Sensex Down 210 Points, Nifty at 24,010; Nifty Prediction for Tomorrow

Nifty Prediction for Tomorrow

Sensex Down 210 Points, Nifty at 24,010: How Will the Market Move Tomorrow?

Indian markets witnessed a correction on June 28th, snapping a four-day winning streak. The benchmark indices, Sensex and Nifty, closed in the red after a volatile trading session.

Market Recap: A Volatile Session with Mixed Signals

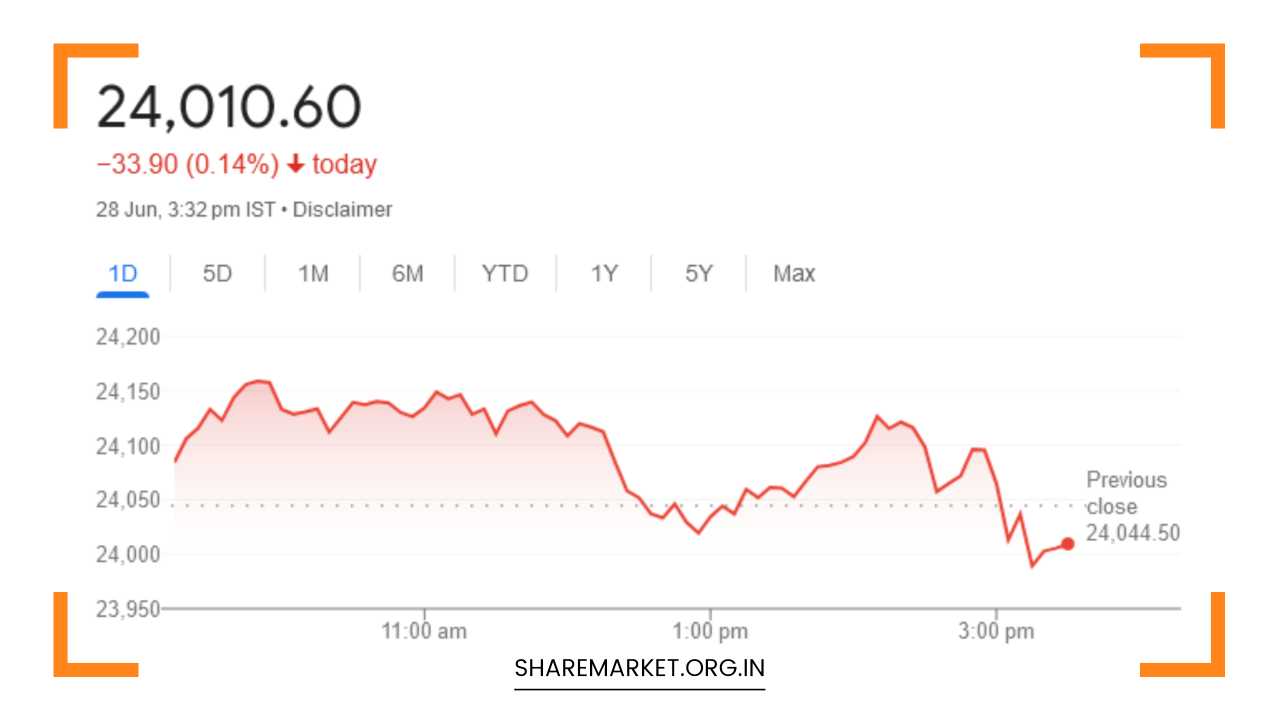

The Sensex ended the day down 210.45 points (0.27%) at 79,032.73, while the Nifty settled 33.90 points lower (0.14%) at 24,010.60. This decline came despite broad positive market sentiment.

Sectoral Performance: Healthcare and Metals Shine, Banks Dip

The sectoral performance was mixed. Healthcare, metal, PSU banks, oil & gas, and realty indices displayed gains of 0.5% to 1%. However, the banking and capital goods indices fell by 1% and 0.4% respectively.

This suggests some profit booking in specific sectors, particularly banking, after a strong recent run.

Individual Stock Performance: A Mix of Gainers and Losers

While the broader market dipped, individual stocks witnessed varied performance. On the Nifty, ONGC, Dr. Reddy’s Labs, Reliance Industries, SBI Life Insurance, and Tata Motors emerged as the top gainers.

Conversely, IndusInd Bank, Bharti Airtel, Axis Bank, ICICI Bank, and Kotak Mahindra Bank were the top losers. The performance highlights selective buying and profit-taking across different sectors.

Market Volatility: A Consolidation Phase or a Correction?

Analysts are divided on the market’s direction for June 29th. Kunal Shah, Senior Technical and Derivative Analyst at LKP Securities, points to the Bank Nifty’s significant correction after a continuous rise last week.

He suggests that further selling pressure could lead to a deeper correction, potentially causing Nifty to consolidate in a tight range.

This view is supported by the high open interest on the put side (options betting on a price decline) for Bank Nifty at 52,000, indicating potential downside pressure in the near term.

Technical Analysis: Nifty at a Crossroads

Rupak Dey, another Senior Technical Analyst at LKP Securities, highlights Nifty’s formation of a small red candle, breaking the four-day winning streak.

While the index closed above crucial moving averages, suggesting underlying bullishness, Dey cautions that Nifty might feel “heavy” after its recent rise.

He warns that a sustained move below 24,000 could trigger profit booking, potentially leading Nifty towards 23,850-23,700 in the short term.

However, Dey acknowledges the upside resistance at 24,200, indicating a potential rebound if the index can climb above that level.

Looking Ahead: Factors to Watch for Tomorrow

Several key factors will likely influence the market’s performance on June 29th:

- Global Cues: International markets, particularly the US and European indices, will play a role in setting the initial sentiment.

- FII Activity: Foreign Institutional Investor (FII) activity will be closely monitored. Any significant FII buying or selling could affect market direction.

- Macroeconomic Data: Any upcoming economic data releases, such as inflation figures or industrial production numbers, could influence investor sentiment.

- Company-Specific News: News related to individual companies or sectors could trigger specific stock movements.

Investor Takeaway: Cautious Optimism with a Focus on Stock Selection

While the market corrected slightly, it’s important to remember that the overall sentiment remains positive. The key for investors is to remain cautious and focus on stock selection.

Analyzing technical charts and company fundamentals can help investors identify strong companies well-positioned for growth even in a volatile market.

Additional Tips for Investors:

- Maintain a diversified portfolio: Don’t put all your eggs in one basket. Diversify your portfolio across various sectors and asset classes to mitigate risk.

- Invest for the long term: Don’t panic during short-term corrections. Stay focused on your long-term investment goals.

- Do your own research: Before investing in any stock, analyze the company’s fundamentals, financials, and future prospects.

By staying informed and making calculated decisions, investors can navigate market fluctuations and potentially achieve their financial goals.