Sensex Down 329 Points, Nifty at 23,092; Nifty Prediction for Monday

Nifty Prediction for Monday

Sensex-Nifty Close Lower: What to Expect on 27 January?

Market Update: The Indian stock market closed on a bearish note on the last trading day of the week, with both the Sensex and Nifty indices experiencing significant declines.

Investor sentiment remained subdued, exacerbated by weak earnings reports from a number of corporate giants, despite some favorable global cues earlier in the session.

The widespread selling pressure was visible across various sectors, reflecting a broad-based market downturn.

Notably, midcap and smallcap stocks were the worst hit, with a notable decline in sectors such as realty, oil & gas, and pharmaceuticals.

The only pockets of strength were seen in the FMCG and IT sectors, which managed to end the session with positive gains.

Stock Market Overview: The trading day began on a promising note, with the Sensex and Nifty indices seeing early gains, bolstered by positive signals from global markets.

However, the optimism quickly faded as the day progressed, and the indices gradually moved into the red.

The selling intensified in the latter part of the session, with midcap and smallcap stocks bearing the brunt of the downturn.

Realty, oil & gas, and pharmaceutical stocks, which have seen strong growth in the past, were also caught in the selling wave.

- Sensex ended the day 330 points down at 76,190, marking a significant loss for the day.

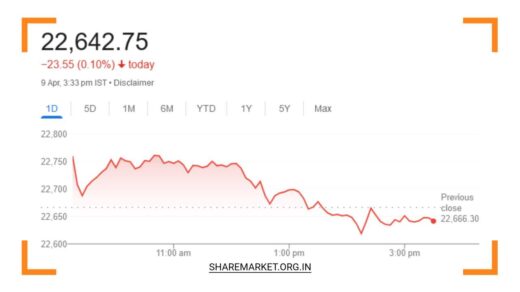

- Nifty dropped by 113 points to close at 23,092, extending the losses across major benchmarks.

- The Nifty Bank index, which represents the banking sector, closed 221 points lower at 48,368, reflecting broader market weakness.

- Midcap stocks faced a sharper decline, falling by 836 points to close at 53,263, underscoring the pressure faced by smaller stocks.

- Out of the 30 stocks that make up the Sensex, 19 ended the day in the red, while the Nifty index saw 32 of its 50 constituent stocks decline.

- Even within the Nifty Bank index, 10 out of 12 stocks closed lower, a clear indication of the broader market pullback.

Despite the overall negative sentiment, FMCG (Fast Moving Consumer Goods) and IT (Information Technology) sectors stood out by posting modest gains, benefiting from a relative sense of stability in these industries amidst the market volatility.

Sectoral Performance: The day’s losses were widespread, with 11 out of the 13 major sectors closing in the red.

The most notable losses were seen in pharma and media stocks, which bore the brunt of the selling pressure.

The pharma sector, a key beneficiary during the COVID-19 pandemic, faced significant declines, as many companies within the sector missed earnings expectations, further dampening sentiment.

Similarly, media stocks struggled as concerns about advertising revenue and higher costs weighed on investor outlook.

The realty sector also took a hit, with rising interest rates and concerns about a slowdown in economic growth impacting sentiment.

While auto and oil & gas stocks also ended lower, they were somewhat cushioned by the decline in global crude oil prices, which provided some relief to oil-related stocks.

However, the positive effects of falling oil prices were short-lived, as the broader concerns about corporate earnings growth and economic deceleration outweighed these supportive factors.

Expert Insights: Amey Ranadive, Senior Technical Analyst at Stockbox, highlighted that the Indian benchmark indices were initially buoyed by favorable global signals, including positive US earnings reports and expectations of US rate cuts, which triggered a brief rally in the early hours of trading.

However, the optimism proved to be short-lived, as corporate earnings in India showed signs of slowing down, a factor that weighed heavily on investor sentiment.

Ranadive noted that the market has been grappling with concerns over corporate profitability, which overshadowed the positive news coming from global markets.

The analyst pointed out that the decline was broad-based, with midcap and smallcap stocks suffering the most.

The sell-off in smaller stocks reflects an increasing risk aversion among investors, who are opting for more liquid and safer options amidst growing uncertainty.

Additionally, Ranadive explained that the underperformance of smallcaps and midcaps was partly a result of higher valuations that these stocks had been trading at, making them more vulnerable to profit-taking when market sentiment soured.

Meanwhile, Vinod Nair, Head of Research at Geojit Financial Services, emphasized that the market is in a period of heightened turmoil.

The primary reason for the weakness, according to Nair, is the fragile investor sentiment, which has been exacerbated by disappointing earnings reports and ongoing concerns about the broader economy.

Nair pointed out that even stocks reporting results in line with expectations are facing selling pressure, highlighting the prevailing bearish mood among market participants.

Despite the broad-based weakness, Nair observed that large-cap stocks have shown some resilience. These stocks, especially those in the IT, FMCG, and energy sectors, have been able to weather the storm better than their smaller counterparts, due to their stable earnings and relatively lower risk profiles.

This has created an opportunity for investors looking for stability amid market volatility.

Looking further ahead, Nair noted that the Indian market has historically faced several challenges, including geopolitical risks and periods of global economic instability.

However, it has always managed to recover in the long term. He mentioned that while the immediate outlook remains uncertain, market conditions could improve once the US Federal Reserve’s stance on interest rates becomes clearer, and once concerns about corporate earnings growth start to stabilize.

What’s Next for the Market? Looking ahead to the trading session on 27 January, market participants will be closely monitoring several factors.

Key drivers include global cues, particularly the US Federal Reserve’s next moves on interest rates, as well as updates from domestic companies regarding earnings reports.

The market is also keen on observing any developments related to geopolitical risks and their potential impact on investor confidence.

The current market environment suggests caution for short-term investors, with volatility likely to persist.

However, for long-term investors, this could present an opportunity to selectively accumulate stocks that have shown resilience during the downturn. As Nair suggested, patience and a gradual approach to buying could prove to be a prudent strategy.

In conclusion, while the market faces significant challenges, including concerns over corporate earnings and geopolitical risks, it’s important to remember that these conditions are not permanent.

The market has a history of recovering from adversity, and for those with a long-term perspective, now may be an opportune time to stay the course and consider strategic investments.

Investors are encouraged to remain informed, evaluate risk carefully, and stay focused on opportunities as they arise.