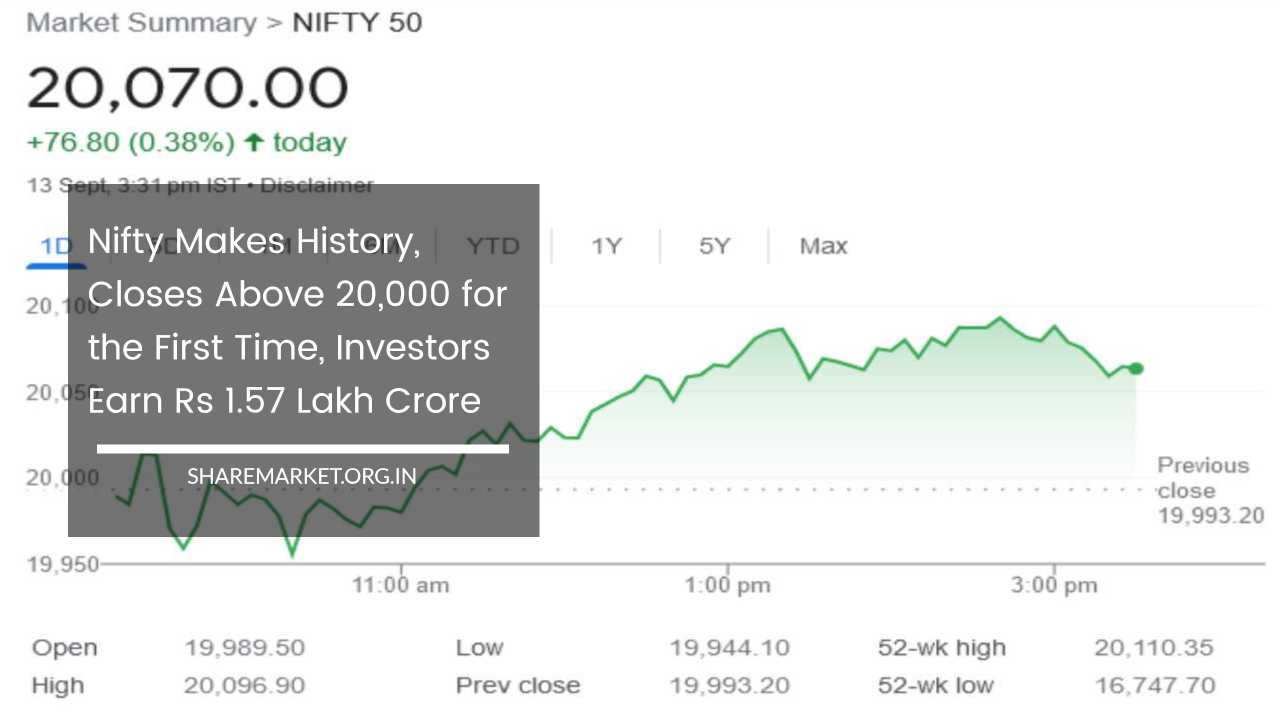

Nifty Makes History, Closes Above 20,000 for the First Time, Investors Earn Rs 1.57 Lakh Crore

Nifty

A Historic Day in the Indian Share Market: Nifty Crosses 20,000, Unveiling New Opportunities and Wealth Creation

The Indian Share Market: A Beacon of Economic Activity

The Indian share market, often regarded as the barometer of the nation’s economic health, stands as a pivotal pillar of the country’s financial landscape.

It is a dynamic arena where investors, traders, and institutions converge to buy and sell shares of publicly-listed companies.

The market’s performance not only reflects the economic climate but also shapes it by allocating capital to businesses, enabling growth, and creating wealth for individuals and institutions alike.

Nifty’s Historic Milestone: Closing Beyond 20,000

In this context, September 13, 2023, will be remembered as a historic day for the Indian share market.

On this momentous day, the Nifty, an index that tracks the performance of 50 prominent companies listed on the National Stock Exchange (NSE), breached the much-anticipated psychological barrier of 20,000 for the first time in its history.

This achievement sent ripples of excitement and optimism throughout the financial community, signifying a remarkable milestone in India’s economic journey.

Sensex Scaling New Heights

Accompanying Nifty’s record-breaking performance, the BSE Sensex, representing the 30 largest and most actively traded stocks on the Bombay Stock Exchange (BSE), also reached an all-time high.

The Sensex closed at 67,466.99 points, registering a notable gain of 245.86 points or 0.37%. This surge in the Sensex added another layer of exuberance to the market, showcasing the breadth of the rally that extended beyond just the Nifty stocks.

A Surge in Investor Wealth

Perhaps the most significant impact of this historic day was the substantial increase in investor wealth.

The combined market capitalization of companies listed on the BSE surged to ₹320.23 lakh crore on September 13, a remarkable jump from ₹318.66 lakh crore on the previous trading day (Monday, September 12).

This uptick in market capitalization amounted to approximately ₹1.57 lakh crore, symbolizing not just the financial gains but also the optimism and confidence that investors have in the Indian economy.

Factors Underpinning the Market Rally

The surge in the Indian share market on September 13 can be attributed to a combination of factors that coalesced to create a favorable environment for investors and traders.

Understanding these drivers provides valuable insights into the market’s dynamics and its resilience in the face of economic fluctuations.

Relief on the Inflation Front

One of the primary factors contributing to the bullish sentiment in the Indian share market was the positive news on the inflation front.

Inflation, which measures the rate at which prices of goods and services rise, had been a concern in the recent past.

However, on this historic day, reports of easing inflationary pressures provided much-needed relief to investors.

A controlled inflation rate is crucial for economic stability, as high inflation can erode the purchasing power of consumers and create uncertainty in financial markets.

Industrial Production on the Rise

Another significant driver of the market’s upward trajectory was the encouraging growth in industrial production.

Industries are the backbone of any economy, and an upswing in their performance indicates increased economic activity.

Positive industrial production figures not only boost investor confidence but also suggest a robust domestic demand, a critical element in sustaining economic growth.

Sectoral Insights: Winners and Losers

Amid the overarching market rally, it’s essential to delve into the sectoral performance to gain a more nuanced understanding of the day’s developments.

Winning Sectors

- Telecommunication: The telecommunication sector emerged as a clear winner, with stocks in this industry closing with gains of more than 1%. This sector’s performance reflects the essential role that communication plays in today’s digital world, with telecom companies benefiting from increased connectivity demands.

- Energy: The energy sector, a vital component of any economy, also posted gains exceeding 1%. The sector’s performance is often closely linked to global oil prices, and any uptick in this industry can have far-reaching implications for the broader economy.

- Consumer Durables: The consumer durables sector, which includes companies involved in the production of household appliances and electronic goods, experienced gains. This uptick may signal increased consumer spending, a positive sign for the economy.

- Metal: The metal sector, encompassing companies engaged in mining and metal production, recorded gains. This sector’s performance can be indicative of industrial demand, infrastructure development, and global economic trends.

- Oil and Gas: Stocks in the oil and gas sector also closed with significant gains. This sector is closely tied to energy consumption and global energy prices, making it a crucial barometer of economic health.

Lagging Sectors

- Information Technology (IT): In contrast to the winning sectors, the IT sector faced a selling environment. This sector, typically characterized by companies involved in software development and technology services, can be influenced by factors such as currency fluctuations and global demand for IT services.

- Auto: The automobile sector witnessed a decline in stock prices. This sector is sensitive to factors like consumer sentiment, fuel prices, and regulatory changes, all of which can impact demand for automobiles.

- Capital Goods: Companies in the capital goods sector, which manufacture industrial machinery and equipment, also experienced a decline in stock prices. The performance of this sector often mirrors trends in industrial production and infrastructure development.

Top Performers on Sensex

Delving deeper into the performance of individual stocks within the Sensex, we find notable gainers that contributed to the overall bullish sentiment.

Bharti Airtel: The telecom giant, Bharti Airtel, emerged as the top performer on this historic day, with its shares surging by an impressive 2.72%. Bharti Airtel’s robust performance signifies the importance of communication services in our increasingly connected world.

Titan: Titan, a company renowned for its watches, jewelry, and eyewear, also enjoyed a favorable day in the market, with its shares registering gains. The company’s performance may reflect increased consumer spending on discretionary items.

IndusInd Bank: IndusInd Bank, a prominent player in India’s banking sector, experienced a rise in its share prices. Banking stocks are closely watched as they mirror the health of the financial sector and, by extension, the broader economy.

Axis Bank: Axis Bank, another leading name in the Indian banking industry, recorded gains. The performance of banking stocks is often influenced by monetary policy, interest rates, and economic stability.

State Bank of India (SBI): State Bank of India, India’s largest public sector bank, also contributed to the positive sentiment, with its shares gaining. The performance of SBI, as a bellwether for the banking sector, holds significance for the entire financial industry.

Minor Setbacks: Sensex Stocks in the Red

While the majority of Sensex stocks ended the day with gains, it’s important to acknowledge those that faced declines.

Mahindra & Mahindra (M&M): M&M, a prominent player in the automobile sector, emerged as the top loser, with its shares witnessing a decline of 1.35%.

This setback highlights the challenges that the auto industry faces, including changing consumer preferences and regulatory shifts.

Larsen & Toubro (L&T): Larsen & Toubro, a significant player in the engineering and construction sector, also faced a decline in its share prices.

The performance of L&T can offer insights into infrastructure development and construction activity in the country.

Nestle India: Nestle India, a renowned name in the food and beverage industry, experienced a decline in its share prices. The performance of consumer goods companies can reflect shifts in consumer demand and preferences.

JSW Steel: JSW Steel, a key player in the metal and steel sector, also witnessed a decline in its share prices. The performance of companies in this sector is closely linked to global steel prices and industrial demand.

Infosys: Infosys, a prominent IT services company, faced a setback in its share prices. The IT sector, with its exposure to global markets, is influenced by various external factors.

Market Dynamics: Gains, Declines, and Stagnation

Examining the broader market dynamics, we find that a substantial number of shares traded on the Bombay Stock Exchange (BSE) closed with gains, reflecting the overall bullish sentiment.

Out of a total of 3,784 shares traded on the exchange, 2,185 concluded the day with gains, demonstrating the widespread enthusiasm among investors.

Conversely, 1,469 shares faced declines, highlighting that not all segments of the market experienced the same level of success. Market fluctuations are common, and a diversified portfolio can help mitigate risks associated with individual stock performance.

A relatively smaller number of 133 shares remained flat, without any significant movement, indicating that some stocks remained stable amid the day’s excitement.

This stability can be attributed to various factors, including investor sentiment and company-specific news.

Furthermore, 148 shares touched their new 52-week highs during the day’s trading session, illustrating the resilience and growth potential of certain companies. This achievement is often regarded as a significant milestone and can attract investor attention.

Conversely, 23 shares touched their new 52-week lows, emphasizing the importance of risk management and due diligence when investing in the stock market. Investors should be aware of the potential downside associated with certain stocks and industries.

A Day to Remember

In conclusion, September 13, 2023, will be etched in the annals of the Indian share market’s history as a day of remarkable achievements.

Nifty’s triumph in crossing the 20,000 mark for the first time, coupled with Sensex reaching new heights, symbolizes the resilience and potential of India’s financial markets.

The surge in investor wealth, reflecting optimism in the nation’s economic trajectory, underscores the crucial role that the stock market plays in wealth creation and capital allocation.

The market’s performance on this historic day was influenced by a combination of factors, including relief on the inflation front and positive industrial production figures.

These factors, in tandem with sectoral winners and losers, provide valuable insights into the dynamics of the Indian economy.

While top-performing stocks and sectoral leaders basked in the limelight, there were also stocks and sectors that faced challenges.

This duality is intrinsic to the stock market, where volatility and opportunity coexist. A well-informed and diversified investment approach can help investors navigate these fluctuations effectively.

As the Indian share market continues to evolve and adapt to changing economic landscapes, investors and market participants will remain vigilant, tracking developments and trends.

Nifty’s historic feat is not just a number on a screen; it represents the aspirations and endeavors of a nation, a testament to India’s growth story.

In the coming days, investors and analysts will closely watch for further market movements and factors that shape the financial landscape.

The stock market, with its ability to allocate capital, foster innovation, and drive economic growth, remains a vital component of India’s journey towards prosperity.