Sensex Gain 226 Points, Nifty at 23,249; Tomorrow Nifty Prediction

Tomorrow Nifty Prediction

Market Close Summary: Indian Stock Market Continues Upward Trend, Key Levels to Watch on January 31

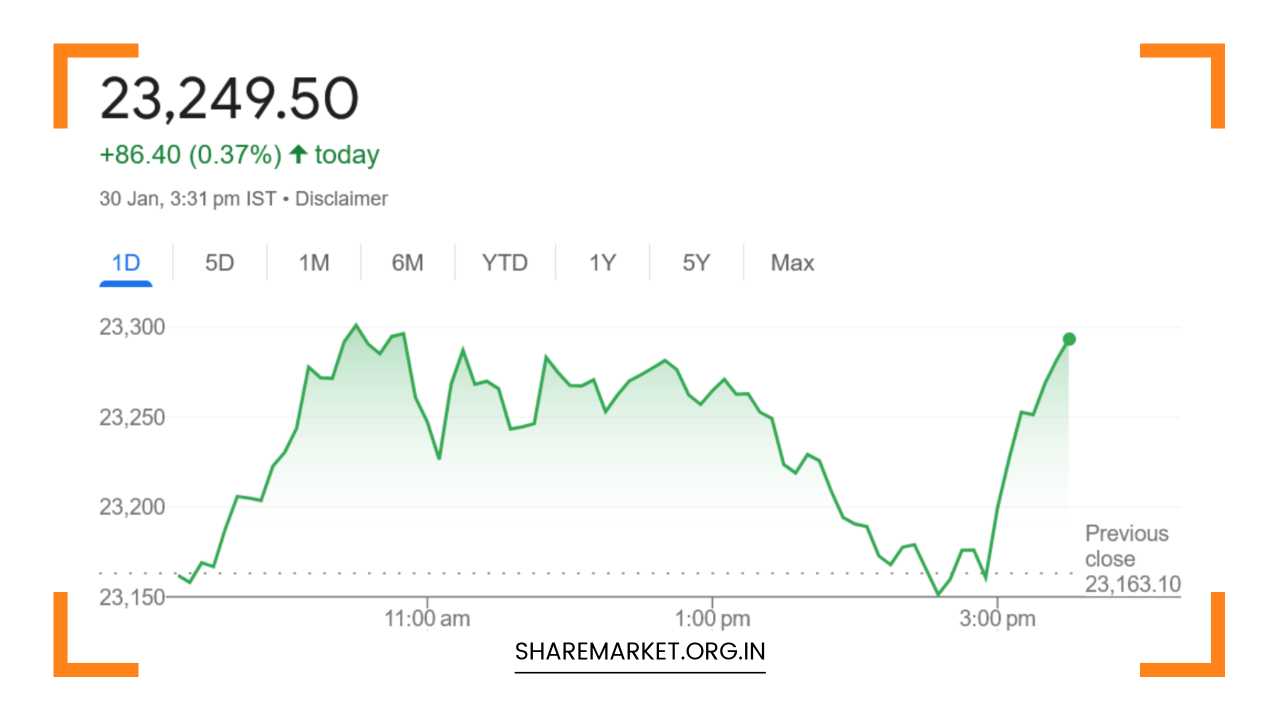

Market Overview: The Indian stock market continued its upward trajectory today, with the Nifty index marking its third consecutive day of gains.

The benchmark index closed the session with a gain of 86 points, settling at 23,249.50, maintaining a steady rally despite some volatility during the day.

The Sensex also followed a similar pattern, rising 226.85 points, or 0.30%, to close at 76,759.81.

In the broader market, the performance was mixed, with advances outpacing declines. A total of 2,051 stocks saw gains, while 1,734 stocks declined, and 117 stocks remained unchanged, reflecting an overall positive market sentiment.

The day’s trading session saw varied performances from individual stocks, with some names posting strong gains while others struggled.

Stock Performance:

Among the major gainers on the Nifty were Bharat Electronics, Hero MotoCorp, Bharti Airtel, Cipla, and Power Grid Corp.

These stocks saw significant upward movement as investors targeted strong performers within the market, particularly in the telecom, automobile, and pharma sectors.

These sectors have been on an upswing in recent weeks, supported by positive earnings reports and optimistic market sentiment.

On the other hand, some prominent stocks faced selling pressure. Tata Motors, Shriram Finance, Adani Enterprises, Bajaj Finserv, and Adani Ports were among the top losers today.

A combination of factors, including profit-booking and sector-specific challenges, contributed to their underperformance.

Despite their losses, these stocks are still being closely watched, especially given the volatile nature of the market and the potential for rebounds in the coming days.

Sectorial Performance:

From a sectorial perspective, the market showed a mixed response. The Oil & Gas, Power, Pharma, Energy, PSU, FMCG, and Realty sectors were the major beneficiaries, each posting gains in the range of 0.5% to 1%.

These sectors have been gaining traction due to a combination of strong earnings, supportive government policies, and rising demand.

Notably, the Energy and Realty sectors performed well, supported by positive developments in infrastructure and energy policy.

In contrast, the Auto, IT, Media, and Consumer Durables sectors faced selling pressure, with declines ranging from 0.4% to 2%.

The IT sector, in particular, has been under pressure in recent days, as investors assess global economic conditions and the outlook for tech spending.

The Auto sector also struggled due to concerns over high input costs and supply chain disruptions, impacting sentiment around major auto stocks.

Technical Insights:

Aditya Gaggar, Director at Progressive Shares, provided some insights into the market’s technical outlook. He pointed out that the term “expiry” often comes with volatility, and today’s session was no exception.

Nifty opened flat before picking up momentum, fluctuating within a defined range for most of the day.

However, a sharp decline in the afternoon wiped out earlier gains, only for the index to stage a strong recovery in the final hour of trading.

Despite the late rally, Gaggar observed that the Realty and Energy sectors were the standout performers, while the IT and Media sectors lagged.

This trend is noteworthy, as it suggests a rotation of capital into sectors that are poised to benefit from macroeconomic trends, such as infrastructure development and rising energy demand.

Looking at the technical indicators, Nifty managed to break out of its falling wedge formation, a positive sign for bulls.

A falling wedge pattern is typically considered a bullish reversal pattern, suggesting that the index may be preparing for a move higher.

However, Gaggar cautioned that the candlestick pattern from today’s session wasn’t particularly bullish, implying that more confirmation is needed before committing to a sustained upward movement.

Currently, resistance for Nifty is seen at the 23,350-23,400 range, while support is expected at 23,065.

These levels are critical in determining the next move for the index. If Nifty can break above 23,400, the path to 23,600 and beyond could open up.

On the other hand, if it fails to maintain support at 23,065, there could be a short-term pullback toward 22,900-23,000.

Market Prediction for January 31:

Jatin Gedia, Technical Research Analyst at Mirae Asset Sharekhan, echoed similar sentiments regarding the Nifty’s technical picture.

According to Gedia, Nifty has now closed with gains for three consecutive sessions, which is a positive sign, but the index is approaching its 20-day moving average at 23,300.

This level is likely to act as a strong resistance and could cap any further upside in the near term.

Additionally, Gedia noted that the momentum indicator on the hourly chart has triggered a negative crossover, which suggests that there could be some consolidation or a slight pullback before a potential move higher.

The market could be preparing for a key event on Saturday, February 1, which may lead to increased volatility. With this in mind, Gedia expects Nifty to trade within a defined range over the next couple of days.

For Nifty, the immediate support zone is between 23,120 and 23,055, while short-term resistance is seen between 23,320 and 23,350.

These levels should be closely monitored as the market navigates through the remainder of the week. Investors should remain cautious and prepared for potential price swings, especially as the market awaits further catalysts in the coming sessions.

Investor Sentiment and Strategy:

Investor sentiment remains cautiously optimistic, with many looking to take advantage of sector-specific opportunities.

However, with the market facing potential resistance at key technical levels, it’s important for investors to tread carefully in the short term.

Those looking to invest in the current market should focus on fundamentally strong stocks in sectors that show long-term growth potential, such as Pharma, Energy, and Infrastructure.

For traders, there may be opportunities for short-term gains by capitalizing on the expected volatility, but it’s crucial to use appropriate risk management strategies, especially as expiry week often brings higher-than-usual fluctuations.

Final Remarks:

The Indian stock market ended January 30 on a positive note, with both the Nifty and Sensex closing higher.

While technical indicators suggest a potential consolidation in the near term, the overall market trend remains constructive.

Investors should keep an eye on key levels for Nifty (support at 23,065 and resistance at 23,350) and sectoral performance in the coming sessions.

As we head into January 31, market participants will likely remain cautious, particularly with the approaching major event on February 1.

Whether the market can sustain its momentum or will experience some pullback depends largely on how the index behaves around these key technical levels.

Traders and investors alike should prepare for a potential mix of volatility and opportunity in the coming days.