Sensex Down 964 Points, Nifty at 23,951; Tomorrow Nifty Prediction

Tomorrow Nifty Prediction

Sensex and Nifty Close Lower for the Fourth Consecutive Day: What to Expect on December 20

Indian stock markets experienced a turbulent session today, with both the Sensex and Nifty ending the day lower for the fourth consecutive trading session.

Weak global cues, the continued sell-off by foreign institutional investors (FIIs), and the depreciation of the Indian rupee against the US dollar added to the negative sentiment.

The benchmark indices saw a decline of more than 1%, and sectors sensitive to interest rate hikes, such as banking and real estate, were particularly hard-hit.

However, pharma stocks emerged as a rare bright spot in an otherwise bearish market. As investors brace for what’s ahead, here’s a comprehensive analysis of today’s market action and what lies ahead for December 20.

Market Overview

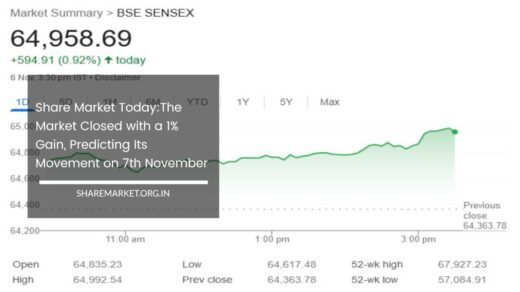

- Sensex: The BSE Sensex closed the day down by 964 points, settling at 79,218.

- Nifty: The Nifty also ended lower, dropping 247 points to close at 23,952.

- Nifty Bank: The Nifty Bank index, a crucial indicator of financial sector health, fell 564 points, closing at 51,576.

The continued downtrend in the market raised concerns about broader economic conditions, particularly as midcap and smallcap stocks, which had earlier been recovering from intraday lows, failed to pull the broader indices out of their slump.

A significant portion of the market breadth was negative today, with 27 out of 30 Sensex stocks and 36 out of 50 Nifty stocks showing losses.

Notably, banking, IT, and metal stocks bore the brunt of the sell-off, while realty, public sector enterprises (PSEs), and FMCG stocks also faced significant pressure.

On the other hand, pharma stocks bucked the trend, with the Nifty Pharma index closing up by more than 1.5%.

The Depreciation of the Rupee

Another significant factor contributing to the negative market sentiment was the Indian rupee’s depreciation against the US dollar.

The rupee closed at an all-time low of 85.07 against the dollar, marking a fresh record low. The rupee’s sharp decline has been driven by the strengthening of the US dollar, rising global inflation concerns, and a tightening of monetary policy by the US Federal Reserve.

For India, the weaker currency means higher import costs, especially for crude oil and other essential commodities, which could exacerbate inflationary pressures in the domestic economy.

The decline in the rupee is also likely to impact sectors with significant import dependency and those with substantial foreign exchange exposure.

These include sectors such as IT, consumer goods, and automobile manufacturing. However, exporters, particularly those in pharma, IT services, and textiles, might see some relief as a weaker rupee can make their products more competitive in international markets.

Global Economic and Market Sentiment

The global markets, particularly US equities, have been under considerable pressure in recent weeks due to the US Federal Reserve’s hawkish stance on interest rates.

The Fed’s decision to continue raising rates in an effort to combat persistent inflation has sent shockwaves through global financial markets.

Rising interest rates generally hurt asset valuations, particularly for growth stocks and sectors sensitive to borrowing costs, like banking and real estate.

This global risk-off sentiment found its way into Indian equities, which are highly influenced by global liquidity flows.

The sell-off in global markets, combined with the tightening monetary policy in the US, has kept FIIs cautious, leading to sustained outflows from Indian equities.

This outflow of foreign capital has added to the pressure on the domestic market, further exacerbating the decline in the Sensex and Nifty.

However, there was some positive news on the global front today: the Bank of Japan (BoJ) surprised markets by maintaining its accommodative monetary policy, defying expectations that it would follow the path of other major central banks by raising interest rates.

This unexpected decision helped reduce some of the selling pressure on global equities, but it was not enough to reverse the negative momentum in the Indian market.

Sectoral Performance

- Banking: The Nifty Bank index was among the hardest-hit sectors, falling by 564 points. Private sector banks and public sector banks alike were affected by the broader market sell-off. The banking sector is particularly vulnerable to interest rate hikes, which increase the cost of borrowing and impact profitability. Additionally, rising global inflation concerns can lead to higher credit defaults, putting pressure on the financial sector.

- IT and Metals: The IT sector also faced significant pressure, with many large-cap IT stocks seeing sharp declines. This was largely due to concerns about reduced global spending on IT services as economies slow down. Similarly, metal stocks continued their downtrend, affected by lower global demand and weaker commodity prices.

- Pharma: In stark contrast, pharma stocks posted strong gains, with the Nifty Pharma index gaining over 1.5%. Pharma is typically seen as a defensive sector, which tends to perform well during market downturns. As investors sought safer havens, stocks of companies in the pharmaceutical sector gained traction, aided by strong fundamentals and steady earnings growth.

- Realty, FMCG, PSE: Other sectors such as real estate, FMCG, and PSE stocks also saw significant selling pressure, primarily due to their sensitivity to rising interest rates and inflationary pressures.

Expert Insights on Market Outlook

- Vinod Nair, Head of Research at Geojit Financial Services, believes the decline in Indian equities is largely a result of the global sell-off triggered by the US Federal Reserve’s aggressive stance on interest rates. He emphasized that sectors such as banking and real estate, which are highly sensitive to interest rate changes, have been disproportionately affected. However, he pointed out that pharma stocks have emerged as a safe haven for investors, driven by increased demand for defensive stocks. Nair expects continued volatility in the markets, with cautious investor sentiment prevailing due to ongoing FII outflows.

- Srikant Chauhan, Head of Equity Research at Kotak Securities, noted that the Nifty is approaching a crucial support level near its 200-day moving average (DMA). He suggested that the market could remain range-bound in the short term, with potential support for Nifty around 23,500. Chauhan also highlighted that the put-call ratio for December has fallen to 0.80, signaling a bearish sentiment, while the India VIX, which measures volatility, has risen to near 15, indicating elevated market uncertainty. He advised investors to wait for a reversal formation before making significant moves, although he remains optimistic about the potential for a recovery if the market stabilizes near key support levels.

Key Levels to Watch

- Support for Nifty: The key support level for Nifty is at 23,500. If the index falls below this level, it could trigger further weakness.

- Resistance for Nifty: Resistance for Nifty is likely to be around 24,500. A sustained move above this level could indicate a potential rebound.

- Sensex: The immediate support for Sensex is at 79,000, with resistance around 80,500.

Final Remarks: Cautious Optimism for Long-Term Investors

The Indian stock market is currently navigating through a period of heightened volatility, driven by a combination of global and domestic factors.

With FIIs continuing to sell, rising interest rates, and the depreciation of the rupee, the near-term outlook remains challenging.

However, the market is approaching key support levels, and defensive sectors like pharma may offer some relief for cautious investors.

For long-term investors, this period of weakness may present an opportunity to accumulate quality stocks at attractive valuations.

However, short-term traders should remain vigilant and wait for clearer signals of a market reversal.

Investors should focus on defensive sectors and keep an eye on key levels for signs of stabilization.

Given the current oversold conditions, the market could see a rebound at any time, but caution is warranted until a reversal formation is established.