Nifty Gain 318 Points, Nifty at 23,311; Tomorrow Nifty Prediction

Tomorrow Nifty Prediction

Indian Stock Market Shows Resilience: Nifty and Sensex Mark Third Consecutive Day of Gains—What to Expect on January 17

Indian equity markets ended on a positive note on January 16, as the benchmark indices saw their third consecutive day of gains.

While the broader market saw limited trading activity, mid and small-cap stocks outperformed the frontline indices.

This trend suggests a continued shift towards a broader market rally, with smaller stocks gaining momentum as large-cap stocks face consolidation.

The Nifty managed to stay above the important psychological level of 23,300, while the Sensex continued its upward journey.

In this article, we delve deeper into the performance of the Indian stock market on January 16 and the outlook for January 17.

Market Performance: Positive Close for the Day

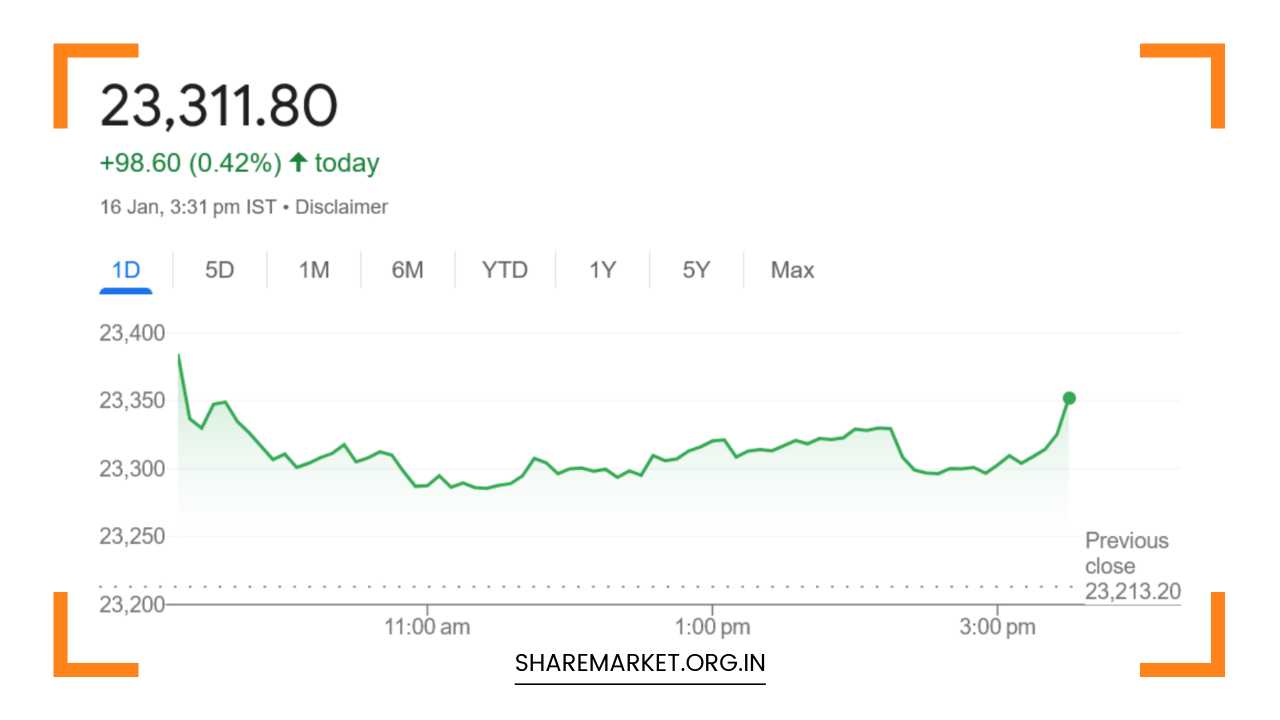

At the end of the trading session on January 16, the Sensex closed 318.74 points, or 0.42%, higher at 77,042.82, and the Nifty ended the day 98.60 points, or 0.42%, up at 23,311.80.

Despite a strong start to the day, the indices faced some resistance, causing a limited range in which the market traded throughout the session.

However, the fact that both the Sensex and Nifty closed higher was seen as a positive sign for market sentiment.

Market breadth remained in favor of the bulls, with 2,669 stocks advancing, 1,132 declining, and 101 stocks remaining unchanged.

This suggests that overall, the market’s gains were broad-based. The top gainers in the Nifty included stocks such as HDFC Life, Shriram Finance, SBI Life Insurance, Bharat Electronics, and Adani Ports.

These stocks not only saw good price appreciation but also helped lift the market, with their robust performances contributing significantly to the index’s upward movement.

On the other hand, there were a few underperformers in the Nifty, such as Trent, Tata Consumer, Dr. Reddy’s Laboratories, HCL Technologies, and Wipro.

These stocks faced selling pressure, contributing to some weakness in the broader market, particularly in the FMCG, IT, and pharma sectors.

Mid and Small-Cap Stocks Lead the Rally

One of the standout features of the trading session on January 16 was the performance of mid and small-cap stocks.

The BSE Midcap Index rose by 1%, while the Smallcap Index saw a stronger gain of 1.4%. This outperformance of smaller stocks over the large-cap indices is an indication that investor sentiment is becoming more optimistic and that risk appetite is increasing.

Many mid and small-cap stocks tend to be more volatile, but they offer higher growth potential in a positive market environment.

The shift towards mid and small-cap stocks suggests that investors are looking beyond the heavyweights and diversifying into stocks with greater growth potential.

These stocks, which are often seen as undervalued compared to large-cap counterparts, may be benefitting from the improving market outlook, with investors hopeful of stronger earnings growth in the coming quarters.

Sectoral Performance: Green Across Most Sectors

In terms of sectoral performance, the day was largely positive. Most sectors closed in the green, with notable gains in sectors such as metal, media, oil and gas, PSU banks, realty, and auto.

These sectors rose by 0.5% to 2.5%, providing a solid boost to the indices.

The PSU banking sector was particularly strong, gaining more than 2% during the day. This was attributed to improved investor sentiment towards public sector banks, as many of these stocks have been underperforming for an extended period.

As a result, investors are increasingly looking to buy into undervalued stocks in this space, hoping for a turnaround.

Other sectors, such as metal and energy, also saw good gains, supported by rising commodity prices and positive global growth expectations.

The auto sector, which has been showing signs of recovery in recent months, continued its upward trajectory, with auto stocks benefiting from an uptick in demand and positive sales data.

However, not all sectors performed well. The durable goods, FMCG, IT, and pharma sectors faced some pressure, which weighed on the market to some extent.

IT and FMCG stocks, in particular, underperformed, reflecting investor concerns about higher input costs, margin pressures, and the broader global economic slowdown.

These sectors tend to be more sensitive to external economic factors, and their underperformance may have been a reflection of global headwinds.

Expert Opinions: Mixed Sentiment on Market Outlook

Aditya Gaggar, Director at Progressive Shares, provided an insightful analysis of the market’s performance.

He observed that despite a strong start to the day, the Nifty struggled to maintain its gains and remained in a limited range.

The index eventually closed marginally higher, up by 98.60 points. Gaggar noted that while the PSU banking sector was a major contributor to the day’s gains, FMCG and IT stocks underperformed, which capped the overall market movement.

From a technical perspective, Gaggar highlighted that the Nifty faces significant resistance at the 23,360 level. A decisive move above this level will be crucial for the market to maintain its uptrend.

If the Nifty fails to break through this resistance, it could slide back towards support levels at around 23,150. Traders and investors should closely monitor this level to gauge the market’s direction.

Jatin Gedia, Technical Research Analyst at Mirae Asset Sharekhan, also weighed in on the market’s outlook.

Gedia noted that after a sharp decline, the Nifty has been in a counter-trend pullback mode, and the upward break of the range seen in the last three trading sessions suggests that the current rally may continue.

He set a target range of 23,500 to 25,630 for the Nifty, assuming the current momentum holds.

Additionally, Gedia pointed to a positive crossover in the Overly Momentum indicator, which signals potential for further buying activity in the near term. On the downside, support levels are seen at 23,160 to 23,140.

What to Expect on January 17: Key Levels to Watch

Looking ahead to January 17, the outlook for the Indian stock market remains cautiously optimistic. The key levels to watch for the Nifty are 23,360 on the upside and 23,150 on the downside.

A break above 23,360 could signal the continuation of the uptrend, with potential for further gains. However, if the Nifty fails to cross this level, there could be a pullback towards support levels.

Given the strength in mid and small-cap stocks, investors may continue to seek opportunities in these segments, as they tend to offer higher growth potential.

Sectoral performance will also remain a key factor to watch, particularly in areas like PSU banks, metal, and auto, which have shown strong performance recently.

Overall, the Indian stock market is displaying resilience and could continue its upward trajectory if key technical levels are breached.

Investors should remain cautious but optimistic, keeping a close eye on global and domestic factors that may influence market sentiment in the coming days.