Nifty Closed at 22,201; Tomorrow Nifty Prediction

Tomorrow Nifty Prediction

Market Takes a breather: Mid-Caps Shine Despite Profit Booking

The Indian stock market witnessed a reversal of fortune today, snapping a two-day winning streak. After a strong opening fueled by bullish sentiment, profit booking in key sectors like banking, auto, and FMCG dragged the indices lower throughout the trading session.

Despite the decline, the broader market wasn’t all doom and gloom. Mid-cap and small-cap stocks provided a silver lining, registering significant gains.

A Tale of Two Markets: Consolidation vs. Surge

The trading session commenced with a positive outlook, mirroring the previous two days’ gains. However, selling pressure emerged as the day progressed, particularly in heavyweight sectors like banking, auto, and FMCG. This profit booking stemmed from a combination of factors, including:

- Technical corrections: After a period of strong gains, investors opted to lock in profits, leading to a natural market pullback.

- Global cues: The delay in a rate cut by the US Federal Reserve might have instilled a sense of caution among domestic investors.

Despite the overall decline, specific segments defied the trend and displayed remarkable resilience. The mid-cap index emerged as the star performer, surging by over 450 points, translating to a commendable 1% rise. This robust performance signifies continued investor interest in smaller companies with high-growth potential.

Additionally, the Nifty Metal Index scaled to a record high, fueled by optimism surrounding the commodities sector. Selective buying activity was also observed in oil & gas and realty stocks, offering some support to the broader market.

Index Performance and Sectoral Analysis

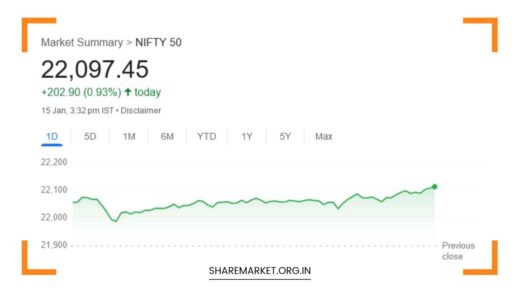

The benchmark indices closed lower, reflecting the profit-taking activity. The Sensex slipped by 118 points, settling at 72,987. Similarly, the Nifty fell 17 points, closing at 22,201.

The Bank Nifty, heavily impacted by selling pressure in banking stocks, witnessed a steeper decline of 172 points, closing at 47,687.

While heavyweight sectors experienced selling pressure, mid-cap and small-cap stocks bucked the trend. The Nifty Midcap 50 index surged by 483 points, ending the day at 50,708, while the Nifty Smallcap 50 index also closed higher, showcasing the dynamism of these segments.

Analyst Viewpoint: A Cautious Optimism

Market experts remain cautious in their outlook, citing upcoming events and global uncertainties. Here’s a breakdown of some key analyst insights:

- Sunil Damania, Chief Investment Officer, MojoPMS: Damania highlights the concerns surrounding the upcoming elections, particularly the potential impact of voting percentage on the election outcome. This uncertainty is weighing on investor sentiment.

- Pankaj Carde, President and Head-Institutional Equities, Asit C Mehta Investment Intermediates: Carde adopts a more optimistic approach, suggesting that any market correction should be seen as a buying opportunity. However, he warns of a potential decline to 21,800 levels in the Nifty 50 if the current government doesn’t retain power.

- Ajit Mishra of Religare Broking: Mishra advises a cautious approach, emphasizing the resistance zone for the Nifty at 22,300-22,400. He suggests focusing on high-quality stocks and recommends keeping a close eye on global markets, particularly the American markets, for potential cues.

- Prashant Tapse of Mehta Equities: Tapse attributes the market decline to profit booking and cautious investor sentiment driven by global factors like the delay in the US Fed rate cut.

The Road Ahead: Navigating Market Volatility

While the immediate future might witness some volatility, analysts remain cautiously optimistic about the long-term prospects of the Indian stock market. Here are some key factors to consider moving forward:

- Election Outcome: The outcome of the upcoming elections will significantly influence investor sentiment. A stable and predictable government is generally viewed as positive for the market.

- Global Cues: The trajectory of the US Fed rate cut and international economic developments will play a crucial role in shaping the domestic market’s direction.

- Corporate Earnings: The upcoming earnings season will provide valuable insights into the financial performance of companies, influencing investor decisions.

Investor Strategy: Focus on Quality and Diversification

Given the current market dynamics, investors are advised to adopt a prudent approach. Here are some key strategies to consider:

- Focus on Quality: Prioritize investing in fundamentally strong companies with a proven track record and good management.

- Diversification: Spread your investments across different sectors and asset classes to mitigate risk.

- Long-Term Perspective: Maintain a long-term investment horizon and avoid being swayed by short-term market fluctuations.

- Stay Informed: Keep yourself updated with market news, economic data, and corporate announcements to make informed investment decisions.

Industry Spotlight: Opportunities Beyond the Headlines

While the broader market experienced profit booking, specific sectors displayed encouraging signs. Let’s delve deeper into some of these bright spots:

-

The Rise of the Mid-Caps and Small-Caps: The outperformance of mid-cap and small-cap stocks indicates a shift in investor focus towards companies with high-growth potential. These segments often house innovative startups and established businesses in niche markets, offering attractive investment opportunities for those with a risk appetite. Investors seeking long-term capital appreciation can consider researching and identifying promising companies within these segments.

-

Metals: A Gleaming Outlook: The Nifty Metal Index reaching a record high highlights the continued optimism surrounding the commodities sector. Factors like rising global demand for metals, coupled with supply chain disruptions, are pushing up prices. Investors interested in this sector can explore companies engaged in metal exploration, mining, and processing.

-

Real Estate: A Foundation for Growth: Selective buying in the real estate sector suggests a potential revival. Government initiatives aimed at affordable housing and infrastructure development could act as catalysts for growth. Investors can consider Real Estate Investment Trusts (REITs) or stocks of companies positioned to benefit from the anticipated rise in the sector.

-

Oil & Gas: Fueling the Future: The buying activity in oil & gas stocks reflects the ongoing importance of this sector in the global energy mix. While the future of energy is undoubtedly shifting towards renewables, oil & gas companies are likely to remain relevant for the foreseeable future. Investors with a balanced approach can explore opportunities in this sector, keeping a close eye on the evolving energy landscape.

Beyond Domestic Shores: Global Influences

The Indian stock market doesn’t operate in isolation. Here’s a glimpse into some key global factors that can influence its trajectory:

-

US Federal Reserve Policy: The decisions of the US Fed regarding interest rates and quantitative easing have a ripple effect on global markets, including India. A delay in the rate cut, as witnessed recently, can lead to capital outflows from emerging markets like India, impacting liquidity and investor sentiment.

-

Geopolitical Tensions: Global conflicts and political instability can disrupt supply chains, influence commodity prices, and create uncertainty in the international financial system. Investors should stay informed about evolving geopolitical situations and their potential ramifications on the Indian market.

-

Performance of Major Indices: The performance of prominent global indices like the S&P 500 and the Dow Jones Industrial Average can influence investor sentiment in India. A strong showing in these indices can boost confidence and encourage investments in emerging markets.

Final Remarks: Embracing Calculated Optimism

The Indian stock market’s recent pullback serves as a reminder of the inherent volatility in the financial world. However, this correction shouldn’t obscure the long-term growth potential of the Indian economy.

By carefully analyzing sector trends, global influences, and adopting a well-defined investment strategy, investors can navigate market fluctuations and position themselves to benefit from future opportunities.

Remember, a disciplined approach, a focus on quality, and a long-term perspective are key ingredients for success in the dynamic world of stock markets.

Excited to see where Nifty heads next after closing at 22,201! Any predictions for tomorrow’s movements?