Nifty Closed at 21,951; Nifty Prediction for Tomorrow

Nifty Prediction for Tomorrow

Market Analysis: Navigating the Complexities of February 28, 2024

The Indian equity market faced significant turbulence on February 28, 2024, with both the Sensex and Nifty experiencing a substantial decline of over one percent.

This downturn was marked by widespread selling across all sectors, with small and midcap stocks bearing the brunt of the losses.

The day witnessed a roller-coaster ride as indices, especially the Sensex, saw a recovery from intraday lows.

Despite the rebound, the market sentiment remained bearish, leaving investors and analysts pondering over the possible implications and future trajectories.

Index Movements:

The Sensex, after hitting an intraday low of 72,222.29, managed to claw back, concluding the day at 72,304.88. However, this still represented a notable decrease of 790.34 points or 1.08 percent.

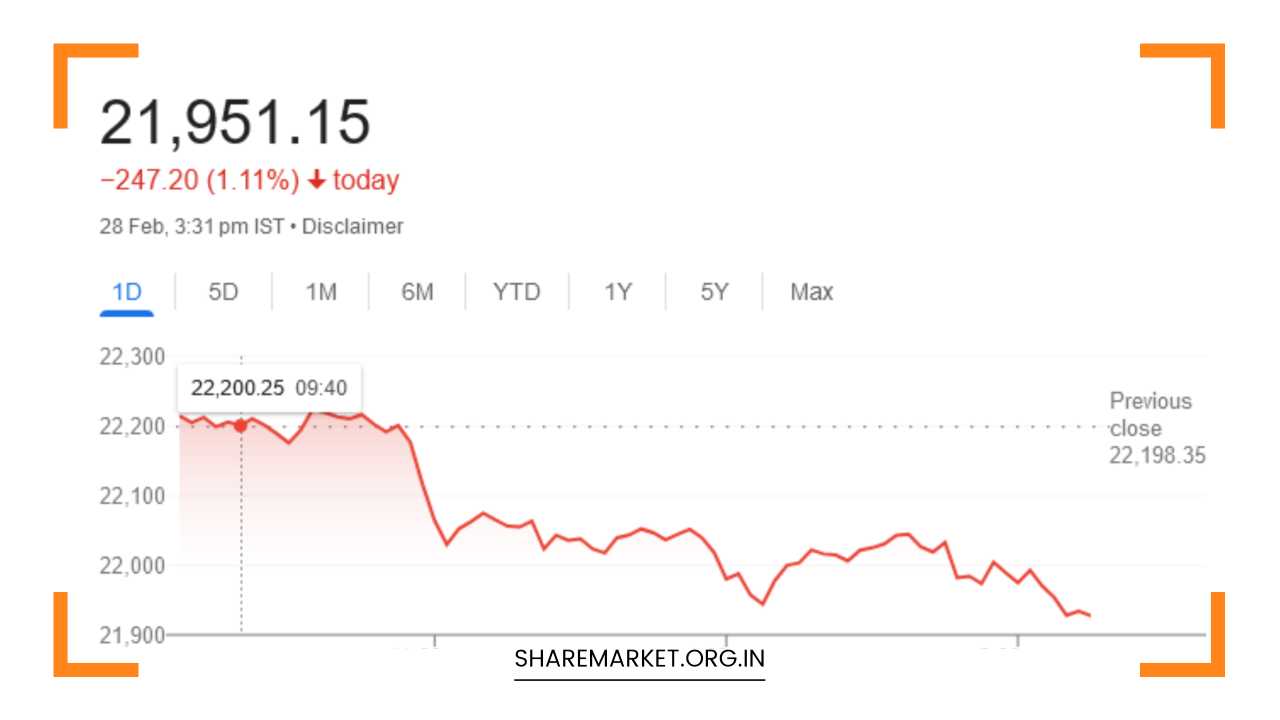

The Nifty, mirroring the trend, closed at 21,951.20, down 247.10 points or 1.11 percent from its previous close, reaching an intraday low of 21,918.85.

Stock-Specific Analysis:

Individual stocks played a pivotal role in shaping the market narrative on February 28. Notable decliners in the Nifty included Power Grid Corporation, Apollo Hospitals, Eicher Motors, and Maruti Suzuki. In contrast, the top gainers featured heavyweights like HUL, Infosys, TCS, and Bharti Airtel.

This divergence among stocks showcased the nuanced dynamics at play within the market, emphasizing the importance of a granular approach to stock selection.

Sectoral Impact:

The impact of the downturn was felt across all sectors, with auto, oil and gas, electricity, and realty indices closing in the red, each witnessing a 2 percent decline.

The broader market, as reflected in the BSE midcap and smallcap indices, also experienced a dip of 2-2 percent.

This broad-based sell-off indicates a lack of sector-specific immunity, as the market grappled with concerns that cut across industries.

Market Analyst Perspectives:

Aditya Gaggar, Director at Progressive Shares, provided insights into the market’s behavior on February 28. He characterized the day’s trading as exhibiting rangebound activity, ultimately concluding with bears dominating the session.

Gaggar highlighted that selling pressure intensified in the second half of the trading session, causing the Nifty to dip below the psychological mark of 22,000 points.

The Nifty closed at 21,951.15, marking a significant fall of 247.20 points. Gaggar pointed out the emergence of a bearish engulfing candlestick pattern, signaling short-term weakness in the Nifty.

Technical Analysis:

The technical analysis offered by Gaggar indicated that the Nifty 50 index had breached the downside congestion zone, confirming weakness in the short term.

Immediate support for the Nifty was identified at 21,820, while resistance stood at 22,100. This technical perspective served as a roadmap for investors, offering crucial levels to watch in the upcoming sessions.

Rupak Dey, a seasoned analyst from LKP Securities, delved deeper into the day’s market movements. He noted a sharp correction in Nifty during the day, driven by heavy selling, as the index dropped below the psychological level of 22,000 points.

Despite the bearish sentiment, Dey highlighted a crucial aspect – the index managed to close just above the 21EMA on the daily time frame. This observation hinted at a potential resilience, even in the face of intense selling pressure.

Dey further emphasized the importance of chart patterns by pointing out that Nifty was navigating within a rising channel on the daily chart.

He presented two potential scenarios based on the index’s behavior. If Nifty breaches the 21,950 level, the correction may intensify, with a downside target of 21,800.

On the contrary, if the index manages to stay above 21,950, a potential upside towards 22,100 could be on the horizon.

Market Sentiment and Concerns:

The market sentiment on February 28 was marked by caution and concern. The widespread decline and the breach of key technical levels raised questions about the sustainability of the ongoing bull market.

Investors were grappling with uncertainties surrounding global economic conditions, geopolitical tensions, and domestic factors such as inflation and interest rate scenarios.

The concerns were palpable in the sell-off across sectors, with no particular industry emerging unscathed. Auto, oil and gas, electricity, and realty indices, representing diverse segments of the economy, all witnessed a 2 percent decline.

This broad-based decline suggests that investors were adopting a risk-averse stance, potentially reallocating their portfolios in response to the evolving market dynamics.

Market Outlook for February 29:

As investors braced for the trading session on February 29, analysts presented contrasting perspectives on the potential market movement.

Aditya Gaggar’s analysis hinted at the continuation of bearish sentiment, with immediate support at 21,820 and resistance at 22,100.

The bearish engulfing candlestick pattern added weight to the argument for a short-term weakness in the Nifty.

Rupak Dey, on the other hand, provided a nuanced view, acknowledging the day’s sharp correction but also highlighting the index’s ability to close just above the 21EMA on the daily timeframe.

The rising channel on the daily chart added an element of technical complexity, offering both bearish and bullish scenarios based on key support and resistance levels.

Investor Guidance:

In such challenging market conditions, investors need to exercise caution and prudence. The technical levels provided by analysts serve as crucial guideposts, allowing investors to navigate the market with a more informed approach.

Monitoring key support levels, such as 21,820, and resistance levels, such as 22,100, will be pivotal in understanding the evolving market sentiment.

Investors are advised to keep a close eye on macroeconomic indicators, global developments, and domestic policy changes that could impact market dynamics.

The potential for increased volatility underscores the importance of a diversified portfolio and risk management strategies.

Engaging with market experts, staying abreast of news developments, and reassessing investment strategies based on changing conditions will be essential in navigating the uncertainties ahead.

Final Remarks:

The market landscape on February 28, 2024, presented a complex tapestry of challenges and opportunities. The widespread decline across sectors, coupled with individual stock movements, indicated a market grappling with multifaceted concerns.

Analyst perspectives offered valuable insights, ranging from technical levels to nuanced chart patterns, providing investors with a roadmap for the days ahead.

As the market approached February 29, the divergent views underscored the inherent uncertainty. Whether the bearish sentiment prevails or the index displays resilience, investors need to remain agile and adaptive.

The careful consideration of technical analyses, coupled with a broader understanding of market fundamentals, will empower investors to make informed decisions in a landscape defined by volatility and rapid shifts.