce monthly payments. Refinancing can provide financial relief and help the borrower avoid foreclosure.

Selling the Property

If the borrower is unable to continue making mortgage payments, selling the property may be a viable option. Selling the property before foreclosure allows the borrower to pay off the mortgage and potentially avoid some of the negative consequences associated with foreclosure.

Credit Counseling

Seeking professional financial advice from a credit counselor can be beneficial. Credit counselors can help borrowers create a budget, develop a repayment plan, and explore options for managing debt. Professional guidance can provide valuable support during financial difficulties.

Frequently Asked Questions (FAQs)

Can I stop the foreclosure process?

Yes, it is possible to stop the foreclosure process by taking proactive steps. Contacting the lender early to discuss options such as loan modification or forbearance can help prevent foreclosure. It is important to address the situation as soon as possible to explore available alternatives.

What happens to my belongings during foreclosure?

During the foreclosure process, it is advisable to remove personal belongings from the property before the eviction process begins. Once the property is auctioned and possession is transferred, the borrower may no longer have access to the property.

Can I buy back my property after foreclosure?

It is possible to buy back a property after foreclosure, but it is challenging. Once the property is sold at auction, it becomes the property of the highest bidder. The borrower may have limited opportunities to repurchase the property, and the process can be complicated and costly.

How long does the foreclosure process take?

The duration of the foreclosure process can vary depending on several factors, including the state’s legal procedures and the specific circumstances of the case. Generally, the foreclosure process in India can take several months to complete, from the initial default to the final auction and possession.

Final Remarks

Home loan foreclosure is a complex and stressful situation that can have significant financial and legal consequences. Understanding the foreclosure process, its causes, and potential outcomes is crucial for homeowners facing this challenge.

By taking proactive measures, seeking professional advice, and exploring available options, borrowers can improve their chances of avoiding foreclosure and protecting their financial future.

Disclaimer: This article provides general information and should not be considered legal or financial advice. For personalized guidance, it is essential to consult with professionals in the field.