Sensex Down 55 Points, Nifty at 24,148; Nifty Prediction for Monday

Nifty Prediction for Monday

Market Closes in the Red: What to Expect on November 11 and Beyond

The Indian equity markets ended in the red on November 8, following a volatile trading session that saw both the Sensex and Nifty swing within a wide range.

After a sluggish start, the market struggled to regain momentum, closing with slight losses. While some sectors managed to show resilience, others came under pressure due to a mix of domestic and global factors.

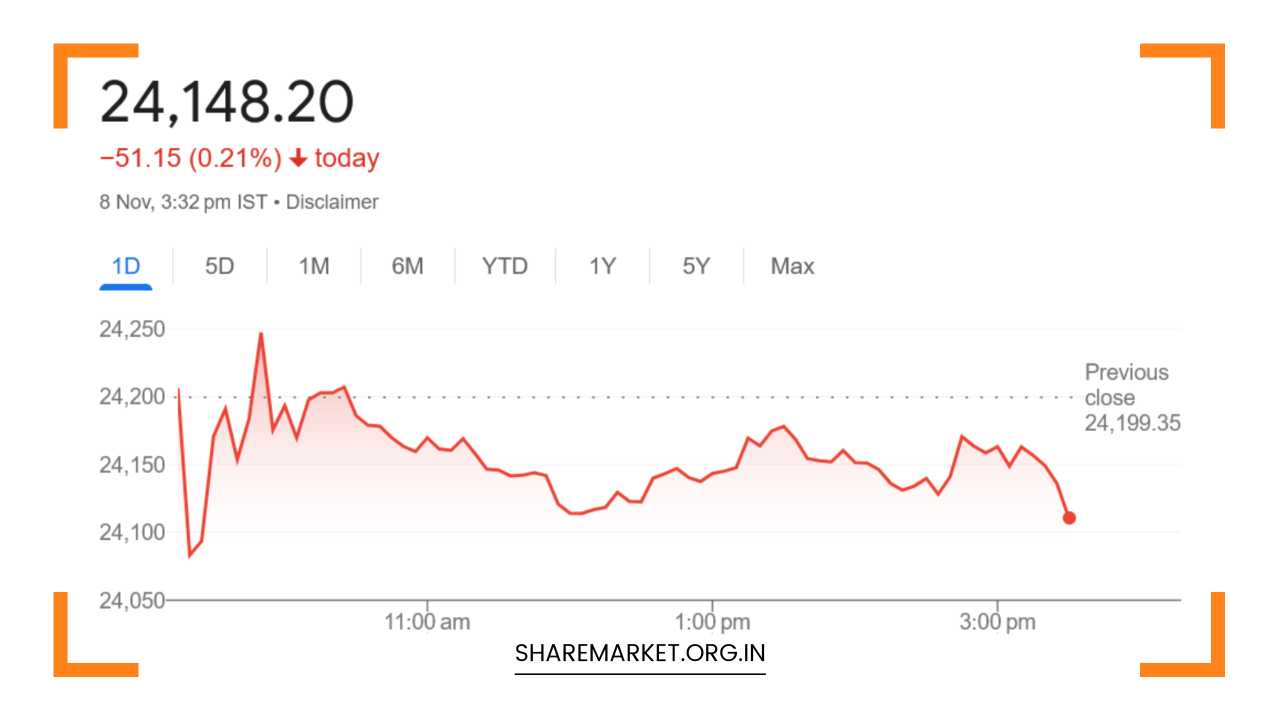

The Sensex closed at 79,486.32, down 55.47 points or 0.07%, while the Nifty ended the day at 24,148.20, down 51.10 points or 0.21%.

On a broader market scale, 1,314 stocks advanced, 2,475 stocks declined, and 95 stocks remained unchanged by the end of the session.

Sectoral Performance and Key Movers

The performance of various sectoral indices was mixed, with the Information Technology (IT) sector emerging as a notable outperformer.

The IT index closed 0.7% higher, bolstered by strong performances from large-cap stocks such as M&M, Titan Company, Tech Mahindra, Infosys, and Nestle—which were among the top gainers on the Nifty. The IT sector’s resilience came as a welcome relief after the sector had faced pressure in the previous week.

On the other hand, sectors like media, PSU banks, metals, oil and gas, power, and realty saw declines ranging between 1% and 2%.

Among the top losers, Coal India, Tata Steel, Trent, Asian Paints, and Shriram Finance faced the most significant drops, with metal stocks like Tata Steel continuing to feel the pinch due to global commodity price pressures.

Realty stocks also experienced sharp declines, reflecting the ongoing challenges faced by the sector amid higher interest rates and concerns around the global economy.

The broader market indices also faced headwinds. The BSE Midcap Index fell by 1%, while the Smallcap Index saw a sharper decline of 1.6%, indicating that the pressure was more pronounced among smaller stocks.

This broad-based weakness suggests that investor sentiment remains cautious, especially as uncertainty lingers over both domestic and international fronts.

Weekly Market Recap: A Reversal of Gains

Looking at the market’s performance over the course of the week, the equity indices have reversed much of the gains achieved the previous week.

As of November 8, the Nifty has dropped by about 1%, with a significant portion of the decline coming from mid and small-cap stocks. Across the sectoral indices, only IT and PSU Banks managed to remain in the green.

The overall decline in the broader market reflects ongoing concerns about economic stability, inflationary pressures, and geopolitical tensions that are affecting investor sentiment.

The real estate sector has been hit particularly hard this week, facing a drop amid worries about higher borrowing costs as interest rates remain elevated in key global markets.

Additionally, sectors such as oil and gas, metals, and power are under pressure due to global commodity price volatility and fears of slowing economic growth.

This has kept the broader market in a consolidation phase, with many investors opting for a more cautious stance.

Geopolitical Tensions and FII Outflows: Dampening Market Sentiment

A significant factor behind the recent volatility in the markets is the ongoing geopolitical unrest, which has weighed on investor sentiment globally.

While the Indian market remains somewhat insulated from global risks compared to other emerging markets, the broader uncertainty stemming from international conflicts and tensions has been felt in the form of continued foreign institutional investor (FII) outflows.

FIIs have been net sellers in the Indian equity market for several months, driven in part by global risk-off sentiment, tightening liquidity, and rising bond yields in developed markets.

Despite the U.S. Federal Reserve’s recent interest rate cut, which typically would provide a boost to emerging markets, the Indian market has remained under pressure as investors continue to remain cautious.

The Indian market has also faced selling pressures due to weak corporate earnings growth, particularly in sectors like banking, metals, and real estate.

Despite the interest rate cuts by the U.S. Federal Reserve, which would normally provide some relief to emerging markets, the lack of enthusiasm among investors has raised concerns.

Prashant Tapase of Mehta Equities remarked that the failure of the rate cuts to significantly excite Indian markets suggests that domestic issues, including rising inflationary pressures, high borrowing costs, and subdued consumption, are overshadowing the potential positives from global monetary policy changes.

Looking Ahead: What Can Investors Expect on November 11?

As we approach November 11, analysts are divided on the short-term outlook, given the ongoing mix of factors weighing on the market.

The consolidation phase seems likely to persist, at least until clearer signals emerge about the global and domestic economic landscape.

Ajit Mishra of Religare Broking emphasized that the market is still in a phase of consolidation, with no clear trend emerging either upward or downward.

While there was some volatility during the session, the Nifty largely traded within a limited range, reflecting the indecisiveness among investors.

From a sectoral perspective, IT stocks remain relatively strong, and investors may continue to find opportunities in this space, especially given the sector’s ability to generate strong earnings and cash flow even during periods of global uncertainty.

Stocks from the FMCG (Fast-Moving Consumer Goods) and pharma sectors could also be potential safe havens, as they tend to outperform during periods of economic uncertainty due to their defensive nature.

The banking sector, however, continues to be stuck in a range, with investors uncertain about the trajectory of loan growth, asset quality, and interest rate risks.

Banks have faced margin pressures due to rising interest rates, and any further tightening in global liquidity could affect their profitability.

The real estate and metal sectors, on the other hand, may remain under pressure as higher interest rates and global commodity price volatility continue to affect earnings in these areas.

Given the current uncertainty, experts suggest that a cautious approach is warranted. Investors are advised to adopt a hedging strategy to protect against downside risks while selectively accumulating stocks with solid fundamentals, particularly those in the IT and FMCG sectors.

Final Remarks: Navigating the Uncertainty

In conclusion, while the Indian equity market remains under pressure, there are still opportunities for investors to navigate the current uncertainty.

The key will be to remain cautious, selective, and well-informed about the evolving global and domestic landscape.

As geopolitical risks and FII outflows continue to weigh on market sentiment, volatility is expected to persist.

However, sectors like IT, FMCG, and pharma may offer relative safety and growth, while areas such as real estate and metals could continue to face headwinds.

For now, the market is likely to remain in a consolidation phase, and investors should be prepared for further volatility until clearer signals emerge about both global economic conditions and domestic corporate earnings trends.