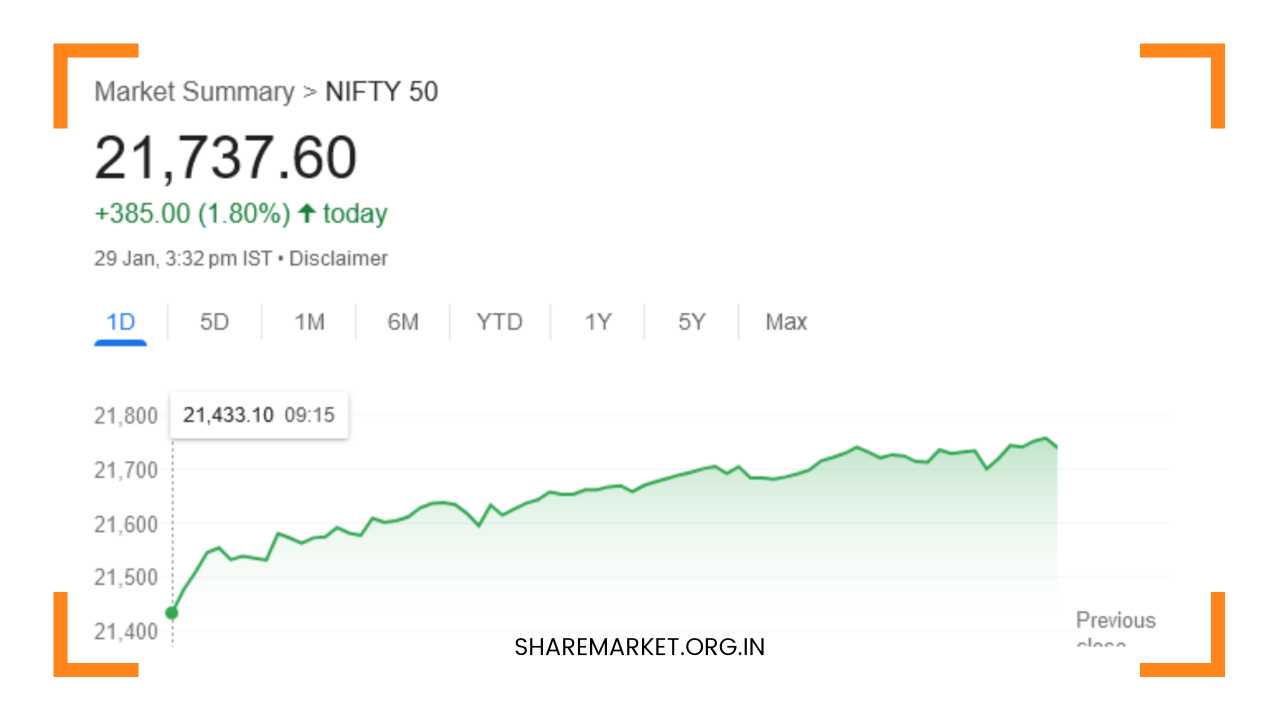

Nifty Closed at 21,737.60; Nifty Prediction for Tomorrow

Nifty Prediction for Tomorrow

Unraveling the Complex Tapestry of the Indian Stock Market: A Deep Dive into January 29 and Beyond

The Indian stock market staged a dramatic recovery on January 29, echoing resilience and strength as it rebounded from previous losses, setting a positive tone for the week ahead.

The day witnessed a surge in buying across all sectors, catapulting both Nifty and Sensex to notable gains.

This extensive analysis meticulously dissects the key market movements, delves into the standout performances of individual stocks, scrutinizes the sectoral indices, and incorporates expert opinions, offering a comprehensive understanding of the intricacies of the day’s trading activities and shedding light on potential market dynamics for January 30.

Market Overview

January 29 was a day of resurgence for the Indian stock market, with Nifty and Sensex notching up gains of approximately 2 percent. The Sensex closed at 71,941.57, exhibiting a robust surge of 1,240.90 points or 1.76 percent.

Simultaneously, the Nifty concluded at 21,737.60, marking an impressive gain of 385.00 points or 1.80 percent.

A rally in Asian markets provided impetus, propelling both indices past significant milestones and closing near the day’s high at 72,000 for Sensex and 21,750 for Nifty.

Top Gainers and Losers

Individual stock performances played a pivotal role in shaping the day’s narrative. Notable gainers on Nifty included ONGC, Reliance Industries, Adani Enterprises, Coal India, and Adani Ports, emerging as the top contributors to the overall positive sentiment.

In contrast, some stocks faced declines, with Cipla, ITC, LTIMindtree, Bajaj Auto, and Infosys experiencing declines and contributing to the day’s losers on Nifty.

Sectoral Performance

A nuanced examination of sectoral indices unveiled a multifaceted landscape. The oil and gas index was a standout performer, closing with an impressive 5 percent increase, underscoring the sector’s robust performance.

Additionally, the power index recorded a commendable 3 percent surge, while the Capital Goods Index witnessed a 2 percent uptick.

The positive sentiment cascaded into the midcap and smallcap segments, with the BSE Midcap Index rising by 1.7 percent and the Smallcap Index closing 1 percent higher.

Build-Up Analysis

Zooming in on individual stocks provided valuable insights into market sentiment and potential trends. ONGC, Reliance Industries, and REC stood out for a long build-up, signaling increased bullish activity around these entities.

Conversely, a short build-up was observed in AU Small Finance Bank, SBI Cards, and United Breweries, indicating a more bearish stance on these stocks.

Expert Opinion and Market Outlook

Aditya Gaggar, Director of Progressive Shares, lent his expert insights into the day’s trading session. Gaggar underscored the significance of the energy segment during the day, highlighting the robust growth exhibited by major players such as Reliance and ONGC.

The Nifty, initiating the week around its key resistance of 21,500, sustained its upward trajectory and closed at 21,737.60, securing a substantial gain of 385 points.

Gaggar provided a comprehensive analysis of the broader market sentiment, noting that, with the exception of the Fast-Moving Consumer Goods (FMCG) sector, all other sectoral indices closed in positive territory.

Energy and PSU banking sectors emerged as the top gainers, making substantial contributions to the overall positive momentum in the market.

The Nifty, in a singular move, surpassed several key barriers, forming a robust bullish candle on the daily chart.

However, Gaggar urged caution regarding potential resistance around the 21,750 mark. He hinted at the possibility of an inverted head and shoulders pattern forming, suggesting a potential trend reversal.

While Gaggar identified immediate resistance at 21,850, he also acknowledged support at 21,570 for Nifty.

Despite these insightful observations, he emphasized that it was too early to make conclusive predictions about future market movements.

Looking Ahead: A Comprehensive Perspective

As we look ahead to January 30, it is essential to synthesize the myriad factors at play and anticipate potential market dynamics.

The rebound on January 29 was undeniably robust, but navigating the complexities of the stock market requires a nuanced approach.

The impressive gains on January 29 were propelled by several factors, including the positive global cues stemming from the rally in Asian markets.

However, as seasoned investors would attest, market dynamics are inherently dynamic and subject to various influences, both domestic and international.

The sectoral performance on January 29 offers intriguing insights into the segments that led the market charge. The oil and gas sector’s stellar 5 percent increase underscores the resilience of this industry and its significance in shaping market sentiment. Additionally, the power and Capital Goods sectors contributed significantly, reflecting broader economic trends.

The build-up analysis further deepens our understanding of investor sentiment. Long build-up in stocks like ONGC and Reliance Industries suggests sustained bullishness, potentially driven by positive expectations and market outlook.

Conversely, short build-up in certain stocks signals a degree of caution and bearish sentiment, warranting attention to potential downside risks.

Aditya Gaggar’s cautionary notes about potential resistance at 21,750 and the formation of an inverted head and shoulders pattern add layers to our understanding.

The identification of immediate resistance at 21,850 and support at 21,570 provides crucial levels for investors to monitor. However, the overarching message remains that the market is dynamic, and predictive models have their limitations.

Final Remarks: Navigating Uncertainties with Informed Decision-Making

In conclusion, January 29 unfolded as a pivotal day for the Indian stock market, marked by a resounding recovery and positive momentum.

The top gainers, sectoral indices, and expert analysis provided a holistic view of the market dynamics. As we look ahead to January 30, the market appears to be at a crossroads, presenting both challenges and opportunities.

Navigating the uncertainties of the stock market requires a blend of analytical acumen, risk management strategies, and an understanding of broader economic trends.

The comprehensive analysis presented here serves as a guide for investors, offering a detailed understanding of recent market movements and expert perspectives.

As market participants chart their course for the coming days, the key lies in informed decision-making, adapting to changing market dynamics, and maintaining a vigilant stance in the face of evolving economic landscapes.