Market Closes with Slight Decline: What to Expect on December 26

Tomorrow Nifty Prediction

Stock Market Update: Sensex and Nifty End Marginally Lower; Market Prediction for December 26

Indian equity markets closed on a subdued note on December 24, 2024, as both Sensex and Nifty ended the day with slight declines, reflecting the cautious sentiment in the market amid volatile trading conditions.

After an initial uptrend, the markets struggled to maintain momentum and ended the session in the red. With global cues mixed and local sectoral performance showing a divergence, the outlook for the coming days remains uncertain.

Investors will be closely watching the market’s movement within key technical levels to gauge the potential direction for the next trading session.

Market Overview:

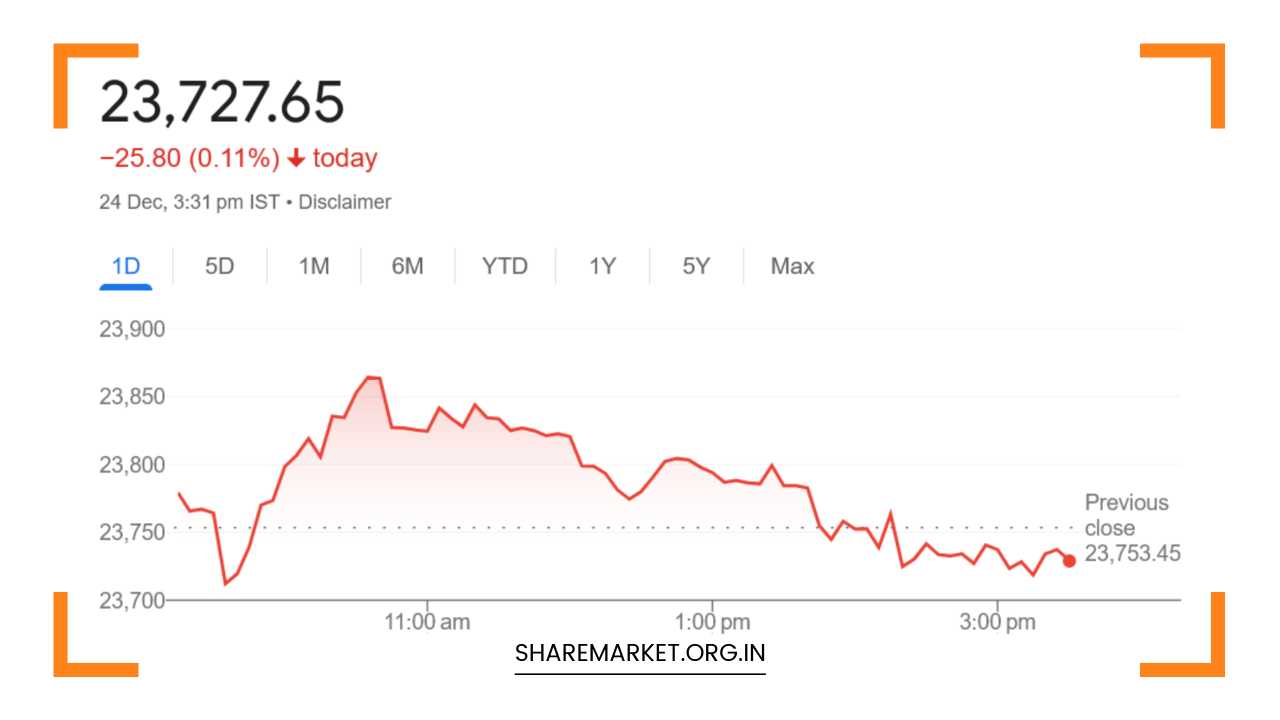

On December 24, 2024, the Sensex closed at 78,472.87, down by 67.30 points or 0.09%, while the Nifty ended at 23,727.65, shedding 25.80 points or 0.11%. The day was characterized by range-bound trading, with both indices fluctuating within a limited range throughout the session.

Overall, market breadth was fairly balanced, with 1,907 stocks advancing, 1,926 declining, and 94 stocks remaining unchanged on the NSE.

The indices failed to gain significant traction in either direction, as investors adopted a cautious approach amidst the holiday season and an absence of major domestic or global triggers.

While some sectors showed strength, others faced selling pressure, resulting in a mixed performance across the broader market.

Sectoral Performance:

- Top Gainers: Among the major gainers, Tata Motors, Adani Enterprises, Eicher Motors, BPCL, and ITC stood out. These stocks were supported by favorable developments in their respective sectors, with auto stocks benefiting from positive sentiment and oil & gas stocks witnessing some inflows.

- Top Losers: On the flip side, Power Grid Corp, JSW Steel, SBI Life Insurance, Titan Company, and SBI were among the biggest losers on the Nifty. The metal and PSU bank sectors, in particular, witnessed the most significant corrections during the session, reflecting broader concerns over their near-term outlook.

From a sectoral standpoint, there was buying interest in auto, FMCG, and oil & gas, which helped to offset losses in sectors such as IT, media, metal, and PSU banks.

The BSE midcap index ended the day flat, while the smallcap index gained 0.3%, reflecting some strength in the smaller-cap stocks compared to their larger counterparts.

Key Market Drivers and Insights:

The market’s movement was largely driven by sectoral rotation and profit-booking at higher levels. As the market opened, stocks in the auto and IT sectors gained early traction.

However, the broader market could not sustain this upward movement as the Nifty faced resistance at the key level of 23,850, preventing it from breaking into positive territory.

Aditya Gaggar, Director at Progressive Shares, observed that while the Nifty made an initial attempt to climb, led by the auto and IT counters, the 23,850 level remained a significant hurdle.

This resistance level has become a crucial technical point for traders and investors, as the index has faced repeated struggles in maintaining upward momentum beyond this point. Ultimately, the Nifty closed lower, marking a loss of 25.80 points or 0.11%.

The auto and FMCG sectors outperformed during the session, with stocks such as Tata Motors, Eicher Motors, and ITC benefiting from strong earnings reports and positive investor sentiment.

However, metal and PSU banks faced profit-booking, which contributed to the overall weak sentiment.

The metal sector, in particular, has been under pressure due to concerns over global demand and price fluctuations.

Interestingly, the midcap index largely followed the movements of the frontline indices, but the smallcap index managed to close 0.3% higher, indicating that investor appetite for smaller stocks remains relatively strong, despite the broader market’s cautious tone.

Technicals and Market Prediction:

From a technical perspective, the market’s action on December 24 indicates that the Nifty is currently trading within a narrow range of 23,650 to 23,850.

This range has now become a critical level for market participants. A break above 23,850 would likely signal a move toward higher levels, possibly testing the 24,000 mark, while a break below 23,650 could lead to a downside move, with potential support levels near 23,500 or lower.

Srikant Chauhan, Senior Technical Analyst at Kotak Securities, pointed out that the Nifty formed a small inside body candle on the daily chart, signaling a continuation pattern.

He added that the current range-bound movement suggests indecision in the market. According to Chauhan, the direction of the market will become clearer only once the Nifty decisively breaks out of this range, either upwards or downwards.

The broader market is also showing signs of divergence, with midcap stocks largely in sync with the frontline indices, but smallcaps slightly outperforming.

This suggests that investors are selectively favoring smaller companies, which could be indicative of a rotation into more risk-on assets.

Global Cues and Domestic Factors:

Global factors are expected to play a pivotal role in the market’s near-term direction. With US markets closed for the holiday season, there is limited influence from global equities.

However, any developments over the coming days—such as geopolitical tensions, economic data releases, or corporate earnings reports—could impact investor sentiment and market direction.

Domestically, the market’s focus will likely remain on sectoral performance and company earnings.

With the end of the calendar year approaching, investors will also be monitoring the performance of specific sectors, especially those that are expected to benefit from the ongoing economic recovery in India, such as automobile, consumer goods, and oil & gas.

Additionally, any monetary policy signals from the Reserve Bank of India (RBI) or updates regarding inflation and growth could affect market sentiment, particularly in the banking and financials sectors.

What to Expect on December 26:

Looking ahead to December 26, investors will closely watch the Nifty’s movement within the 23,650-23,850 range.

A decisive breakout above 23,850 would likely pave the way for a rally towards 24,000, while a breakdown below 23,650 could open the door for a pullback to the next support levels.

In the absence of major global triggers, the market could remain in a consolidation phase, with sectoral rotation providing some pockets of opportunity.

Investors should focus on stocks showing relative strength, particularly in the auto, FMCG, and oil & gas sectors, while maintaining caution around sectors such as IT, metal, and PSU banks that have shown weakness recently.

In conclusion, while the market closed with marginal declines on December 24, its near-term direction will largely depend on how the indices break out of their current range.

With technical indicators suggesting indecision, the coming days will be crucial in determining whether the market can sustain its upward momentum or whether a corrective phase is imminent.