Sensex Down 820 Points, Nifty at 23,883; Tomorrow Nifty Prediction

Tomorrow Nifty Prediction

Sensex-Nifty Close Lower for 4th Consecutive Day: What’s Next for November 13?

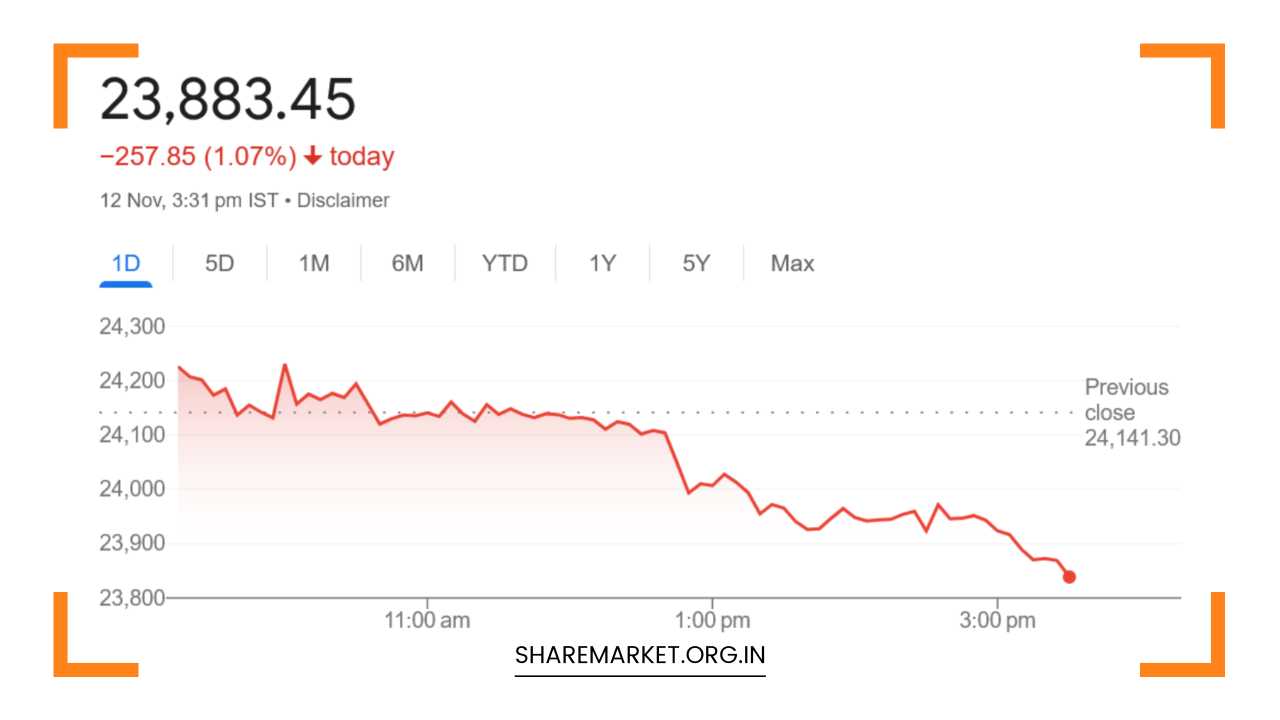

The Indian stock market faced substantial selling pressure on November 12, with both the Sensex and Nifty closing in the red for the fourth consecutive day.

Despite a strong opening, the market reversed course during the day, as selling intensified, particularly in heavyweight sectors like banking, auto, and FMCG.

The Nifty index dropped below the critical psychological level of 24,000, closing at 23,883.50, down 257.80 points or 1.07%.

Similarly, the Sensex finished the day at 78,675.18, down by 820.97 points or 1.03%. With widespread declines across all sectors, the market sentiment remained bearish, and the focus shifted to whether this downward momentum could continue into the next trading session on November 13.

Detailed Market Performance on November 12:

- Sensex: Closed at 78,675.18, down 820.97 points (-1.03%)

- Nifty: Closed at 23,883.50, down 257.80 points (-1.07%)

- Advancers vs. Decliners: Out of 3,889 stocks traded, 1,155 advanced, while 2,641 declined. Only 93 stocks remained unchanged, reflecting the broad-based weakness across the market.

- Sectoral Performance: All major sectoral indices ended the day lower, with notable losses in auto, banking, capital goods, FMCG, metals, and energy. The auto and PSU bank indices were among the hardest hit, reflecting broader concerns over growth prospects.

- Mid and Small Caps: The broader market, as reflected by the BSE Midcap and Smallcap indices, also faced a tough day, both falling by about 1%. This suggests that weakness was not confined to large-cap stocks, and smaller stocks were equally affected by the market’s broader downtrend.

- Top Losers on Nifty: Major stocks that suffered the biggest losses included Britannia Industries, HDFC Bank, NTPC, Asian Paints, and Bharat Electronics, with HDFC Bank and NTPC seeing significant declines, contributing heavily to the day’s losses.

- Top Gainers on Nifty: On the flip side, there were some bright spots with stocks like Trent, HCL Technologies, Sun Pharma, Infosys, and Reliance Industries bucking the trend and registering gains. However, the overall market breadth remained negative, highlighting that these gains were more of an exception rather than the rule.

Sectoral Weakness and Broader Market Sentiment:

The weak performance across all major sectors, including auto, banking, FMCG, metals, and oil & gas, painted a grim picture of the overall market sentiment.

The auto sector has been under pressure due to concerns over rising raw material costs and slowing demand, especially in the face of global economic uncertainty.

The banking sector, a heavyweight in the index, has been facing challenges due to concerns over asset quality and profitability amidst high interest rates and slow credit growth.

The capital goods and metal sectors, which are typically more sensitive to the health of the economy, saw declines as investors worried about a potential slowdown in industrial and infrastructure activity.

FMCG stocks, which are usually seen as defensive, were also not immune to the selloff, as inflationary pressures continued to impact margins for consumer goods companies.

The oil & gas sector was hit by fluctuations in global crude prices, which have been volatile recently due to geopolitical tensions and supply concerns.

Similarly, the telecom and media sectors also ended in the red, continuing their struggles with competitive pressures and regulatory concerns.

What’s Driving the Selloff?

The market’s recent weakness is largely driven by a combination of global and domestic factors. Globally, concerns over rising interest rates in developed economies, particularly the US Federal Reserve’s stance on inflation control, have dampened investor sentiment.

The strength of the US dollar and the uncertainty around global growth prospects have also contributed to the volatility in emerging markets, including India.

In addition, persistent worries about inflation, especially in food and energy prices, continue to weigh heavily on consumer sentiment.

Domestically, while India’s economic growth remains relatively resilient compared to global peers, there are concerns about the impact of higher interest rates on corporate earnings, especially for capital-intensive sectors.

Additionally, the lack of fresh positive triggers and earnings growth for major sectors has kept the market range-bound, leading to profit-taking in sectors that had previously outperformed.

Technical Outlook for November 13:

Looking at the technical setup, the Nifty has formed a bearish engulfing pattern on the daily chart, which indicates that bears are in control of the market.

This pattern suggests that the index is likely to remain under pressure in the near term, with further downside risks.

According to Aditya Gaggar, Director of Progressive Shares, the immediate support for Nifty is seen at 23,800, a level that traders should closely monitor.

If Nifty breaks below this support, the next level of support is seen at 23,650. A breach of these levels could lead to further losses, with the index potentially targeting the 23,500 mark.

On the resistance side, Gaggar pointed out that there are multiple resistance levels at higher points, with 24,100 being the immediate hurdle.

This level will likely act as a strong resistance, where selling pressure could emerge, preventing any meaningful rebound in the index.

The market is likely to remain range-bound unless there is a strong catalyst that pushes the indices either above 24,100 or below 23,800.

Insights from Experts:

Ajit Mishra, Vice President of Research at Religare Broking, provided a cautious outlook for the market, noting that the ongoing correction phase is likely to persist, given the weak trend.

He highlighted that the Nifty has now reached near its previous swing low of 23,800, which is a key support level. If this level breaks,

Nifty could see further downside, potentially testing the 200-day exponential moving average (DEMA) at 23,540.

Mishra advised traders to focus on stock-specific strategies rather than trying to trade the broader market, as the overall trend remains negative.

Key Levels to Watch for November 13:

- Immediate Support: 23,800 – A critical level for Nifty; a break below could trigger further downside towards 23,650.

- Next Support Level: 23,540 – The 200 DEMA, which could act as a major trendline support for Nifty.

- Immediate Resistance: 24,100 – A strong resistance zone where selling pressure may cap any upside.

- Critical Resistance: 24,300 – A higher resistance level that would require strong bullish momentum to overcome.

Final Remarks:

The Indian stock market remains under pressure as broad-based selling continues to weigh on the Sensex and Nifty.

The bearish technical setup, combined with global economic uncertainties and domestic growth concerns, suggests that the market is likely to remain volatile in the near term.

Traders should be cautious, watching key support levels closely, particularly the 23,800 level for Nifty, which could determine the next move in the market.

With resistance around 24,100, any rallies will likely face stiff headwinds. Stock selection will remain critical, with investors advised to focus on specific sectors and stocks with strong fundamentals, while managing risk effectively.