Sensex Down 153 Points, Nifty at 25,057; Tomorrow Nifty Prediction

Tomorrow Nifty Prediction

Market Update: Sensex and Nifty Close Lower; Prediction for October 16

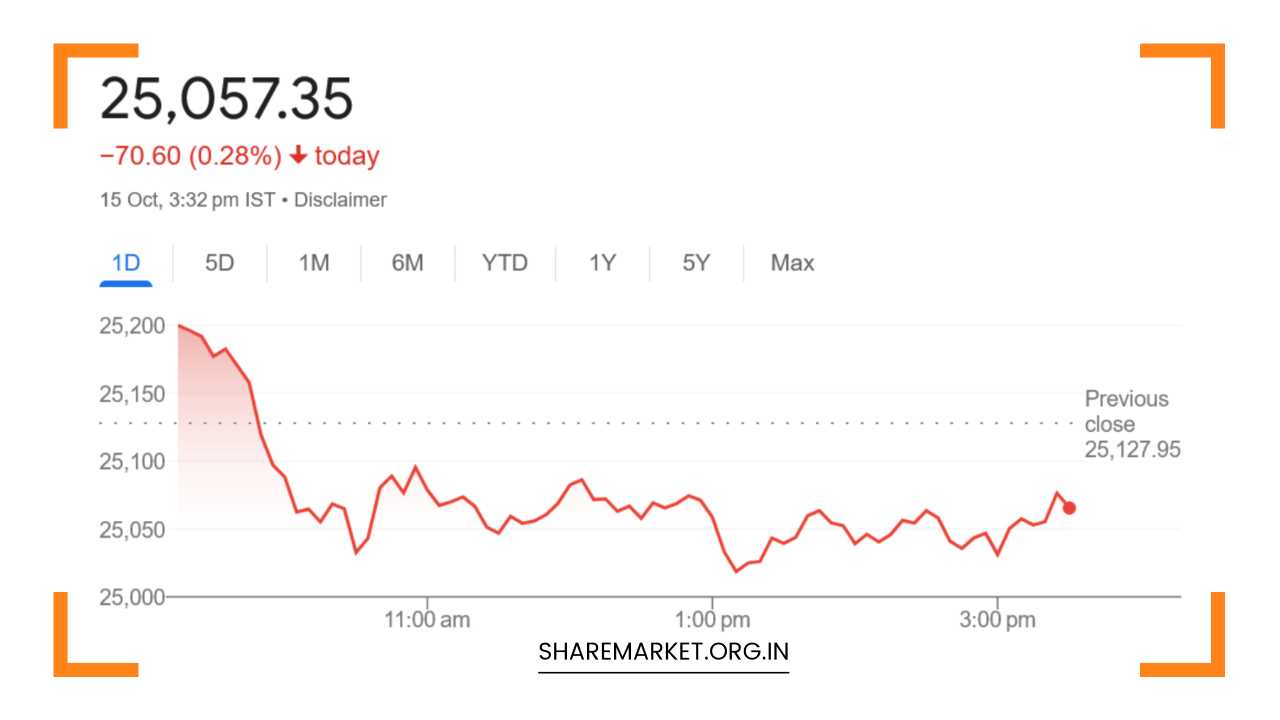

Today, the Indian stock market witnessed considerable volatility, culminating in a decline for both the Sensex and Nifty indices.

Despite showing fluctuations throughout the trading session, the Nifty managed to hold above the critical 21 Exponential Moving Average (EMA) on the daily time frame.

However, analysts caution that a drop below this level could indicate increasing weakness and lead to further declines in the near term.

Market Performance Recap

As the second trading day of the week concluded, the Sensex closed down by 153 points, finishing at 81,820.

Meanwhile, the Nifty recorded a decline of 71 points, settling at 25,057. On a more positive note, the Nifty Bank index demonstrated resilience, closing up by 89 points at 51,906.

In contrast to the declines in the major indices, the Midcap and Smallcap indices showed notable gains, with the Smallcap index climbing approximately 1%.

Throughout the day, investors were particularly active in sectors such as real estate, public sector enterprises (PSE), and fast-moving consumer goods (FMCG).

These sectors saw a resurgence in buying activity, which helped support the broader market. However, on the flip side, significant selling pressure was evident in the metals, automotive, and energy sectors, leading to declines in these areas.

The pharmaceutical and IT indices also closed lower, reflecting broader market concerns.

The Indian rupee displayed a slight upward movement, ending the day 2 paise stronger at Rs 84.04 per dollar. This minor appreciation may provide some relief, particularly for companies reliant on imports and foreign investments.

A closer look at individual stock performance reveals a challenging environment for many investors. Out of the 30 Sensex stocks, 21 faced declines, while 31 out of 50 Nifty stocks also fell.

The Nifty Bank index was not immune to this trend, as 10 of its 12 constituent stocks experienced declines. These numbers underscore a cautious sentiment prevailing among market participants.

Sectoral Insights

When analyzing sector performance, it is crucial to note which areas exhibited strength amid the broader market decline.

The Realty sector stood out as the biggest gainer today, reflecting increased investor interest and possibly a recovery from previous lows.

This sector’s upward momentum could be attributed to improved demand in residential and commercial real estate, as economic conditions stabilize.

Following Realty, the media sector also enjoyed some gains, buoyed by positive sentiment and potential growth prospects in digital content consumption.

Conversely, the metal and auto sectors faced significant headwinds, grappling with both domestic and global challenges.

Rising input costs, coupled with fluctuating demand, have put pressure on these sectors, leading to profit-taking by investors.

The pharmaceutical and IT sectors, which have traditionally been strong performers, closed lower today, reflecting concerns over valuation and future growth prospects.

The ongoing global economic uncertainties and geopolitical tensions may have contributed to investor caution in these sectors.

Technical Analysis

From a technical perspective, today’s market movements indicate a need for caution. The Nifty has formed a Dark Cloud Cover candlestick pattern on its daily chart, a potential signal of bearish sentiment.

This pattern typically emerges after an uptrend and can indicate a reversal, particularly if confirmed by subsequent price action.

Analysts emphasize the importance of the current consolidation range between 25,000 and 25,200. A breakout from this range is essential for a clearer picture of market direction.

If the Nifty can maintain its position above 25,200, it may pave the way for a rally. Conversely, a decline below 25,000 could usher in increased selling pressure, potentially driving the index down toward the next support level at 24,900 and subsequently 24,700.

Rupak Dey of LKP Securities reinforces this view, stating that while the Nifty held above the 21 EMA today, a drop below this critical support could trigger significant weakness.

Such a decline would not only affect investor sentiment but could also lead to a broader sell-off across various sectors.

Looking Ahead: What to Expect on October 16

As we approach October 16, market participants are advised to remain vigilant and monitor key support and resistance levels.

The 25,200 mark serves as a significant resistance level; sharp reversals have historically occurred at this threshold.

Should the Nifty manage to break through this level, it may regain upward momentum, potentially shifting investor sentiment.

Aditya Gaggar, director at Progressive Shares, highlights that today’s closing at 25,057.35 indicates a precarious balance between buyers and sellers.

He stresses the need for a sustained rally above 25,200 to establish a more bullish outlook for the market.

In the meantime, he suggests that traders should focus on sectors that have shown resilience, such as realty and media, as potential opportunities for investment.

Investors should also keep an eye on macroeconomic factors, including inflation data, global market trends, and geopolitical developments, which can significantly impact market sentiment.

The upcoming earnings season will also be critical, as companies report their quarterly performance, providing insight into the health of various sectors and the economy as a whole.

Final Remarks

In summary, today’s market performance underscores the complexities of navigating the current financial landscape.

With the Sensex and Nifty closing lower, investors are faced with a cautious environment marked by sectoral divergences and technical uncertainties.

Keeping an eye on key support and resistance levels will be crucial as market participants prepare for potential developments on October 16 and beyond.

As always, a diversified investment strategy and vigilant monitoring of market trends will be vital in managing risk and identifying opportunities in these fluctuating conditions.