Sensex Down 1,176 Points, Nifty at 23,587; Nifty Prediction for Monday

Nifty Prediction for Monday

Nifty Closes Below 23,600: Market Prediction for 23 December and Beyond

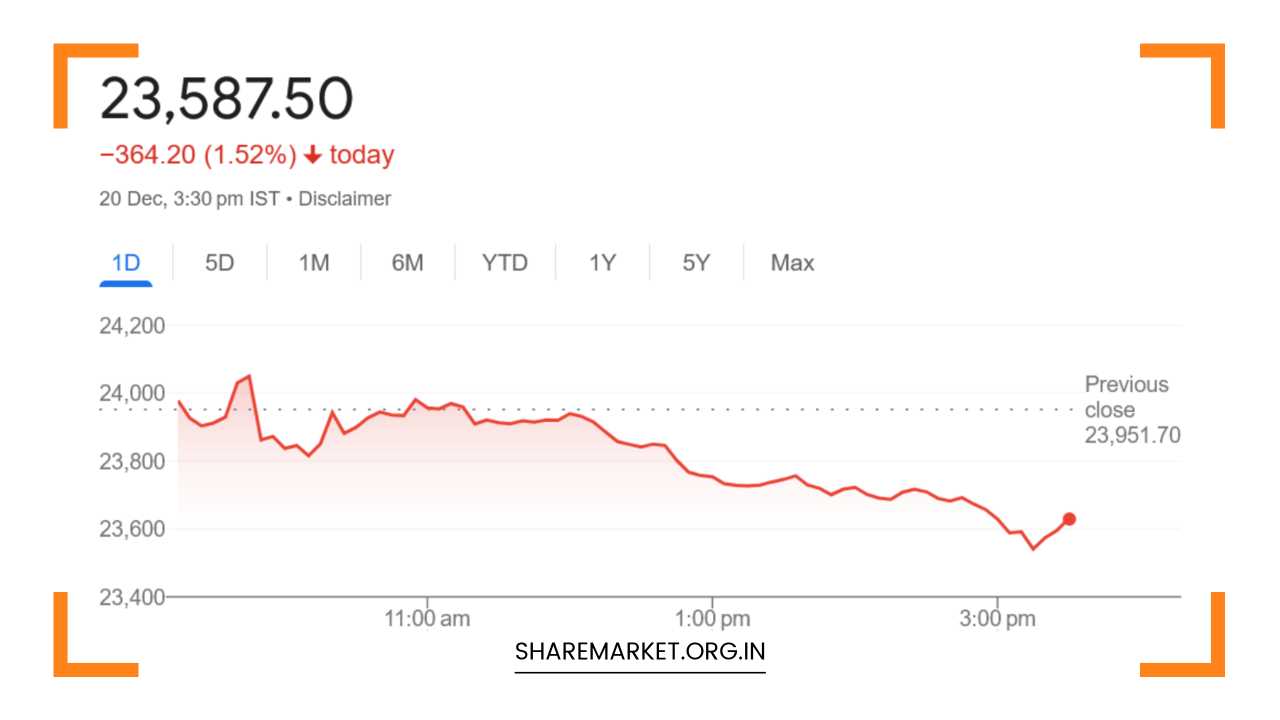

Market Recap: December 20, 2024: On December 20, the Indian stock market faced a significant sell-off, with both major equity indices ending the day sharply lower.

The Nifty slipped below the critical 23,600 mark, while the Sensex also witnessed a substantial decline, continuing the broader market weakness that has been observed over the past week.

At the close of trading, the Sensex stood at 78,041.59, down 1,176.46 points or 1.49%, while the Nifty ended at 23,587.50, shedding 364.2 points or 1.52%.

The market breadth was overwhelmingly negative, with 2,859 stocks declining, compared to just 963 stocks advancing, and 95 stocks remaining unchanged.

Across sectors, there was a widespread downturn. The Realty index experienced the steepest decline, falling by 4%.

Other key sectors such as Auto, IT, Capital Goods, Metal, Telecom, and PSU Banks also recorded losses, each seeing a drop of about 2%.

The BSE Midcap and Smallcap indices were also not spared, each falling by more than 2% as investor sentiment remained weak.

Weekly Market Performance: Largest Decline in Two Years

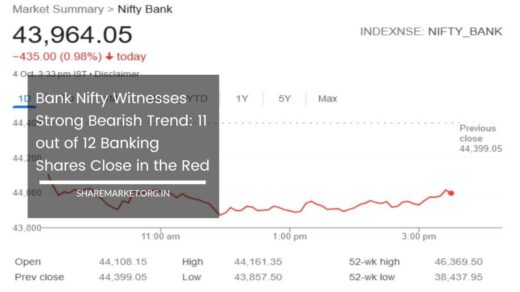

On a weekly basis, December 20 marked the biggest weekly decline in two years. The Nifty Bank index, a critical sector in the Indian market, plummeted by 5% during the week, while the Midcap index lost around 4%.

The total market capitalization of companies listed on the BSE fell by a staggering Rs 19 lakh crore. This significant decline has left investors on edge, with market volatility increasing across all sectors.

In particular, PSU Banks, PSU, and Metal sectors were among the worst performers, each seeing declines of around 6%.

This week’s losses have raised concerns about the broader economic growth trajectory, and many experts are predicting more caution in the months to come.

Sectoral Performance and Stock Highlights

Banking and Financials: While the overall market was down, certain sectors showed resilience, with ICICI Bank and HDFC Bank standing out as relative gainers.

Both stocks, despite the broader market weakness, closed higher, suggesting that investors are viewing them as attractive buying opportunities in the current environment.

In fact, some analysts believe that the recent declines in these stocks have created favorable valuations for long-term investors.

IT Sector: The IT sector continued its downward spiral, with Tech Mahindra among the worst-hit stocks in the Nifty, dropping sharply on December 20.

The sector has been facing headwinds due to a slowdown in global IT spending, particularly in the U.S. and Europe.

Automobile and Realty: The Auto sector also witnessed a broad-based sell-off, with M&M being one of the biggest losers. Similarly, the Realty sector saw heavy losses, with stocks like DLF and Godrej Properties falling significantly.

Rising interest rates and a cooling housing market are weighing heavily on investor sentiment within the real estate space.

Pharma and FMCG: On the positive side, the Pharma sector remained resilient, with stocks like Dr. Reddy’s Laboratories and Cipla posting gains.

Meanwhile, FMCG stocks such as Nestle India and HDFC Life closed the day in positive territory, though the sector’s high valuations amid a continued slowdown in consumption are raising questions about the sustainability of these gains.

Expert Opinions and Market Sentiment

- VK Vijayakumar – Chief Investment Strategist, Geojit Financial Services:

VK Vijayakumar, a noted market expert, has a cautious stance on the market, given the rising global and domestic headwinds. He pointed out that the 10-year U.S. bond yield has surged to 4.52%, reflecting growing global inflationary pressures and tightening liquidity conditions. This, combined with sluggish growth in corporate earnings in India, is making the Indian market less attractive to Foreign Institutional Investors (FIIs). As a result, FIIs have been reducing their exposure to Indian equities, putting additional pressure on the market.Vijayakumar also suggested that while FIIs may return once the U.S. dollar stabilizes and global conditions ease, the pressure on investments is likely to persist in the short term. He speculated that a slight recovery could take place before the Reserve Bank of India’s Monetary Policy Meeting in February 2025. However, he remains cautious about the broader outlook, highlighting the risk of further market volatility.

On a positive note, Vijayakumar highlighted that the recent correction has led to attractive valuations in certain large-cap stocks, particularly in the banking sector. He recommended stocks like ICICI Bank and HDFC Bank as potential buying opportunities. However, he also stressed the importance of caution, urging investors to avoid excessive exposure to overvalued sectors like FMCG, which have already entered a high valuation zone due to the ongoing consumption slowdown.

- Vinit Sambre – Head of Equities, DSP Mutual Fund:

Vinit Sambre echoed similar concerns, emphasizing that market levels are currently elevated, leaving little safety margin in most sectors. According to Sambre, in this environment, investors need to be particularly careful and avoid overexposure to sectors that may be vulnerable to further declines. He stressed the importance of maintaining a defensive stance and focusing on stocks with strong fundamentals and reasonable valuations.Sambre advised investors to remain in a wait-and-watch mode, as it is difficult to predict the exact trajectory of the market in the near term. The combination of global economic uncertainty, rising bond yields, and a cooling Indian economy suggests that more caution is warranted for the foreseeable future.

Investment Strategy Moving Forward

Given the current market dynamics, experts suggest that investors should adopt a cautious approach in the short term, focusing on high-quality stocks that are reasonably priced. Here are some key strategies for investors:

- Focus on Valuations: With several stocks trading at elevated valuations, it’s critical to assess the price-to-earnings (P/E) ratios and overall market conditions before making investment decisions. Sectors like FMCG and IT may continue to underperform, so investors should be selective and avoid stocks that are overly expensive.

- Look for Value in Large-Caps: The banking sector, particularly stocks like ICICI Bank and HDFC Bank, is currently seen as undervalued, making it an attractive opportunity for long-term investors. These stocks have shown resilience during the recent market correction and are expected to benefit once market conditions stabilize.

- Diversify Portfolio: In such uncertain times, diversification remains key. Investors should not only focus on large-cap stocks but also consider defensive sectors such as Pharma or Consumer Staples that may provide some stability in a volatile market.

- Stay Agile and Monitor Global Developments: Global factors, such as the U.S. Federal Reserve’s monetary policy and global inflation trends, will continue to influence market movements. Keeping a close eye on these developments and adjusting strategies accordingly will be important.

Final Remarks: Caution Amidst Volatility

As we approach the end of the year, the market remains under pressure from both global and domestic challenges.

The sharp declines in major indices have left investors wary, and while select sectors like banking and pharma may offer some opportunities, the overall outlook remains cautious.

Given the current uncertainties, experts recommend that investors remain in a defensive position, focusing on quality stocks with attractive valuations while awaiting clearer signals from both the domestic and global economies. Patience and caution will be key in navigating the market in the coming months.