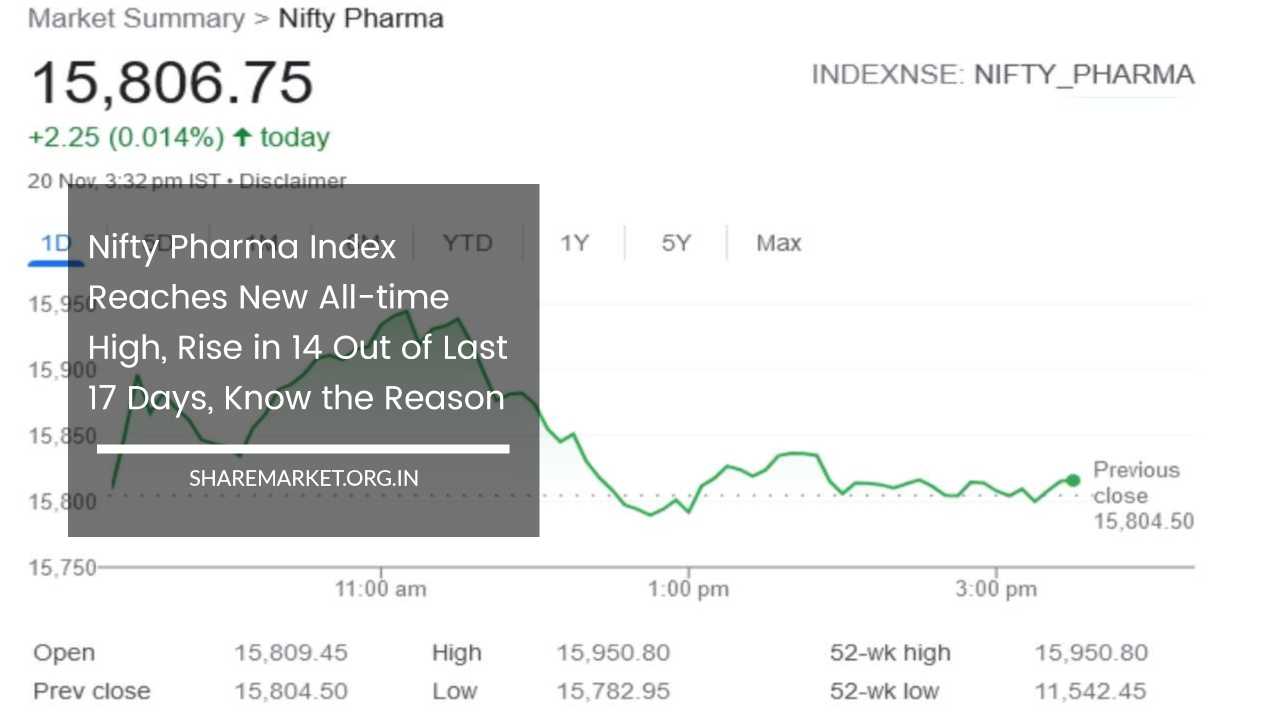

Nifty Pharma Index Reaches New All-time High, Rise in 14 Out of Last 17 Days, Know the Reason

Nifty Pharma

The Nifty Pharma Index Sets New Records

The pharmaceutical sector is currently experiencing a noteworthy moment with the Nifty Pharma Index reaching an unprecedented all-time high on November 20.

This significant surge reflects a confluence of factors that have propelled pharmaceutical stocks to new heights, attracting attention from investors and analysts alike.

Strong Q2 Earnings Propel Pharma Stocks

At the heart of this remarkable performance is the robust earnings reported by pharmaceutical companies during the September quarter.

The sector has not only weathered market fluctuations but has demonstrated a substantial and sustained upward trajectory.

This surge is indicative of the sector’s resilience and ability to navigate challenges effectively, positioning it as a key player in the current market dynamics.

Consistent Gains: 14 Out of 17 Days

One of the striking features of this surge is the remarkable consistency in the index’s performance, closing with gains on 14 out of the last 17 days.

This streak underscores the sector’s strength and its ability to deliver positive results consistently. Such sustained performance is a testament to the underlying stability and attractiveness of pharmaceutical stocks in the current market environment.

Outperforming Benchmarks: A 9% Surge Since October 26

In comparison to benchmark indices, namely Sensex and Nifty, the Nifty Pharma Index has outperformed, recording an impressive 9 percent surge since October 26.

This outperformance highlights the relative strength and attractiveness of pharmaceutical stocks, which have become a focal point for investors seeking opportunities for substantial returns.

Individual Stock Performances Unveiled

Delving into the individual stock performances within the pharma sector provides deeper insights into the driving forces behind this surge.

Alkem Laboratories, for instance, has experienced an outstanding 23 percent increase, while Aurobindo Pharma recorded an 18 percent surge.

The performances of Ipca Labs, Zydus Life, Torrent Pharma, and others showcase the sector’s diversity and the varying degrees of success among its key players.

Market Analyst Insights: Rajesh Palvia’s Perspective

Rajesh Palvia, an analyst at Axis Securities, sheds light on the factors contributing to this remarkable performance. According to Palvia, the strong financial results of pharma companies during the September quarter played a pivotal role.

In a period of market volatility, the pharmaceutical sector emerged as a stronghold, providing crucial support to the overall market.

IT and Pharma: Cornerstones of Market Support

Palvia’s observation extends to the role of IT and pharma companies in supporting the market during challenging times.

Notably, during a week where banking stocks faced challenges due to changes in risk weighting by the Reserve Bank of India (RBI), it was the IT and pharma sectors that bolstered the market’s upward trajectory. This underscores the diversified and stabilizing impact of these sectors on the broader market.

Sectoral Consolidation and Derivatives Market Opportunities

Palvia further observes a trend of consolidation in the IT and pharma sectors over the last few months. This consolidation suggests a period of strategic realignment and recalibration within the sectors.

Smart players in the derivatives market have recognized these opportunities and strategically positioned themselves to capitalize on potential upswings.

This proactive approach aligns with the fundamental principle of anticipating market trends and adjusting investment strategies accordingly.

Sustained Momentum: Breakouts and Future Expectations

The expectation of continued momentum in the pharma sector is supported by the breakout performances of several stocks.

Breakouts, where a stock surpasses a certain level of resistance, often signal a potential upward trend. Investors and traders closely monitor such breakouts as they may represent favorable entry points or validate existing bullish sentiments.

Financial Health Check: Q2 FY 2024

An in-depth analysis of the financial health of pharma stocks during the second quarter of fiscal year 2024 reveals encouraging results.

The sector experienced a substantial 14.3 percent increase in revenue growth compared to the same period last year and a 1.7 percent increase compared to the preceding quarter.

Revenue Growth: Double-Digit Increase

Pharma stocks exhibit a double-digit increase in revenue growth, a key metric reflecting the sector’s sustained demand and effective business strategies.

Factors such as higher sales, successful product launches, and stability in the US market contribute to this impressive revenue growth.

Improved Profit Margins: Indicators of Efficiency

Another positive aspect of the financial performance is the improvement in profit margins. Profit margin improvement indicates that companies are effectively managing costs, optimizing operations, or perhaps even benefiting from favorable pricing dynamics.

This is a crucial metric for investors as it reflects the efficiency and profitability of a company.

Gaurav Dua’s Insights: The Role of Branded Generic Exports

Gaurav Dua, Senior Vice President and Strategy Head at Sharekhan by BNP Paribas, offers additional insights into the surge in the Nifty Pharma index. Dua attributes this notable rise primarily to the outstanding performance of branded generic exports in regulated markets, especially the US.

Global Competitiveness: Sun Pharma, Dr. Reddy’s Lab, Lupin, Zydus

Dua’s insights highlight the global competitiveness of Indian pharmaceutical companies, as exemplified by the success of key players like Sun Pharma, Dr. Reddy’s Lab, Lupin, and Zydus. The ability of these companies to compete on a global scale underscores the strength and resilience of the Indian pharmaceutical industry.

Beyond Financial Markets: Pharma’s Societal Impact

The surge in the pharmaceutical sector extends beyond financial markets, contributing to broader economic narratives. A thriving pharmaceutical industry generates economic value through revenue generation and job creation.

Moreover, it plays a vital role in global healthcare, contributing to the well-being of populations. The sector’s success is intertwined with global health considerations, making it a strategic and socially impactful industry.

Final Remarks: Pharma’s Significance in an Evolving Financial Landscape

In conclusion, the surge in the Nifty Pharma Index is a multifaceted phenomenon driven by strong financial performances, strategic positioning, and the global competitiveness of Indian pharmaceutical companies.

The sector’s ability to navigate challenges, its consistent growth, and its impact on market sentiments underscore its significance in the broader economic landscape.

As market participants continue to monitor and react to these dynamics, the pharmaceutical sector remains a focal point of interest and potential opportunities in the evolving financial landscape.

Investors are likely to closely track developments in the sector, recognizing its potential to deliver sustained value in a dynamic market environment.