Sensex Down 269 Points, Nifty at 23,501; Nifty Prediction for Monday

Nifty Prediction for Monday

Navigating the Market Maze: A Deep Dive into Post-Rally Correction and Upcoming Catalysts (June 21st Recap and June 24th Outlook)

Market Reversion: A Short-Lived Correction or Shift in Sentiment?

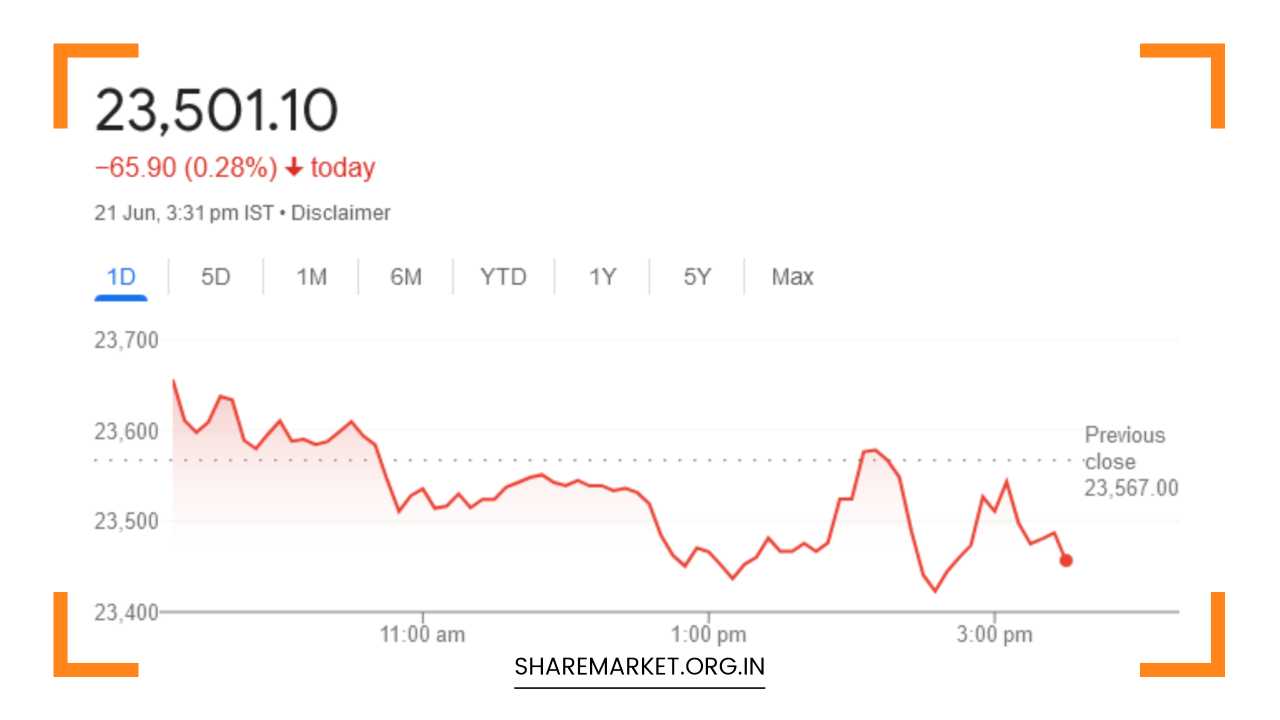

Indian stock markets on June 21st witnessed a reversal of fortune, snapping a six-day winning streak that saw the Nifty climb over 2400 points and the Sensex gain nearly 7500 points since the June 4th lows.

The benchmark indices closed marginally lower despite broader market participation, with over 1600 stocks advancing.

This pullback, following a strong rally, raises questions about the market’s immediate direction and potential triggers for the upcoming trading session on June 24th.

Dissecting the Decline: A Multifaceted Approach

While profit booking by investors is a natural response after a sustained period of gains, a closer look reveals a more nuanced picture. Here’s a breakdown of the contributing factors:

-

Profit Booking Takes Center Stage: As analysts suggest, profit booking by investors likely played a significant role in the decline. The recent rally, fueled by post-election optimism and a perception of undervalued stocks, might have enticed investors to lock in some profits, particularly considering weak cues from global markets. This profit-taking activity, especially in sectors that had outperformed in the previous days, contributed to the broader market correction.

-

Global Jitters Spillover: Geopolitical tensions, rising inflation concerns in the US, and a potential slowdown in China’s economic growth cast a shadow on global markets. This negative sentiment likely trickled down to the domestic markets, prompting some investors to adopt a cautious stance.

-

Technical Correction: From a technical analysis perspective, the recent rally might have pushed the Nifty and Sensex towards their overbought zones on certain technical indicators like the Relative Strength Index (RSI). A pullback in such scenarios is often seen as a healthy correction, allowing for price consolidation before the next leg up.

Sectoral Shifts: Winners and Losers

The decline wasn’t uniform across all sectors. Here’s a closer look at the sectoral performance:

-

Resilient Sectors: IT, metal, media, and telecom continued their upward trajectory. This suggests continued investor confidence in these segments, potentially driven by factors like strong corporate earnings, digital transformation tailwinds for IT, and the government’s focus on infrastructure development that benefits metals.

-

Vulnerable Sectors: Auto, FMCG, PSU banks, and realty faced selling pressure. This could be attributed to several factors:

- Monsoon Concerns: As highlighted by Vinod Nair of Geojit Financial Services, slow progress of the monsoon raises concerns for the FMCG sector. A delayed monsoon can disrupt agricultural output and dampen consumer demand for FMCG products, leading to cautious investor behavior.

- Valuation Concerns: After the recent rally, some investors might perceive valuations in certain segments like auto to be stretched, prompting profit booking.

- PSU Banks and Realty: These sectors might be awaiting specific triggers or policy measures in the upcoming budget before attracting renewed investor interest.

Expert Opinions: Gauging Market Sentiment

Market experts offer valuable insights to navigate this temporary turbulence:

-

Vinod Nair of Geojit Financial Services: Highlights concerns over the slow monsoon progress impacting the FMCG sector. He emphasizes the importance of monitoring monsoon developments for potential impact on consumer-driven sectors.

-

Kunal Shah of LKP Securities: Focuses on the Bank Nifty’s performance, observing a resistance level at 52,000. A breakout above this level could signal further momentum in the banking sector. Conversely, a dip towards 51,000 might present a buying opportunity for long-term investors.

-

Prashant Tapase of Mehta Equities: Emphasizes the upcoming Union Budget in July as the biggest market driver. He echoes the sentiment that investors anticipate a market-friendly budget with measures to boost economic activity and encourage investments.

The Looming Budget: A Catalyst for Market Direction

All three experts unanimously agree that the Union Budget in July will be the most significant driver for the market in the near future.

The budget has the potential to shape investor sentiment and influence market movements. Investors are eagerly anticipating measures that prioritize economic growth, stimulate investment activity, and provide a roadmap for fiscal consolidation.

A budget perceived as market-friendly, with initiatives to boost consumption and incentivize corporate investment, could trigger a significant market rally.

Beyond the Headlines: Additional Considerations

For a more comprehensive analysis, consider incorporating the following:

- Specific Data Points: Include the closing figures for Nifty (23,501.10), Sensex (77,209.90), and sectoral indices on June 21st. This allows readers to gauge the extent of the decline and identify outperformers (e.g., Bharti Airtel, LTI Mindtree, Adani Ports) and underperformers (e.g., Adani Enterprises, UltraTech Cement) for a more granular understanding of sectoral movements.

-

Global Market Influence: Monitor developments like the US Federal Reserve’s interest rate decision or key economic data releases from China and Europe on June 24th. These events can influence foreign investor flows and potentially impact domestic market sentiment.

-

Technical Analysis: Look for support and resistance levels on the Nifty and Sensex charts using technical indicators like moving averages and Fibonacci retracements. This can provide insights into potential short-term trading opportunities.

Looking Ahead: Charting the Course for June 24th

The upcoming trading session on June 24th is likely to be influenced by a confluence of factors:

-

Market Sentiment: The overall market mood will be crucial. If profit booking has subsided and global cues are supportive, the market could witness a rebound. Conversely, lingering concerns or negative news flow could lead to further consolidation.

-

Sectoral Performance: Sectors that outperformed in the recent rally, like IT and metals, might continue their momentum if their underlying fundamentals remain strong. Sectors facing headwinds, like FMCG and auto, might see a turnaround if positive triggers emerge, such as encouraging monsoon progress or budget announcements favoring those sectors.

-

Budget Buzz: As the July budget draws closer, any leaks or pre-budget announcements could trigger pre-emptive buying or selling in certain sectors, depending on the perceived impact of the proposed measures.

Final Remarks: A Market of Opportunities

The June 21st correction serves as a reminder of the inherent volatility in the stock market. While profit booking, global jitters, and technical factors contributed to the pullback, the underlying fundamentals remain largely intact.

The upcoming Union Budget presents a pivotal moment, with the potential to reignite market enthusiasm. By closely monitoring sectoral trends, expert opinions, global developments, and technical indicators, investors can make informed decisions and navigate the market maze effectively.

This period of consolidation also presents potential buying opportunities for investors with a long-term perspective, especially if they can identify stocks with strong fundamentals and attractive valuations.

Remember, a well-diversified portfolio across different sectors and asset classes can help mitigate risk and position you to capture potential gains as the market navigates its course.