Nifty Closed at 22,198; Nifty Prediction for Tomorrow

Nifty Prediction for Tomorrow

Resilient Indian Stock Market Navigates Volatility with Positive Outlook

In the intricate tapestry of the Indian stock market, February 27th showcased resilience amidst a volatile trading session. The BSE Sensex, a key benchmark, closed at 73,095.22, marking a robust gain of 305.09 points or 0.42%.

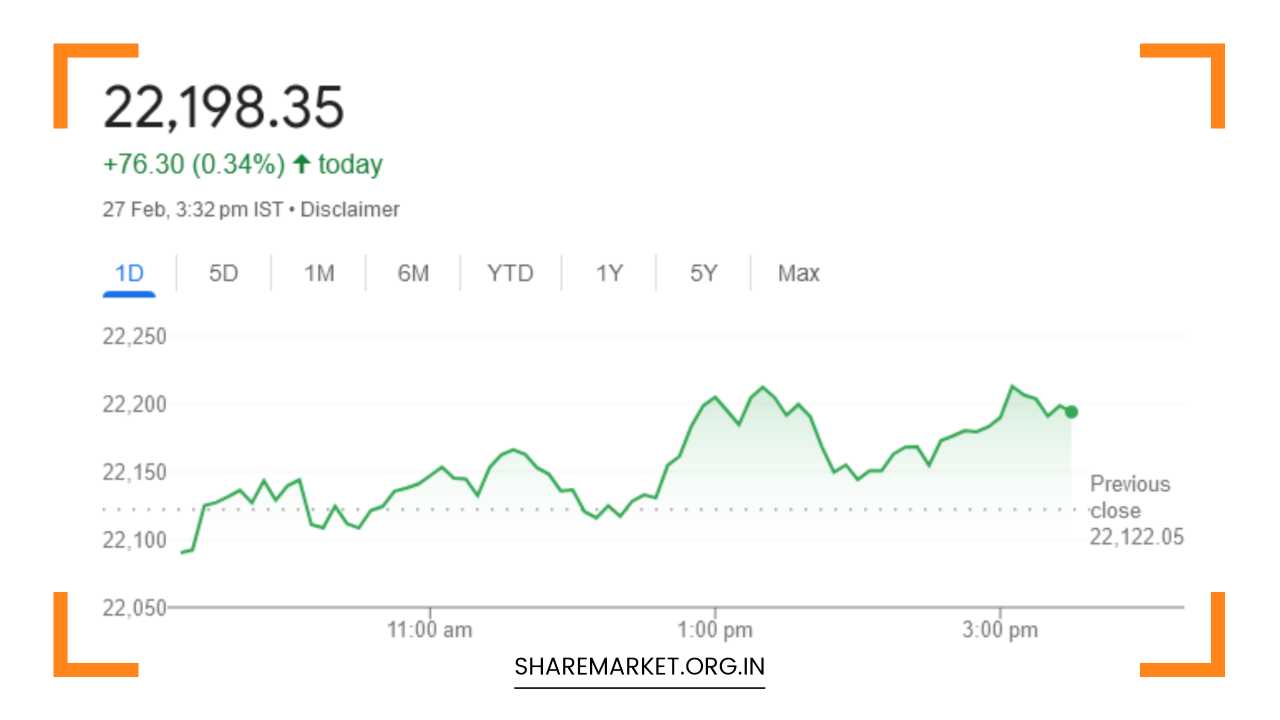

Similarly, the Nifty, another significant index, closed at 22,198.30, securing a noteworthy 76.30 point gain or 0.34%.

However, amid this positivity, the BSE Midcap and Smallcap indices experienced a marginal decline, emphasizing the nuanced nature of the market movements.

Notably, the Bank Nifty stood out by exhibiting strength, rising 12 points and closing at 46,588, in stark contrast to the midcap index, which fell 61 points, closing at 49,041.

Market Breadth and Top Performers

The market breadth painted a diverse picture with approximately 1340 shares gaining momentum, 1968 shares witnessing declines, and 72 shares remaining unchanged.

The top Nifty gainers included prominent names such as Tata Motors, TCS, IndusInd Bank, Power Grid Corp, and Sun Pharma.

On the flip side, notable losers comprised Hero MotoCorp, Bajaj Finance, SBI, Divis Labs, and UPL, reflecting the ebb and flow of different sectors within the market.

Sectoral Dynamics and Mixed Performances

Delving into specific sectoral performances, a discernible increase of 0.5-1% was observed in Auto, Capital Goods, IT, Pharma, and Realty.

However, the oil and gas index emerged as a laggard, closing down by 1%. The BSE Midcap and Smallcap indices closed with slight losses, indicating a mixed bag of outcomes across sectors.

Insights for February 28th Trading Session

Looking ahead to the trading session on February 28th, market analysts offer insightful perspectives. Jatin Gedia of Sharekhan notes that Nifty exhibited a weak start but managed to reverse its fortunes, concluding the day in positive territory.

Analyzing the daily chart, Gedia highlights that Nifty is firmly holding the support zone of 22,100 – 22,070, with the 40-hourly average located in this range.

The broader market sentiment suggests consolidation within a wide range (21,900 – 22,300) over recent trading sessions.

Technical Analysis and Market Trends

Bollinger Bands, a key technical indicator, are narrowing, signaling a range-bound market. Gedia interprets the positive crossover in the Hourly Momentum Indicator as a bullish sign, indicating potential buying opportunities during intraday dips.

On the downside, Nifty finds significant support at 21,900, while facing immediate resistance at 22,300. These technical insights provide traders and investors with a roadmap for potential market movements in the short term.

Turning attention to Bank Nifty, it is navigating a range between 46,300 and 47,400. In the recent trading session, it remained at the 40-day average (46,300) and bounced back, suggesting a continuation of the uptrend in the upcoming sessions. Immediate resistance for Bank Nifty is seen at 47,000, with the next resistance level at 47,200.

Analyzing Bullish Signals and Market Control

Rupak De of LKP Securities contributes to the market narrative by highlighting a bullish engulfing pattern formed by Nifty after two days of weakness.

Beyond this technical pattern, the positive trend persists as Nifty continues to remain above the short-term moving average. Bulls seem to retain control as Nifty closes above the previous consolidation high.

If Nifty surpasses the 22,200 mark, De anticipates a rally up to 22,400 in the short term. Notably, there is strong support for Nifty at 22,000, providing a downside buffer.

Cautious Optimism and Strategic Considerations

In the midst of these technical analyses, the broader sentiment is cautiously optimistic. Analysts are pointing towards potential buying opportunities and sustained positive trends in key indices.

Investors are advised to monitor support and resistance levels meticulously, enabling them to make informed decisions in the dynamic and ever-changing landscape of the stock market.

Market Dynamics and Investor Preparedness

As market participants gear up for the trading session on February 28th, the focus remains on navigating the intricacies of the market, leveraging technical indicators, and staying attuned to evolving trends.

The cautious optimism prevalent in the market suggests that while challenges persist, opportunities for strategic investments and trades may continue to emerge.

With a blend of technical analysis and market sentiment, investors can position themselves to navigate the ongoing volatility and potentially capitalize on the evolving market dynamics.

Final Remarks: Navigating Opportunities in Dynamic Markets

In conclusion, the Indian stock market’s ability to weather volatility on February 27th reflects a resilient foundation.

The positive outlook is underscored by the impressive gains in key indices, despite the nuanced declines in midcap and smallcap segments.

As traders and investors look ahead to the February 28th trading session, a combination of technical analysis and market sentiment provides valuable insights.

The cautious optimism resonating in the market encourages a strategic approach, emphasizing the importance of monitoring support and resistance levels.

With bullish signals observed in Nifty and the Bank Nifty’s resilient performance, there appears to be a potential for continued positive momentum.

However, the market’s dynamic nature necessitates adaptability and preparedness for unexpected shifts.

As the Indian stock market continues its journey through fluctuating landscapes, investors can leverage these insights to make informed decisions, strategically positioning themselves for potential opportunities in the evolving market scenario.

Whether it’s capitalizing on intraday dips or anticipating trend reversals, a comprehensive understanding of technical indicators and market dynamics equips investors to navigate the complexities of the stock market with confidence.