Sensex Gain 1,078 Points, Nifty at 23,658; Tomorrow Nifty Prediction

Tomorrow Nifty Prediction

Market Update: March 24 – A Continued Bullish Trend, What to Expect on March 25

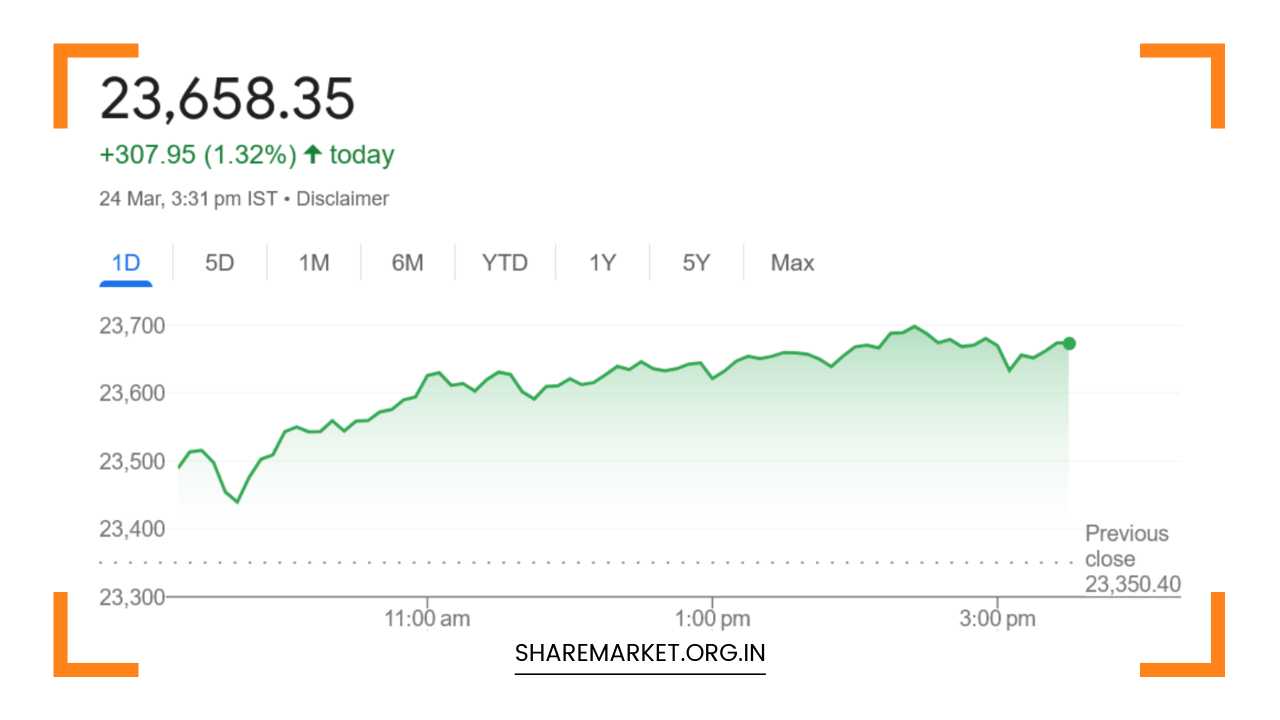

Market Overview: The Indian equity market closed with strong gains on March 24, continuing the bullish momentum that has defined the week.

The Nifty index surged past the 23,700 mark, posting a gain of more than 1%. The market was driven by widespread buying across sectors, fueled by growing optimism that the U.S. might take a more lenient approach to tariffs under President Trump’s administration.

This expectation, alongside broader global sentiment, contributed to the uptrend, which saw both the BSE Sensex and Nifty hit key levels not seen since February 6.

Today’s market performance marked another milestone, with the Sensex crossing 78,000 and the Nifty breaking the 23,700 barrier.

The market started the day on a positive note, with the Nifty quickly crossing the 23,500 mark and maintaining its upward trajectory throughout the session.

However, a sell-off in the final hour of trading tempered the intraday gains, as investors appeared to book profits after an extended rally.

Despite this, the uptrend has now lasted for six consecutive trading sessions, reflecting investor confidence and overall market strength.

Market Close:

By the end of the trading day, the BSE Sensex had surged by 1,078.87 points, or 1.4%, to close at 77,984.38. Similarly, the Nifty added 307.95 points, or 1.32%, to settle at 23,658.35.

All sectoral indices ended in the green, showcasing broad-based buying across the market. The banking sector led the rally, with both private and public banks witnessing significant gains.

Other sectors, such as capital goods, IT, oil and gas, power, and PSU banks, also posted strong performances, with gains ranging from 1% to 3%.

In addition, mid-cap and small-cap stocks mirrored the performance of the frontline indices, with both the BSE Midcap and Smallcap indices rising by more than 1%.

The day’s top gainers on the Nifty included Kotak Mahindra Bank, NTPC, SBI, Power Grid Corporation, and Tech Mahindra, all of which saw substantial upticks. Conversely, M&M, Titan Company, IndusInd Bank, Trent, and Bharti Airtel were among the top Nifty losers, reflecting some profit-taking in select stocks.

Key Market Drivers:

The return of foreign portfolio investors (FPIs) to Indian equity markets has been one of the most significant factors driving the ongoing rally.

Last week, there was considerable short covering in the index futures segment by FPIs, which helped propel the benchmark indices higher.

Despite this positive activity, it is worth noting that 68% of the market remains in short positions, suggesting that further short covering could continue to fuel the rally in the coming days.

This resurgence of FPI activity has been a major catalyst, as foreign investors have historically been significant players in driving Indian markets higher.

The expectation that global monetary policies will remain accommodative, coupled with favorable domestic macroeconomic conditions, has prompted renewed confidence in Indian equities.

Additionally, global risk sentiment has improved, as investors appear to be optimistic about potential progress in U.S.-China trade negotiations, which has further boosted appetite for emerging market stocks.

However, despite the positive sentiment, experts urge caution. The market may be entering a period of heightened volatility, and investors are advised to proceed carefully.

The U.S. “Tit for Tat” tax day, scheduled for April 2, 2025, is a potential risk that could disrupt global markets.

VK Vijayakumar, Chief Investment Strategist at Geojit Investment Services, highlighted that investors need to be cautious as uncertainty surrounding the tax dispute could create market turbulence.

He advises investors to wait for clarity on reciprocal tax measures before making significant investment decisions.

Technical Outlook:

From a technical perspective, the market remains in a bullish phase, but the Nifty index is approaching an overbought zone.

The Nifty has seen a sharp rally, and the formation of a bullish candle on the daily chart suggests that the index is on a strong upward trajectory. The Nifty is now nearing its previous swing high of 23,800, which could act as an immediate resistance level.

This level is crucial for traders to watch, as a break above it could lead to further upside potential, while failure to breach this level could trigger a consolidation or a correction.

Rupak Dey, Senior Technical Analyst at LKP Securities, notes that the Nifty has already broken above the 23,600 resistance level and has consistently traded above its 50-day exponential moving average (EMA) for the past three days.

The Relative Strength Index (RSI) has also formed a bullish crossover, a sign of continued strength in the market.

Dey believes that as long as the Nifty stays above 23,500, the short-term outlook remains positive. However, if the index falls below this support level, a correction could be in the cards.

Dey’s analysis suggests that the immediate support for Nifty lies at the 23,400 level, and a drop below this level could trigger a more significant pullback. On the other hand, if the index holds above the 23,500 mark, the uptrend is likely to persist.

Sectoral Performance:

In terms of sectoral performance, the banking sector has been one of the primary drivers of the rally. The sector was buoyed by strong buying in both private and PSU banks, driven by improved sentiment around India’s economic recovery and the overall financial sector.

The capital goods, IT, and oil and gas sectors also performed well, benefiting from strong domestic and global demand.

The realty sector, in particular, has seen a resurgence, with real estate stocks gaining traction due to improved sentiment in the housing market.

Similarly, energy stocks also gained, as expectations of higher energy consumption and government push for infrastructure development provided positive momentum.

Mid-cap and small-cap stocks have largely mirrored the performance of the Nifty, although these stocks have outperformed the broader index in some cases.

Investors have been particularly active in these segments, seeking opportunities for higher returns.

Market Prediction for March 25 and Beyond:

Looking ahead to March 25, the market seems poised to continue its bullish trend, but with caution advised due to overbought conditions.

The key resistance levels for Nifty are at 23,700 and 23,800, with a potential for a pullback if these levels are not breached. On the downside, 23,400 remains an important support level, and any dip below this could lead to a correction.

While the short-term outlook remains positive, investors should monitor global developments, particularly any news related to U.S.-China trade negotiations and the upcoming “Tit for Tat” tax day.

A more significant pullback or consolidation could occur if these external factors introduce volatility into the market.

Final Remarks

The Indian equity market remains in a strong uptrend, driven by favorable macroeconomic factors, foreign investor interest, and a broad-based rally across sectors.

However, with the Nifty entering overbought territory and potential external risks on the horizon, caution is advised in the near term. As always, it is important for investors to stay informed, monitor key levels, and adjust their strategies accordingly.