Sensex Gain 1,961 Points, Nifty at 23,907; Nifty Prediction for Monday

Nifty Prediction for Monday

Sensex and Nifty Close with Significant Gains: What to Expect on November 25?

On November 22, Indian stock markets experienced a remarkable rally, with both benchmark indices — the Sensex and Nifty — posting strong gains of over 2%.

This surge reflected positive sentiment across global and domestic fronts, lifting investor optimism and triggering a broad-based rally in major stocks.

Despite this, experts urge caution, as the path ahead for the markets remains uncertain, especially with upcoming election results and the ongoing global and domestic market dynamics.

Market Performance on November 22

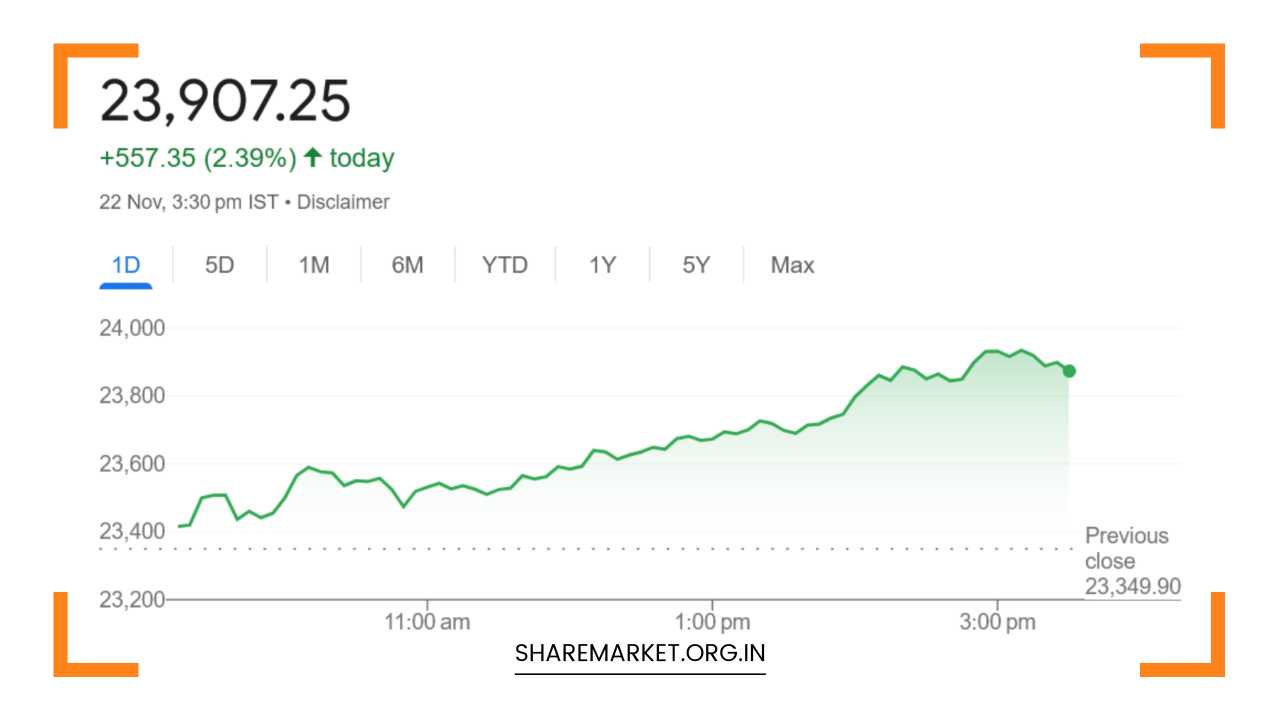

The Sensex and Nifty saw substantial gains on November 22, climbing 2.5% and 2.39%, respectively. At the end of the trading session, the Sensex surged by 1,961.32 points, or 2.54%, closing at 79,117.11.

Similarly, the Nifty gained 557.40 points, or 2.39%, to close at 23,907.30. This broad-based rally was marked by a significant rise in stocks across various sectors, especially in heavyweights like State Bank of India, TCS, ITC, UltraTech Cement, and Titan Company, which were among the top Nifty gainers.

On the other hand, Bajaj Auto was the only stock among the Nifty components that ended in the red.

A total of 2,340 stocks advanced, while 1,418 stocks declined, and 118 remained unchanged, reflecting a predominantly positive day for the broader market.

The BSE Midcap index gained 1.3%, while the Smallcap index rose by 0.9%, indicating that the rally was widespread across market segments.

Notably, PSU banks, IT, FMCG, energy, and realty sectors all closed in the green, with gains of 2-3%, reflecting investor confidence in these key areas.

What Led to the Rally?

Several factors contributed to the strong performance of Indian indices on November 22. Vinod Nair, Head of Research at Geojit Financial Services, explained that the market witnessed a broad-based rally from an oversold zone, driven largely by large-cap stocks.

He attributed this surge to a combination of factors, including expectations of improvement in corporate earnings during the second half of the financial year.

After a period of correction, valuations of many stocks appeared attractive, particularly those that had been oversold.

Global cues also played a crucial role in driving market sentiment. Nair highlighted the impact of Japan’s October inflation decline and the announcement of a 39 trillion yen stimulus package in Japan, which sparked optimism in global markets.

This, in turn, had a ripple effect on Indian markets, with global investors becoming more confident about the potential for growth.

Additionally, positive political developments in both global and domestic arenas helped calm investor nerves, providing further relief to the domestic stock market.

How Will the Market Move on November 25?

As we look ahead to November 25, the market faces several key factors that could shape its movement.

One of the primary triggers will be the election results for two major Indian states, scheduled for Saturday, November 25.

These results have the potential to influence investor sentiment, as they may give a clear indication of political stability and could affect the market’s near-term direction.

According to Prashant Tapase of Mehta Equities, the rally on November 22 was driven by a wave of relief, partly due to the exit polls indicating a likely victory for the BJP in both states.

This outcome has boosted investor sentiment and contributed to the positive movement in the market. Investors seem to be ignoring the allegations of bribery against the Adani Group for now, with the broader market rally overshadowing these concerns.

Tapase also noted that after weeks of consistent sell-offs driven by disappointing Q2 earnings and continued FII outflows, many stocks have now become attractive from a valuation perspective, which is fueling buying interest.

While the relief rally has been significant, Tapase cautioned that it does not necessarily signal a complete recovery in the market.

He emphasized that this bounce could be a short-term phenomenon, and the market’s overall trend will depend on the upcoming election results and broader macroeconomic factors.

The Role of FII Selling and Risk Management

Despite the rally, experts like Ajit Mishra, Senior Vice President at Religare Broking, urge investors to approach the current market cautiously.

Mishra pointed out that while a strong bounce has been seen, it is crucial to understand that this could merely be a one-day recovery.

“This is not yet a confirmed sign that the market is on the path to a full recovery,” he said.

Mishra explained that while the Nifty has managed to cross its 200-day moving average (DMA), which is often seen as a key technical indicator of market strength, it is essential to monitor the FII selling trends.

The intensity of foreign institutional investor (FII) outflows continues to be a critical factor in determining the market’s trajectory. If the selling pressure from FIIs persists, it could dampen the market’s bullish momentum.

Broader Market and Small-Cap Stocks

In the broader market, mid-cap and small-cap stocks have gained 1.3% and 0.9%, respectively. While this growth has been encouraging, Gaurang Shah, Head of Research at Geojit Financial Services, cautioned that high volatility in the broader market requires extra caution, particularly with microcap stocks.

Given the inherent risks associated with smaller stocks, Shah recommended that investors adopt a stock-specific approach and avoid making broad sectoral bets.

Technical Indicators and Market Sentiment

From a technical perspective, Sameet Chavan, Chief Technical Analyst at Angel One, shared his insights on the market’s near-term outlook.

Chavan emphasized that while today’s rally was promising, it remains uncertain whether the uptrend will be sustained.

He suggested that Nifty needs to break above the 23,800-24,000 zone for the rally to gain momentum.

Until such a move occurs, any pullback should be viewed as an opportunity to exit long positions. He also warned that if the market faces any setbacks, the Nifty could potentially drop to levels around 23,200-23,100.

Chavan recommended that investors continue to adopt a strong risk management strategy in the current market environment.

This includes being prepared for potential downside risks while remaining open to short-term opportunities in the event of any positive developments.

Final Remarks

The strong performance of the Sensex and Nifty on November 22 reflects a significant shift in market sentiment, fueled by improving global and domestic conditions.

While the rally is a positive sign, investors should remain cautious and mindful of the risks posed by FII outflows, political uncertainty, and market volatility.

The upcoming election results and the direction of foreign investments will be key factors in determining whether the market can sustain this uptrend.

Given the uncertain nature of the current market environment, investors are advised to remain vigilant, closely monitor key developments, and adopt a disciplined approach to risk management in the days ahead.