Market Crashed After Record Rise: Nifty Prediction for Tomorrow

Nifty Prediction for Tomorrow

Deciphering the December 20, 2023, Market Plunge and Charting the Path Forward

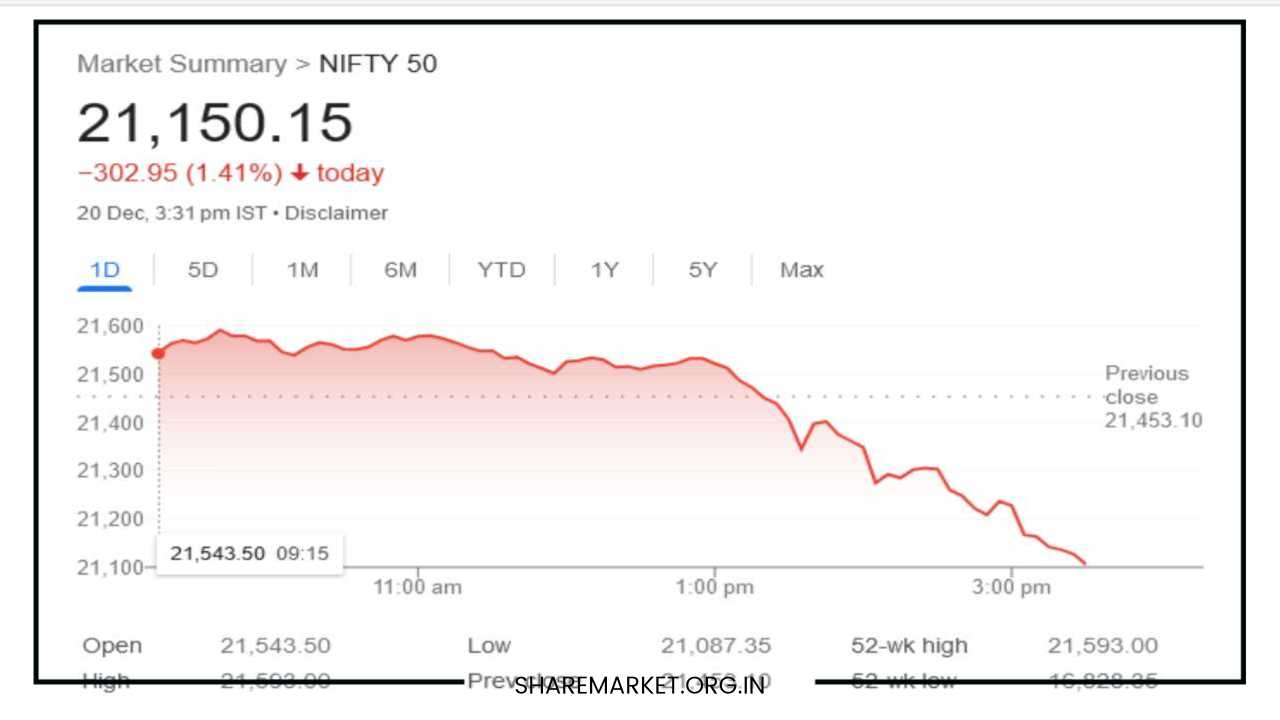

The Indian stock market witnessed a tumultuous day on December 20, 2023, experiencing a sharp downturn after reaching a record high earlier in the day.

This analysis provides an in-depth exploration of the day’s events, covering top gainers and losers, sectoral impacts, expert opinions, macroeconomic factors, and the global context, while also delving into potential market movements on December 21, 2023.

Market Recap:

In a surprising turn of events, the benchmark Indian equity indices closed in the red, succumbing to intense selling pressure that triggered a significant market reversal.

The Sensex and Nifty, representing the pulse of the market, incurred heavy losses, and the midcap index witnessed a staggering drop of over 3 percent.

The downturn was widespread, affecting all sector indices of BSE, with the metal, power, and auto sectors taking the brunt of the impact. Oil-gas, FMCG, and IT stocks also faced substantial pressure.

Closing Numbers:

At the close of the trading session, the Sensex faced a substantial decline of 931 points, settling at 70,506, while the Nifty witnessed a drop of 303 points, closing at 21,150.

The Nifty Bank recorded a significant setback, losing 426 points and closing at 47,445, and the midcap index plummeted by 1,488 points, settling at 44,025.

Stock Movements:

Selling dominated the market landscape, affecting 46 out of 50 Nifty stocks. All 30 Sensex stocks saw declines, and 10 out of 12 Nifty Bank shares experienced selling pressure.

Despite the market turmoil, the rupee managed to strengthen marginally by 1 paise against the dollar, closing at 83.17.

A nuanced analysis of the 2,600 shares traded on NAC revealed a rise in 358 shares, a decline in 2,159 shares, and no change in 83 shares.

Top Gainers and Losers:

In the aftermath of the market turbulence, specific stocks stood out. ONGC, Tata Consumer Products, Britannia Industries, and HDFC Bank emerged as the top gainers of Nifty.

On the flip side, Adani Ports, Adani Enterprises, UPL, Tata Steel, and Coal India found themselves among the top Nifty losers.

Expert Analysis – Vinod Nair (Geojit Financial Services):

Vinod Nair of Geojit Financial Services attributed the sharp market downturn to profit-booking, a natural response to the recent sharp rally in mid-cap and small-cap stock valuations.

Additionally, the surge in crude oil prices prompted investors to secure profits. Despite positive global signals, the domestic market experienced sudden selling in the second half of the trading session.

Nair emphasized that a decline was observed across most sectors, with FMCG, banking, and IT exhibiting the least decline.

Market Outlook – Aditya Gaggar (Progressive Shares):

Aditya Gaggar, Director at Progressive Shares, offered insights into the potential market trajectory on December 21, 2023.

He noted the formation of a strong bearish candle at the record level, indicating a shift in the short-term trend in favor of bears.

However, Gaggar highlighted the possibility of a hidden bullish divergence on lower time frames.

If Nifty stages a comeback from the support zone of 21,040-21,080, a recovery could be expected, albeit with limitations, potentially reaching 21,380.

Analyst Perspectives – Prashant Tapse (Mehta Equities):

Prashant Tapse of Mehta Equities contextualized the market’s downturn, explaining that the recent race to set records had driven the market into the overbought zone.

Consequently, profit booking was anticipated and materialized on December 20. Tapse observed selling across all sectors, affecting even mid and small-cap stocks.

He pointed out that crude oil could pose a short-term challenge following recent attacks on ships in the Red Sea.

Insights from Rupak Dey (LKP Securities):

Rupak Dey of LKP Securities focused on the continued bearish sentiment contributing to a sharp correction in Nifty.

The failure to sustain above 21,500 resulted in call writing at the 21,500 strike, leading to a significant decline.

Dey anticipated a phase of consolidation in Nifty in the short term, identifying resistance at 21,500 and support at 21,100. This analysis suggested a cautious approach amid the prevailing market conditions.

Macroeconomic Factors:

Beyond the immediate market dynamics, macroeconomic factors played a role in shaping the day’s events.

The recent surge in crude oil prices emerged as a key concern, prompting investors to reassess their positions and book profits.

The attacks on ships in the Red Sea heightened uncertainties, leading to increased caution among market participants.

Global Context:

While global signals were initially positive, the sharp and sudden selling in the domestic market during the second half of the trading session contradicted the favorable international sentiment.

This dichotomy underscores the complex interplay between domestic and global factors, requiring investors to navigate the market with heightened awareness of both local and international developments.

Final Thoughts:

The events of December 20, 2023, marked a significant shift in the Indian stock market’s trajectory, with a sudden reversal and substantial declines across key indices.

Expert opinions indicate a cautious outlook for the coming days, emphasizing the importance of support levels and potential hidden bullish divergences.

As investors navigate the market landscape, vigilance and strategic decision-making become crucial in responding to the dynamic conditions presented by the recent market turbulence.

The interplay of macroeconomic factors and global dynamics further adds layers of complexity, reinforcing the need for a nuanced and well-informed approach to navigate the evolving market scenario.

Investors must stay attuned to ongoing developments and adapt their strategies accordingly, recognizing that market volatility can be both a challenge and an opportunity for those well-prepared and informed.