Sensex Gain 1,436 Points, Nifty at 24,188; Tomorrow Nifty Prediction

Tomorrow Nifty Prediction

Market Closes Strong with Solid Gains: What to Expect on January 3

Equity Market Overview: The Indian equity market kicked off the year 2025 with remarkable strength, building on a solid performance in the first two days of January.

A combination of strong sectoral performances, heavy short covering, and renewed optimism in global markets led to a sharp rally, driving the Sensex to the psychological 80,000 mark for the first time in recent months.

Despite the challenges posed by a weaker rupee and concerns about the broader global economic environment, domestic equity markets showed resilience and upward momentum.

As we approach the trading session on January 3, investors are keen to see if this positive trend continues, or whether the market will face any corrective pullbacks.

The first two days of January have already offered valuable insights into market sentiment and potential directions for the short to medium term.

The index levels, sectoral performance, and global developments are all crucial to watch in the coming sessions.

Stock Market Performance on January 2

On January 2, the Indian equity indices displayed impressive strength, with broad-based buying across all major sectors.

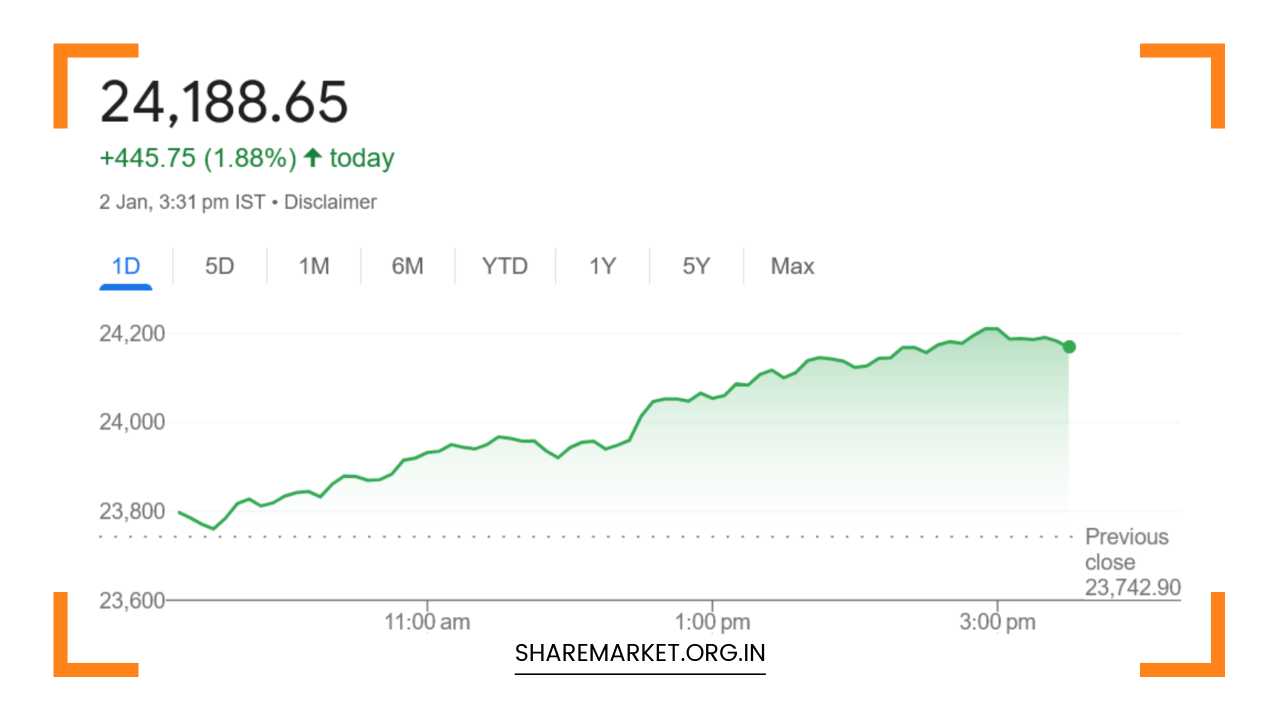

The Nifty closed the day at 24,188.65, up by 445.75 points, or 1.88%, while the Sensex surged 1,436.30 points, or 1.83%, ending at 79,943.71.

The rally was driven by gains in key sectors such as auto, IT, banking, and metals, which collectively powered the indices higher.

The overall market breadth was positive, with 2,312 stocks advancing, 1,496 declining, and 108 remaining unchanged, suggesting widespread optimism and a strong market undercurrent.

In terms of sectoral performance, the auto index led the charge with a 3.5% gain, benefiting from strong buying interest in stocks like Maruti Suzuki and Eicher Motors.

The IT sector, buoyed by key players such as Infosys and TCS, also gained 2%, reflecting the ongoing strength in the tech space.

Other sectors such as banking, metals, and financial services contributed to the positive sentiment, with the BSE Midcap and Smallcap indices also registering healthy gains of around 1%.

Among individual stocks, Bajaj Finserv, Bajaj Finance, Shriram Finance, and Eicher Motors emerged as the top gainers within the Nifty, reflecting investor confidence in the financials and auto segments.

Conversely, Britannia Industries and Sun Pharma were among the biggest losers on the day, pulling down the overall sectoral performance in consumer goods and pharmaceuticals.

Expert Insights:

- Ajit Mishra of Religare Broking emphasized that January 2 marked a turning point for market participants. After a period of range-bound consolidation, the benchmark indices surged by nearly 2%, lifting investor sentiment. Mishra highlighted the strength in the auto and IT sectors, which spurred the initial rally. As the day progressed, other sectors followed suit, leading to broad-based buying and a positive trend in mid and small-cap stocks as well.

Mishra pointed out that the Nifty’s rally had alleviated some of the recent pressures, bringing the index closer to the next resistance at the 100-day exponential moving average (DEMA), which is currently around the 24,250 level.

A decisive breakout above this level could open the door for further gains towards 24,400, with a potential target of 24,700 to 24,800 in the medium term.

On the downside, Mishra noted that the Nifty needs to hold above the 24,000 level to maintain the bullish momentum.

A break below 24,000 could lead to a correction and may cause a sharp selloff, especially if global factors such as rising crude prices or concerns about US bond yields start to weigh on investor sentiment.

- Aditya Gaggar, Director at Progressive Shares, observed that the market was dominated by bulls throughout the session on January 2. After a steady start, a strong, one-sided rally carried the Nifty through multiple resistance levels, culminating in a strong close at 24,188.65. Gaggar noted that the rally was largely driven by heavyweight stocks in the Nifty, particularly in the auto and IT sectors. Despite the strong market action, mid and small-cap stocks underperformed the frontline indices, pointing to a preference for large-cap stocks.

Gaggar cautioned that a pullback or retracement was possible given the sharp upward movement in the market. A minor correction could test the 24,000 support level before the next phase of the rally.

If the market continues to show strength, the Nifty could head towards its next targets at 24,700 to 24,800, further extending the bullish trend.

- Prashant Tapase of Mehta Equities acknowledged that the first two days of the new year had brought substantial strength to the market, especially after a relatively lackluster end to 2024. The market’s rally, driven by short covering and gains in sectors like banking, IT, auto, and metals, was impressive. Tapase also pointed to the psychological significance of the Sensex crossing 80,000, which reflects growing confidence in the market’s near-term outlook.

However, Tapase also cautioned about potential risks in the broader economic environment. Despite the positive domestic market performance, concerns about the currency market remain, particularly the weaker rupee, which hit new lows amid rising crude oil prices and slowing global growth.

Tapase highlighted that any further rise in US bond yields could put pressure on domestic equity markets and exacerbate foreign fund selling, which has already been a factor in recent months.

Therefore, while the domestic market has shown resilience, external factors could introduce volatility in the near term.

Looking Ahead to January 3:

As we head into the trading session on January 3, the market is at a crucial juncture. The strong gains of the past two days have pushed the Nifty closer to key resistance levels, particularly the 24,250 mark, where the 100-day exponential moving average lies.

A decisive breakout above this level could open the path for further gains, potentially targeting 24,400, and later 24,700–24,800.

However, investors should be cautious of a potential pullback or retracement, especially if global factors such as rising crude oil prices or inflationary pressures in key economies continue to weigh on sentiment.

A dip below the 24,000 support level would signal a correction and could lead to heightened volatility in the near term.

Key Focus Areas for Investors:

- Sectoral Performance: The auto, IT, banking, and metal sectors are likely to remain in focus, given their strong performance in the last few days. Any signs of weakness in these sectors could dampen the market’s overall strength.

- Technical Levels: The 24,000 level will be a critical support zone for the Nifty, while 24,250 and 24,400 will act as immediate resistance levels. A breakout above 24,250 could signal a strong rally, while failure to hold above 24,000 could lead to a pullback.

- Global Developments: External factors such as the movement of US bond yields, global crude oil prices, and any further signs of a global economic slowdown could influence domestic market sentiment.

Overall, while the Indian equity market has started 2025 with impressive gains, staying vigilant about key support and resistance levels, along with monitoring global macroeconomic conditions, will be crucial for investors navigating the market in the coming sessions.