Market Outlook: Nifty Closes Above 19550 | Analyzing Market Trends for September 6

Market Outlook

Market Outlook and Analysis for September 5, 2023

The stock market continues to be a dynamic and ever-evolving environment, with daily fluctuations influenced by a multitude of factors.

On September 5, 2023, the Indian stock market witnessed another trading session filled with opportunities and challenges.

In this comprehensive analysis, we will delve into the key developments of the day, assess the performance of major indices, examine the top gainers and losers, explore sectoral trends, and gain insights from expert opinions.

Additionally, we will explore the outlook for the market on September 6, 2023, and consider factors that might shape trading activities in the near term.

Market Recap for September 5, 2023

Index Performance: Sensex and Nifty

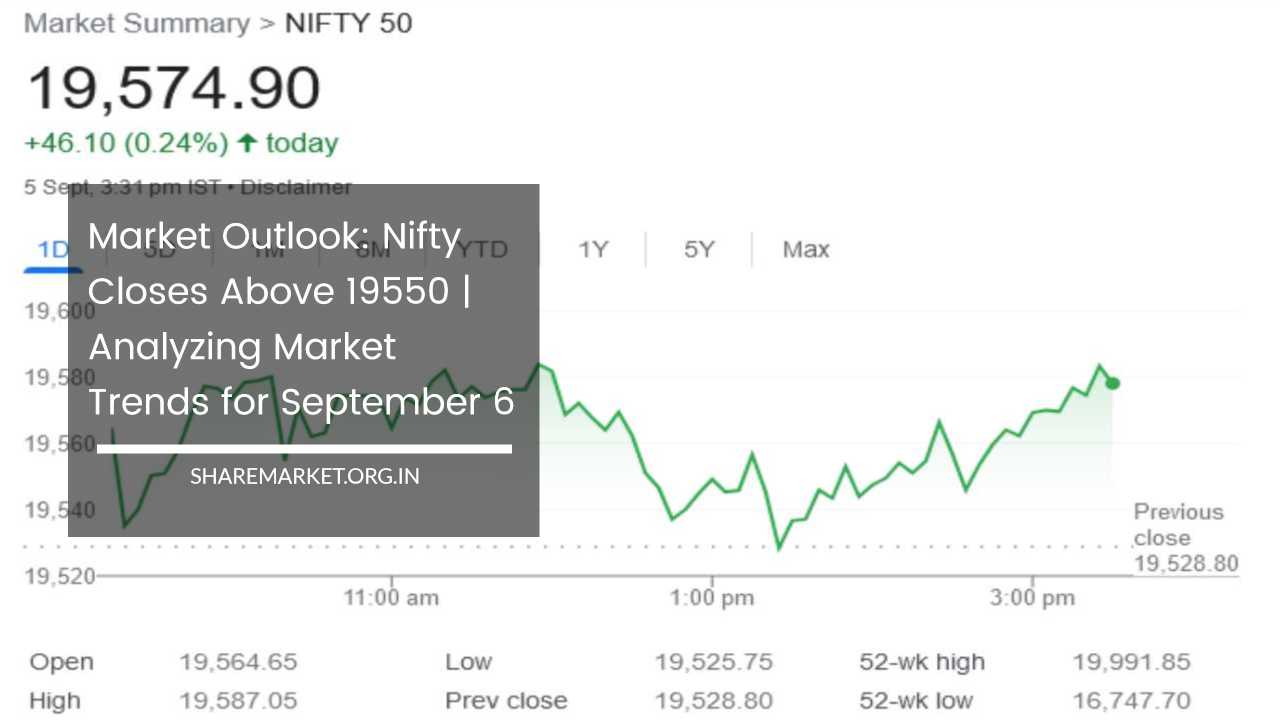

September 5, 2023, marked the third consecutive day of gains for the Indian stock market. The benchmark indices, Sensex and Nifty, exhibited notable strength throughout the trading session.

The Sensex gained 152.12 points, equivalent to 0.23 percent, closing at 65,780.26. Simultaneously, the Nifty recorded a gain of 46.10 points, or 0.24 percent, closing at 19,574.90.

This positive momentum is indicative of continued investor confidence, but it is essential to delve deeper into the day’s market dynamics to understand the contributing factors.

Individual Stock Performance

A closer look at individual stocks reveals a mixed bag of performance, with some stocks making substantial gains and others experiencing losses. Among the top gainers in the Nifty were Apollo Hospitals, Coal India, Sun Pharma, BPCL, and Bajaj Auto.

Conversely, UltraTech Cement, SBI Life Insurance, Dr. Reddy’s Laboratories, Maruti Suzuki, and Eicher Motors were among the leading Nifty losers.

This divergence in stock performance underscores the importance of diversification in an investment portfolio.

While certain sectors and companies may thrive, others may face challenges, highlighting the significance of risk management and a well-balanced investment strategy.

Sectoral Analysis

The performance of various sectors also plays a critical role in shaping the overall market sentiment. On September 5, 2023, healthcare and realty sectors emerged as strong performers, registering gains of approximately 1 percent.

These sectors have attracted investor interest due to their growth potential and resilience in the face of economic challenges.

However, the banking sector experienced a slight decline during the trading session. The banking sector’s performance is closely tied to economic indicators, and fluctuations in this sector can influence broader market sentiment.

Small and Medium-Sized Stocks: A Rising Trend

One noteworthy trend in recent times has been the robust performance of small and medium-sized stocks. Arvinder Singh Nanda of Master Capital Services pointed out that the Nifty Midcap index has made substantial gains, crossing the psychological milestone of 40,000 points.

This remarkable achievement represents a gain of approximately 35 percent in the past six months alone.

Similarly, the Smallcap index has surged by about 40 percent since March 2023, surpassing the 12,000 mark. Investors have increasingly turned to midcap and smallcap stocks, attracted by their potential for higher returns and closer alignment with the country’s economic development.

These stocks are often viewed as more agile and responsive to changing economic conditions, making them appealing options for those seeking growth opportunities.

Arvinder Singh Nanda believes that the trend of investing in midcap and smallcap stocks is likely to continue, driven by the increasing risk appetite of investors.

The improvement in India’s economic conditions and the acceleration of domestic growth have contributed to this shift in investment preferences.

Additionally, the rise in liquidity within mid and small-cap stocks has further fueled investor interest.

Expert Opinions on the Market Outlook

As investors look ahead to September 6, 2023, it’s essential to consider expert opinions to gain insights into potential market movements.

Aditya Gaggar of Progressive Shares provides valuable analysis, noting that the Nifty 50 index formed a DOJI candlestick pattern on September 5 at the resistance level of 19,580 points. This technical pattern suggests indecision in the market.

Gaggar emphasizes that a crucial factor to watch is whether Nifty can surpass this resistance barrier and close convincingly above it.

If it does, the market could potentially target levels above 19,710 points. However, it’s equally important to be aware of potential downside risks, with support for Nifty expected at the 19,450 mark.

On a similar note, Jatin Gedia of Sharekhan offers his insights into the market’s performance on September 5. He observes that Nifty opened the trading day with gains and subsequently consolidated within a narrow range for most of the session.

This consolidation led to the hourly momentum indicator slipping into the negative zone, suggesting a bearish momentum.

Despite this, Gedia highlights the overall positive trend in the market, with buying interest evident during declines, a sign of resilience and investor confidence.

According to his analysis, Nifty may soon reach the 19,650 level. Key support levels to watch are 19,490 – 19,470, while resistance levels are anticipated around 19,650 – 19,700.

Bank Nifty: A Consolidation Phase

Bank Nifty, a significant component of the Indian stock market, also experienced consolidation on September 5, 2023.

The index consolidated within a narrow range of 250 points, following a sharp upmove. This consolidation phase is seen as a pause in the uptrend, allowing for potential accumulation before a breakout.

Market experts suggest that Bank Nifty is likely to break out of this consolidation range and gain momentum in the coming trading sessions.

This optimism is supported by a positive crossover in the momentum indicator, indicating underlying strength in the index. In the short term, Nifty may target levels around 44,900 – 45,000.

Looking Ahead: September 6, 2023, Market Outlook

As investors prepare for the trading session on September 6, 2023, several factors are likely to influence market sentiment and direction.

It’s crucial to monitor both domestic and global developments, economic indicators, and corporate news to make informed investment decisions.

Key Factors to Watch on September 6, 2023:

- Global Economic Conditions: Global economic trends and geopolitical events can have a significant impact on Indian markets. Keep an eye on international developments and their potential repercussions.

- Economic Indicators: Economic data releases, such as GDP growth, inflation figures, and employment data, can provide valuable insights into the health of the Indian economy. These indicators may influence market sentiment.

- Corporate Earnings: The performance of individual companies and their earnings reports can greatly affect stock prices. Pay attention to earnings announcements and guidance from major corporations.

- Government Policies: Government policies related to taxation, infrastructure development, and economic reforms can shape the business environment and impact market dynamics.

- Global Markets: Consider how global markets, especially major indices like the S&P 500 and Dow Jones, are performing. International trends can influence foreign institutional investment in Indian stocks.

- Currency Exchange Rates: Exchange rate fluctuations can impact the profitability of companies engaged in international trade. Monitor the rupee’s performance against major currencies.

- Technical Analysis: Continue to analyze technical indicators and patterns to identify potential entry and exit points for trades. Watch for key support and resistance levels.

- Volatility: Keep an eye on market volatility, as it can present both opportunities and risks for traders and investors. Implement risk management strategies to protect your portfolio.

In conclusion, the Indian stock market exhibited resilience and strength on September 5, 2023, with key indices closing in positive territory.

While individual stock performances varied, sectors like healthcare and realty stood out with notable gains. Small and medium-sized stocks continued their impressive rally, attracting investor interest.

As we look ahead to September 6, 2023, expert opinions suggest that Nifty may target higher levels, but it’s essential to remain vigilant and consider potential support and resistance levels.

Additionally, Bank Nifty is poised for a potential breakout from its consolidation phase.

Investors should remain well-informed, diversify their portfolios, and employ sound risk management strategies to navigate the dynamic landscape of the Indian stock market.

Keep a watchful eye on key economic indicators, global developments, and corporate news to make informed decisions and seize opportunities while mitigating risks.