Sensex Down 548 Point, Nifty at 23,381; Tomorrow Nifty Prediction

Tomorrow Nifty Prediction

Market Closes with a Decline: Key Insights and What to Expect for February 11

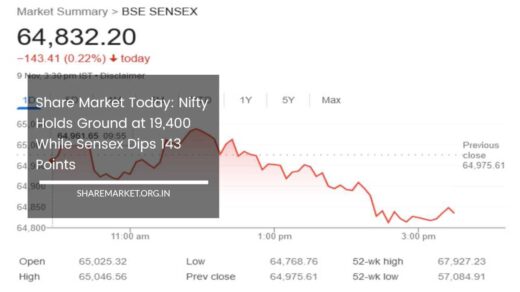

Market Overview: The Indian stock market closed on a bearish note on February 10, with both the Sensex and Nifty experiencing notable declines.

The Nifty fell below the crucial 23,400 mark, marking a significant downtrend for the day. As the market continues to face selling pressure, investors and analysts alike are closely watching for further signs of weakness or potential support levels that might lead to a market reversal.

Here’s a deeper look into the day’s market action and what to expect on February 11.

Stock Market Performance:

On February 10, the Sensex closed down by 548.39 points, or 0.70%, at 77,311.80, while the Nifty finished 178.35 points lower, or 0.76%, at 23,381.60.

The market breadth was decidedly negative, with 2,917 stocks declining and only 1,029 advancing. In terms of sectoral performance, all major indices closed in the red, indicating broad-based selling across sectors.

Notable losers included companies like Trent, Power Grid Corporation, Tata Steel, Titan Company, and ONGC.

On the other hand, a few stocks bucked the trend, with Kotak Mahindra Bank, Britannia Industries, Bharti Airtel, HCL Technologies, and Tata Consumer Products showing positive gains for the day.

Sectoral Performance:

The mid and small-cap segments of the market also came under significant pressure, as both indices fell by approximately 2%, signaling broad market weakness.

The sectoral indices also reflected a similar trend, with a majority of sectors closing lower. The metals sector saw some of the sharpest declines, followed by the media, pharma, consumer durables, power, and realty sectors.

These sectors fell by 2-3%, reflecting the growing concern over macroeconomic challenges, including the impact of rising global trade tensions and weak domestic consumption.

Expert Analysis:

Aditya Gaggar, Director at Progressive Shares, pointed out that the ongoing trade disputes and tariff-related issues, particularly between major global economies, have continued to put pressure on Indian equity markets.

The market opened on a sluggish note and continued to trend lower throughout the session, with the Nifty closing down by 178.35 points, or 0.76%.

The realty and metals sectors were hit the hardest, as both saw significant declines due to growing concerns over global demand and domestic economic conditions.

Selling pressure was notably higher in mid-cap and small-cap stocks, which were down by more than 2% each, exacerbating the bearish sentiment.

Rupak Dey, Senior Technical Analyst at LKP Securities, emphasized the bearish nature of the Nifty Index’s price action.

According to Dey, the Nifty continues to face downward pressure after forming a lower top on the daily chart, indicating that the market is in a declining phase.

This technical pattern, combined with the Nifty’s breach below key support levels, suggests that further downside could be imminent if the market fails to recover in the short term.

Dey also pointed out that the market sentiment weakened further after the Nifty fell below the 21-EMA (Exponential Moving Average), a widely used indicator of short-term price trends.

The Relative Strength Index (RSI) has also entered a bearish crossover, adding to the negative technical outlook.

Key Levels to Watch:

One of the most significant developments for the Nifty on February 10 was its breach of the 23,500 support level, a critical psychological and technical threshold for traders and investors.

According to Dey, the next major support level for the Nifty is now seen at the 23,240 mark. If the index falls further below this level, it could open up the possibility of a deeper correction, with the potential for the Nifty to test the 23,000 level.

On the flip side, resistance for the Nifty is expected at the 23,465 level, and a break above this point could signal a possible rebound.

Technical Outlook:

The Nifty’s technical setup paints a bearish picture in the short term. The sharp decline on February 10 was accompanied by a strong bearish candlestick formation, signaling that the market is in a downtrend.

As the Nifty continues to trade below critical support levels, including the 21-EMA and the 23,500 mark, the chances of further downside increase.

In addition, the bearish crossover in the RSI suggests that momentum is firmly on the side of the bears. If the Nifty fails to hold above the 23,350 level, the decline could extend towards the 23,000 mark, a level that has historically acted as a psychological and technical support zone for the index.

However, traders should remain alert for any signs of a reversal. If the Nifty manages to recover above the 23,465 resistance level, it could lead to a short-term bounce or consolidation around the 23,500 level.

The market’s response to these key levels will likely set the tone for the coming sessions.

Market Sentiment and Economic Factors:

Global factors continue to weigh heavily on investor sentiment. The ongoing trade war, particularly the tariff issues between the U.S. and China, is one of the primary concerns for global equity markets, including India. These trade tensions have created uncertainty, leading to market volatility.

Moreover, concerns over slowing global economic growth and its impact on Indian exports and corporate earnings are adding to the cautious outlook.

Domestically, while India’s economic fundamentals remain relatively strong, concerns over inflation, rising commodity prices, and the overall economic slowdown are contributing to investor apprehension.

Additionally, the ongoing corporate earnings season has seen mixed results, further adding to the cautious sentiment.

As a result, the Indian stock market is facing heightened volatility, making it crucial for investors to stay informed and exercise caution in the short term.

Market Prediction for February 11:

Looking ahead to February 11, the market is expected to remain under pressure, especially if the Nifty fails to find support at the 23,240 level.

The key support and resistance levels to watch are 23,240 on the downside and 23,465 on the upside. If the Nifty continues to break below these levels, the index could test the 23,000 mark, which will be a crucial area for bulls to defend.

Investors will also need to closely monitor global cues, including developments related to trade tensions and macroeconomic data, as these factors could significantly influence market sentiment.

In the absence of a strong positive catalyst, the market may continue to face downward pressure in the short term.

In conclusion, the Indian stock market closed with a notable decline on February 10, with the Nifty breaking key support levels.

The technical indicators and global concerns suggest that the market could experience further downside in the short term, especially if the Nifty fails to hold above the 23,240 support level.

However, any positive developments or a break above resistance levels could provide a catalyst for a potential market recovery. As always, investors should proceed with caution and stay vigilant in this volatile market environment.