Sensex Down 236 Points, Nifty at 24,548; Tomorrow Nifty Prediction

Tomorrow Nifty Prediction

Market Closes in the Red as Caution Prevails Ahead of Key Economic Data – What to Expect on December 13

The Indian stock market ended on a negative note on December 12, 2024, as cautious trading prevailed in the lead-up to the release of crucial economic data, including inflation and Industrial Production (IIP) figures.

Investors refrained from making aggressive moves, opting instead to adopt a wait-and-watch approach, reflecting heightened uncertainty in both domestic and global markets.

This cautious sentiment resulted in a decline across key indices, with a notable number of stocks in the broader market experiencing losses.

Market Summary:

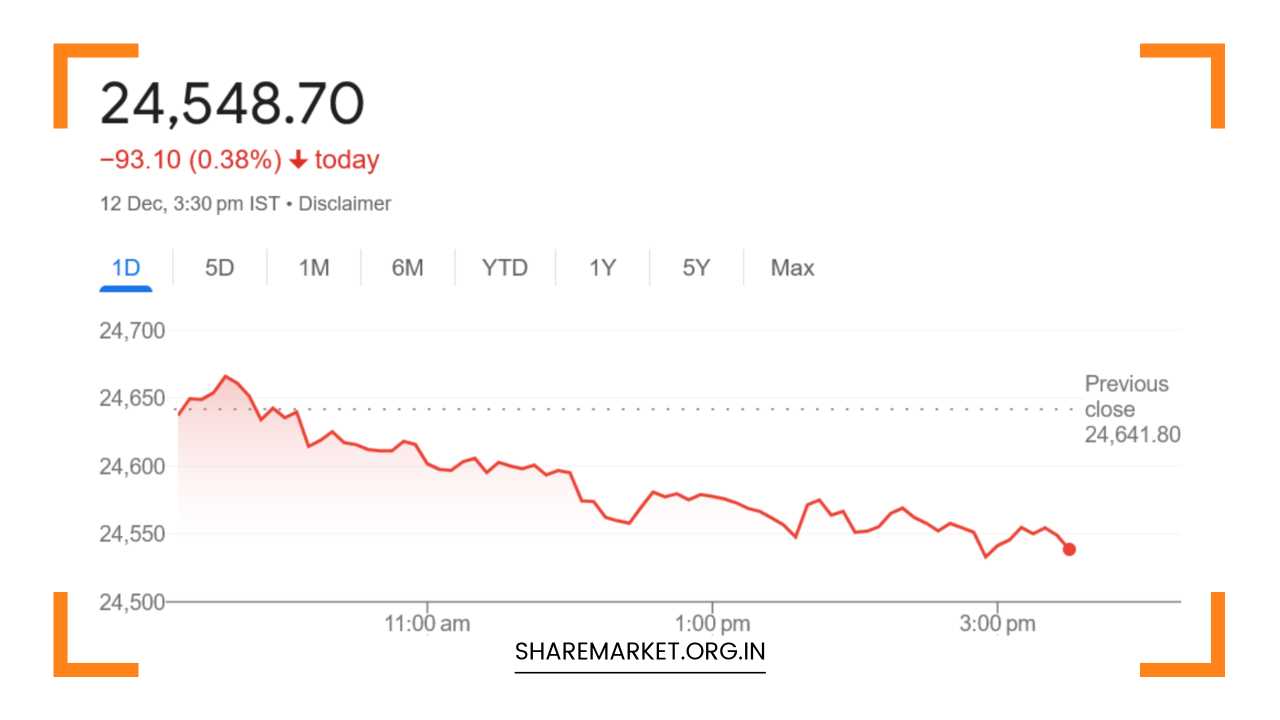

On December 12, Indian equity indices registered declines, with the Nifty 50 slipping below the important support level of 24,600.

By the close of trading, the Sensex stood at 81,289.96, down 236.18 points or 0.29%, while the Nifty 50 ended at 24,548.70, losing 93.10 points or 0.38%.

The market breadth was notably negative, with 1,440 stocks advancing, 2,395 declining, and 102 remaining unchanged, indicating a broad-based sell-off across various sectors.

Sectoral Performance:

Among the Nifty 50 stocks, Adani Enterprises, Tech Mahindra, IndusInd Bank, Bharti Airtel, and Adani Ports emerged as the top gainers, reflecting some isolated pockets of strength in the market.

However, the broader market sentiment remained weak, with several large-cap stocks registering losses. NTPC, Hero MotoCorp, HUL, Coal India, and BPCL were among the biggest decliners, contributing significantly to the market’s overall downturn.

Sectoral performance further highlighted the risk-off sentiment, as all sectors except IT closed in the red.

The Media sector was the hardest hit, plummeting nearly 2%, followed by the FMCG sector, which ended the day down by 1%.

Additionally, the BSE Midcap and Smallcap indices closed lower, with the Midcap Index losing 0.46% and the Smallcap Index falling by 0.97%, reflecting a broader sell-off in smaller stocks.

The IT sector bucked the trend and ended the day in the green, driven by strong performances from leading tech companies like Infosys and Tata Consultancy Services (TCS), which have been benefiting from a favorable global demand for tech services, especially in the wake of ongoing digital transformation across industries.

Technical Analysis and Market Prediction:

According to Aditya Gaggar, Director of Progressive Shares, the market’s sluggish start to the weekly expiry trade gradually extended its losses, bringing the Nifty closer to its key support zone of 24,500-24,550.

By the end of the day, the Nifty closed at 24,548.70, marking a loss of 93.10 points or 0.38%. This move brought the index close to its lower consolidation range, suggesting that a short-term bearish trend could persist unless there is a decisive recovery in the coming sessions.

The Nifty’s technical chart shows a bearish candle formation at the lower end of the consolidation zone, signaling that the downward momentum may continue unless there is a strong rebound.

The immediate support level for the Nifty is pegged at 24,500, which is a crucial psychological level for the market.

A sustained breach below this level could trigger further selling, with the next significant support lying at 24,430, coinciding with the 50-day moving average (50 DMA).

On the upside, the Nifty faces resistance at 24,690, a level that traders will be closely watching. If the index manages to break above this resistance, it could potentially signal a shift in momentum toward the upside.

However, given the current market conditions, including global uncertainties and the potential for weaker-than-expected economic data, the upside appears to be capped in the near term.

Investor Sentiment: Global Risks and Domestic Data

The cautious trading observed on December 12 can largely be attributed to the upcoming release of key domestic economic data—inflation and IIP numbers—which have the potential to shape investor sentiment in the short term.

Market participants are wary of any surprises that could either exacerbate inflationary pressures or signal a slowdown in industrial growth.

On a global scale, investors are grappling with a variety of uncertainties. Rising US bond yields continue to weigh on investor sentiment, making equities less attractive relative to fixed-income investments.

The US Federal Reserve’s ongoing tightening cycle and its impact on global liquidity are contributing factors to the risk-off sentiment that is evident across emerging markets, including India.

Geopolitical risks, particularly the ongoing conflict in the Middle East and West Asia, also remain a key concern for investors.

Any escalation in these regions could trigger further volatility in global markets, especially in energy prices, which would, in turn, affect inflation dynamics in India.

The Indian market is particularly vulnerable to fluctuations in global oil prices, as the country is a major importer of crude oil.

The outflow of foreign funds from Indian equities, exacerbated by rising US bond yields, has also dampened investor confidence.

Foreign Institutional Investors (FIIs) have been net sellers in recent months, which has contributed to the broader market weakness.

What to Expect on December 13:

As we head into December 13, the market will be closely watching the inflation and IIP data, which will be released later today.

If the inflation data comes in higher than expected, it could prompt concerns about the Reserve Bank of India (RBI) tightening monetary policy further, potentially dampening economic growth.

Conversely, weaker-than-expected IIP data could fuel fears of a slowdown in industrial activity, further weighing on market sentiment.

Given the current setup, traders will be monitoring the 24,500-24,550 support zone closely. A break below this level could lead to a deeper correction, with the next target being the 24,430 level.

On the other hand, a rebound from this support zone could give hope for a potential recovery, especially if the market reacts positively to the economic data.

Final Remarks:

In summary, the market is currently in a consolidation phase, weighed down by both domestic economic concerns and global macroeconomic risks.

While certain sectors, particularly IT, are showing relative strength, the overall market sentiment remains cautious, with profit-booking across the broader indices and sectors.

The upcoming economic data will play a critical role in shaping the market’s direction in the short term, and investors will need to remain vigilant as the situation develops.

In this environment, traders should exercise caution, monitor key support and resistance levels, and stay informed on both domestic and global economic developments.

Given the heightened uncertainty, it may be prudent for investors to adopt a more defensive approach until there is greater clarity on the economic and geopolitical landscape.