Sensex Down 110 Points, Nifty at 23,532; Nifty Prediction for Monday

Nifty Prediction for Monday

November 18 – Nifty Faces Continued Volatility Amid Sectoral Divergence

Indian stock markets continued their downward trajectory on November 14, marking the sixth consecutive day of declines.

Despite sharp fluctuations in early trading, the market remained range-bound, with major indices unable to sustain any significant directional momentum.

The overall sentiment was weighed down by selling pressure in several key sectors, while some pockets of the market, including auto, media, and real estate, managed to post modest gains.

Investors are now cautiously eyeing the next critical support and resistance levels as the market navigates through a period of heightened volatility.

Market Performance Overview:

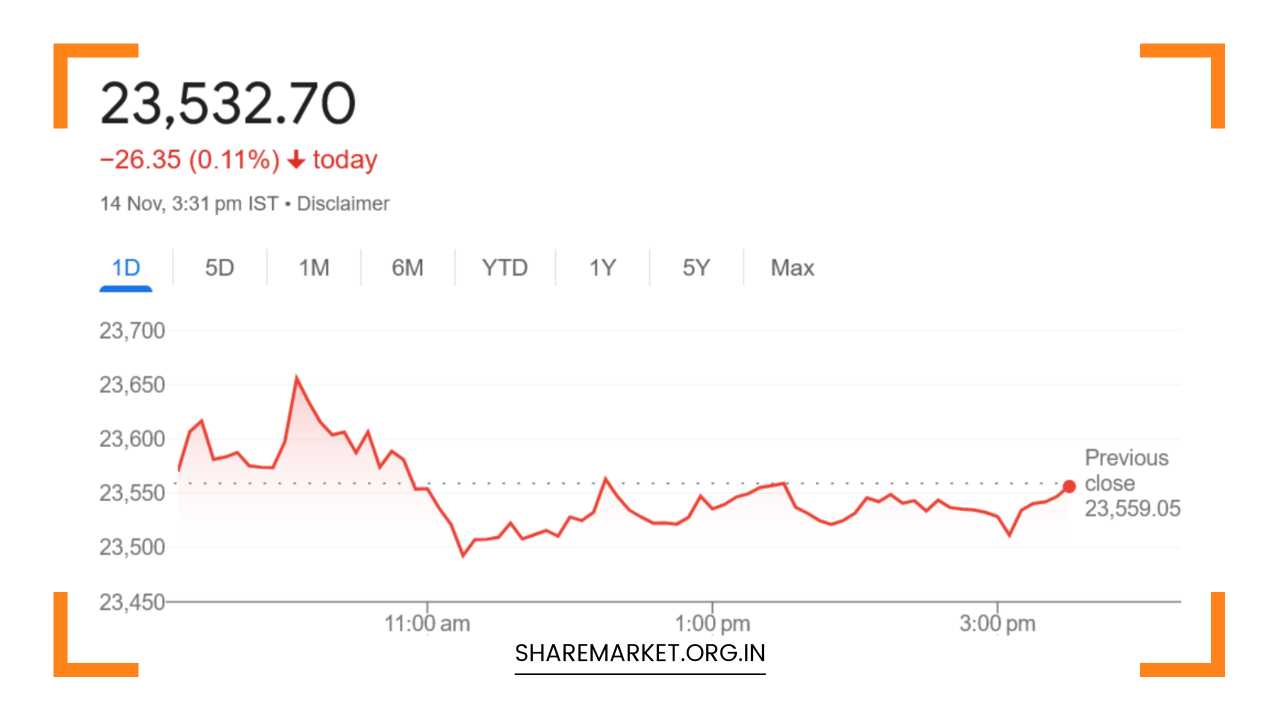

On November 14, the Nifty 50 closed at 23,532.70, down by 26.35 points, or 0.11%. Similarly, the Sensex ended the session 110.64 points lower at 77,580.31, reflecting a 0.14% decline.

This marks the sixth consecutive day of losses for the Indian market, which has now dropped by approximately 2.5% so far this week.

The day’s trading was characterized by volatility, with sharp swings in the early hours, but the market ultimately settled in a narrow range.

The broader market picture revealed mixed sectoral performance. On one hand, FMCG, oil and gas, PSU banks, and power sectors saw declines ranging from 0.3% to 1%.

On the other hand, auto, media, and real estate sectors exhibited some resilience, posting gains of 0.6% to 2%.

This divergence in sectoral performance is a clear indication of the ongoing market uncertainty, with some sectors outperforming while others struggle under the weight of broader market pessimism.

Stock Highlights:

- Among the top losers on the Nifty were stocks such as HUL, BPCL, Tata Consumer, Nestle, and Britannia. These FMCG giants have been under pressure due to concerns around rising input costs, inflationary pressures, and slowing consumption in some segments. Oil and gas stocks, including BPCL, have been impacted by the volatility in global crude prices and domestic demand concerns.

- On the other hand, Eicher Motors, Hero MotoCorp, Reliance Industries, HDFC Life, and Kotak Mahindra Bank were among the top gainers. The auto sector saw strength, led by Hero MotoCorp and Eicher Motors, reflecting investor optimism around potential recovery in demand post-pandemic, as well as positive cues from the festive season.

- Midcap and smallcap stocks showed some resilience despite the broader market decline. The BSE Midcap index rose by 0.4%, while the Smallcap index gained around 1%, signaling that retail investors are finding attractive valuations in smaller, more nimble companies.

Sectoral Insights:

The market’s weakness was mainly driven by FMCG, oil & gas, and banking stocks, while sectors like auto and real estate posted a positive performance.

- FMCG: The FMCG sector has been facing headwinds as inflation continues to impact demand for discretionary items. Stocks like HUL, Britannia, and Tata Consumer have witnessed selling pressure due to slowing consumption growth and margin compression resulting from rising input costs. Given the rising cost of raw materials, coupled with higher inflation, these stocks may continue to face headwinds until there are clearer signs of demand recovery.

- Oil & Gas: Stocks in the oil and gas sector, especially BPCL, came under pressure amid global crude price volatility and concerns about domestic demand. Any sustained weakness in crude prices could continue to impact the margins of these companies.

- Banking & Financials: The banking sector has faced mixed performance, with some heavyweights like Kotak Mahindra Bank and HDFC Life outperforming. However, the broader banking space has been weighed down by investor concerns about a potential slowdown in credit growth, rising non-performing assets (NPAs), and a cautious macroeconomic outlook.

- Auto & Real Estate: The auto sector has been one of the few bright spots in the market. Stocks such as Hero MotoCorp and Eicher Motors posted gains amid expectations of higher sales during the festive season. The real estate sector also saw positive movement, reflecting a recovery in demand, particularly in affordable housing.

Market Prediction for November 18:

With the Indian market set to remain closed on November 15 for Guru Nanak Jayanti, investors will be looking closely at how the market resumes its trading on November 18.

The outlook for Nifty remains uncertain, with a mix of technical indicators and expert opinions suggesting that the market could experience further volatility in the near term.

Jatin Gedia, Technical Analyst at Sharekhan by BNP Paribas, notes that the Nifty is currently trading near the 200-day moving average (23,556), which represents a critical support level.

The Hourly Momentum Indicator has triggered a positive crossover, suggesting a potential short-term pullback.

However, the overall trend remains weak, and any rally towards the 23,700 – 23,750 range could be seen as a selling opportunity.

On the downside, support at 23,180 is crucial, coinciding with the 61.82% Fibonacci retracement level.

In the Bank Nifty, after the sharp declines in the previous sessions, the index is expected to consolidate within a narrow range.

The immediate support for Bank Nifty is around 49,700, which aligns with the 200 DMA, while resistance is seen in the 50,560 – 50,700 range.

A break below 49,700 could lead to further downside, while a rally above the resistance levels could signal a temporary recovery.

Sameet Chavan, Technical Analyst at Angel One, highlights 23,800 as the immediate resistance level for Nifty, with a more significant resistance at 24,000.

On the downside, the index could find support at 23,200, which aligns with the 50-WEMA and the 61.8% retracement of the post-election rally.

A sustained move below 23,200 could indicate further weakness, potentially driving the Nifty towards the 23,000 mark.

Expert Opinions and Market Sentiment:

- Ramdev Agarwal, Chairman of Motilal Oswal Financial Services, remains optimistic about the long-term prospects of the Indian stock market. Despite the ongoing sell-off by Foreign Institutional Investors (FIIs), he advises investors to stay patient. He suggests that once FIIs exit the market, their re-entry prices will be significantly higher. By then, the Nifty could reach levels as high as 30,000, driven by strong earnings growth and structural reforms in the Indian economy.

- Ajit Mishra, Vice President of Religare Broking, advises caution, especially for those holding leveraged positions. After the recent sell-off, the Nifty index has shown sluggishness, and the market remains range-bound. He also highlights that with the earnings season winding down, the focus will shift to the IT and banking sectors, which will likely provide cues for future market direction.

Final Remarks:

As we approach November 18, the market faces a delicate balance between technical support levels and sectoral performance.

The Nifty is at a critical juncture, with immediate resistance at 23,800 and support at 23,180. The Bank Nifty could experience some consolidation, with key levels around 49,700 and 50,560.

Investors are advised to remain vigilant, particularly in sectors that are showing signs of resilience like auto and real estate, while keeping an eye on key economic data and global cues.

For long-term investors, patience remains crucial, as market volatility could present opportunities in the coming months.

However, it is essential to stay cautious and avoid excessive exposure to leveraged positions, especially given the current uncertainty in the market.