Nifty Cross 23,550, Sensex Up 141 Points; Nifty Prediction for Tomorrow

Nifty Prediction for Tomorrow

Market Recap and Analysis: A Day of Tentative Moves in a Rangebound Market

Market Swings But Manages Gains: A Look Back at June 20th’s Trading Session

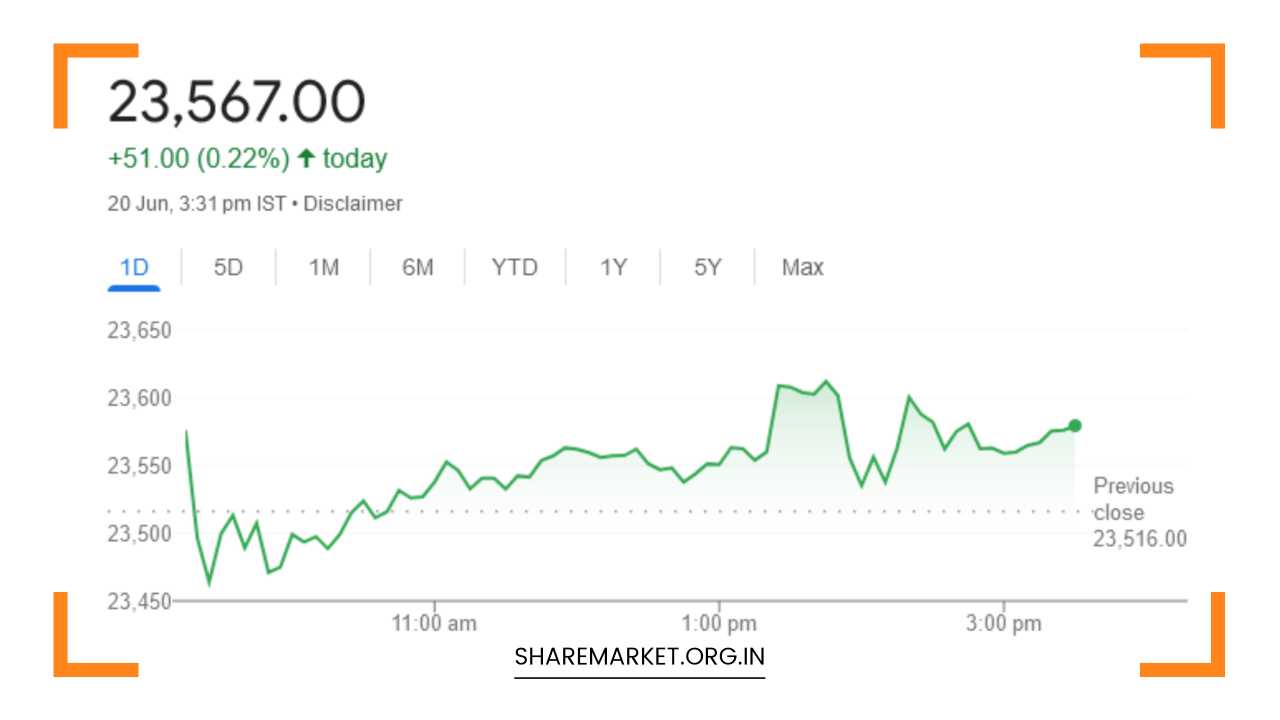

The Indian stock market navigated a volatile session on June 20th, 2024, with both the Sensex and Nifty ending the day on a positive note. Despite the swings, the gains were modest, reflecting a cautious undercurrent amidst investors.

The Sensex benchmark index edged up by 0.18%, settling at 77,478.93. The Nifty 50, a broader representation of the market, also inched higher by 0.22%, closing at 23,567.

Dissecting the Day’s Action: Sectoral Shifts and Stock Performances

A closer look reveals a mixed bag of sectoral performances. Sectors like metals, capital goods, realty, and oil & gas witnessed buying interest, indicating investor confidence in these segments.

Analysts believe this could be due to factors like rising commodity prices, infrastructure projects, and a potential pick-up in economic activity. On the other hand, automobiles, pharmaceuticals, and PSU banks encountered selling pressure.

Profit booking after recent gains, concerns surrounding chip shortages in the auto industry, and potential regulatory changes in the pharma sector might be contributing to this cautiousness.

Breaking Down the Numbers: A Day Dominated by Advancers

Over 2068 stocks witnessed gains on June 20th, showcasing a broadly positive sentiment at the individual stock level. However, this optimism was tempered by the decline in 1304 stocks.

Notably, 83 stocks remained unchanged, highlighting the cautious approach adopted by some investors, possibly waiting for a clearer market direction before making significant moves.

Focus on Broader Market: Midcaps and Smallcaps Lead the Way

The BSE midcap index and smallcap index continued their outperformance, gaining 0.5% and 1% respectively. This sustained momentum in the broader market suggests potential opportunities beyond the large-cap space. Analysts attribute this trend to several factors, including:

- Lower valuations: Midcap and smallcap stocks may offer comparatively attractive valuations compared to their large-cap counterparts.

- Higher growth potential: Smaller companies often have the potential for faster growth rates, which can be enticing for investors seeking capital appreciation.

- Diversification benefits: Including midcap and smallcap stocks in a portfolio can help diversify holdings and potentially reduce overall portfolio risk.

Market Analysis: A Doji Paints a Picture of Indecision

Nagaraj Shetti, an analyst at HDFC Securities, sheds light on the technical aspects of the market’s recent movement. He identifies a “doji-like pattern” on the daily chart of Nifty.

This candlestick formation typically signifies indecision between buyers and sellers, suggesting a continuation of the current sideways rangebound movement. The presence of this pattern underscores the cautious sentiment prevailing in the market.

Short-Term Volatility and Potential Opportunities

Shetti anticipates short-term volatility in the coming sessions, with potential weakness around the 23750-23800 zone.

However, he interprets this as a buying opportunity for short-term traders who are comfortable with higher risk. He suggests that the market might target 23950 in the near term, with immediate support resting at 23450.

These levels provide crucial reference points for traders to make informed decisions based on their risk tolerance and trading strategies.

Expert Insights: A Look Beyond the Headline Numbers

Aditya Gaggar, Director at Progressive Shares, delves deeper into the sectoral dynamics. He emphasizes the strong performance of the metals and realty sectors, attributing it to specific factors driving investor interest.

For instance, rising metal prices globally due to supply chain disruptions and infrastructure projects undertaken by the government could be fueling investor interest in the metals sector.

Similarly, expectations of a revival in the real estate sector due to lower interest rates and increased demand for housing could be contributing to the rally in realty stocks.

Conversely, he acknowledges the profit booking activity in the auto sector, possibly due to concerns surrounding chip shortages impacting production, and the pressure faced by the pharma sector amid worries about potential regulatory changes.

Mid and Smallcaps Maintain Momentum

Gaggar reiterates the continued outperformance of midcap and smallcap stocks, indicating that investor focus might be broadening beyond the large-cap space.

This trend could potentially lead to a more diversified market participation and potentially higher returns, but also carries inherent risks associated with smaller, less established companies.

Looking Ahead: A Breakout or Continued Consolidation?

The spinning top candlestick pattern observed on the Nifty chart underscores the ongoing market indecision. The presence of support at 23,340 and resistance at 23,660 indicates a defined range within which the market has been trading. A breakout on either side of this range will be critical in determining the future direction.

Potential Breakout Scenarios and Their Implications

-

Upward Breakout: If the Nifty decisively breaks above the resistance level of 23,660, it could signal a resumption of the uptrend. This could be fueled by positive economic data, increased foreign inflows, or upbeat corporate earnings. A breakout in this direction could lead to further gains in the near term, with targets potentially extending towards 24,000 or higher.

-

Downward Breakout: Conversely, a break below the support level of 23,340 could indicate a shift towards a downtrend. This might occur due to negative global cues, rising interest rates, or weak corporate earnings reports. A breakdown below support could lead to further selling pressure and potential targets towards 23,000 or lower.

Strategies for Navigating a Rangebound Market

Given the current market indecision, investors might consider the following strategies:

-

Focus on Stock Selection: Meticulous stock selection, considering factors like company fundamentals, valuations, and growth prospects, can be more important than chasing market trends in a rangebound environment.

-

Invest for the Long Term: A long-term investment approach can help ride out short-term volatility and potentially benefit from the market’s long-term growth trajectory.

-

Utilize Averaging Techniques: Rupee-cost averaging or systematic investment plans (SIPs) can help investors to average out their purchase cost and potentially reduce the impact of market volatility.

-

Maintain Discipline and Risk Management: Sticking to a well-defined investment plan, practicing sound risk management techniques, and avoiding emotional decision-making are crucial during periods of market uncertainty.

Final Remarks: A Balancing Act – Patience and Strategic Moves

The June 20th trading session presented a scenario of cautious optimism with tentative moves. While the indices closed with gains, the overall sentiment remained indecisive.

Investors are likely waiting for a clearer directional signal before making significant commitments. Analyzing expert opinions alongside technical indicators like support and resistance levels can be instrumental in navigating this phase of consolidation.

In the absence of a decisive breakout, patience, coupled with strategic stock selection and disciplined risk management, might be key for investors in the near term.

Looking beyond the immediate session, long-term investors can find opportunities in a rangebound market by focusing on quality stocks and employing strategic investment techniques.