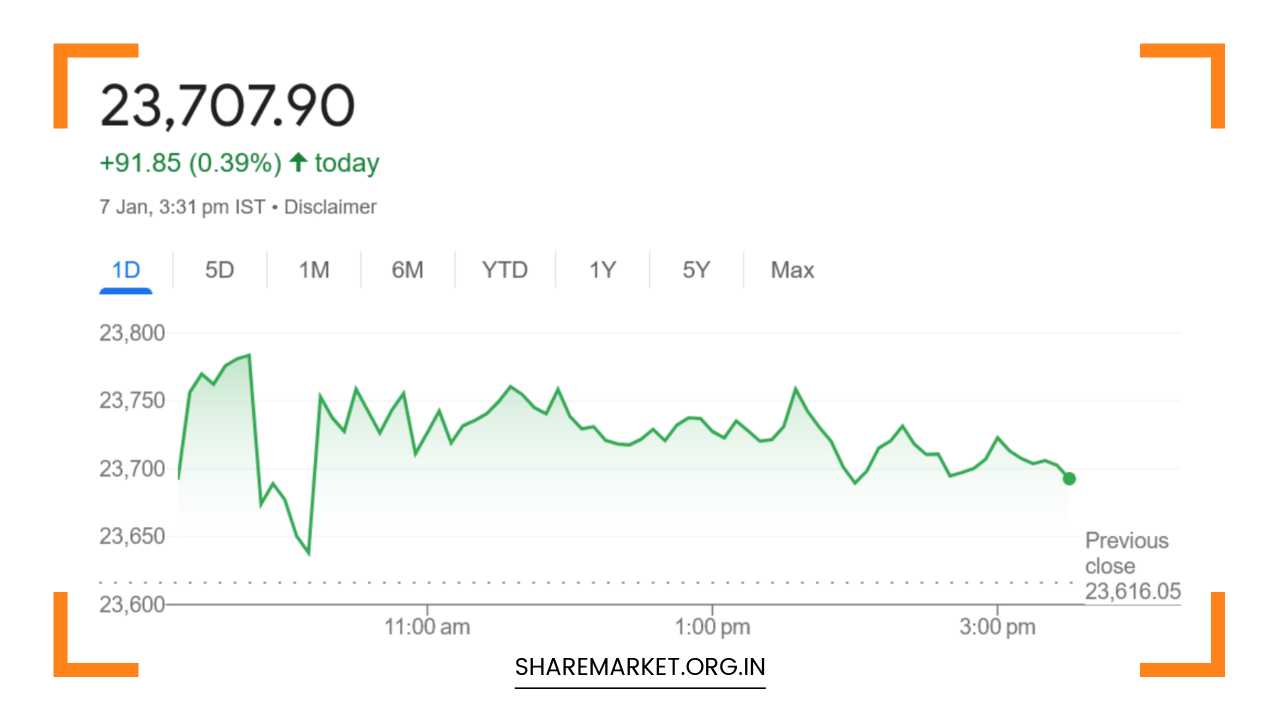

Sensex Gain 234 Points, Nifty at 23,707; Tomorrow Nifty Prediction

Tomorrow Nifty Prediction

Indian Equity Market: Positive Close on January 7, But Challenges Persist for January 8

The Indian equity markets closed on a positive note on January 7, with both the Nifty and Sensex ending the day higher.

The Nifty rose by 91.85 points, or 0.39%, to close at 23,707.90, while the Sensex gained 234.12 points, or 0.30%, to finish at 78,199.11.

However, despite the day’s gains, the market continues to face a variety of challenges that suggest the recent upward movement may not be sustainable in the near term.

Market participants should brace for potential volatility, as several key factors — both technical and fundamental — could limit the market’s upward momentum in the coming days.

Nifty Faces Key Resistance Levels

The Nifty’s rally has been intermittent, with multiple false starts over the past few weeks, leading some experts to remain cautious about the market’s ability to sustain its positive momentum.

According to Sameet Chavan, Head of Technical and Derivative Research at Angel One, the bounce in the Nifty could face significant resistance around the 200-Day Simple Moving Average (200 DSMA), which is located in the range of 23,900 to 24,000.

Historically, the 200 DSMA serves as a strong technical resistance, and any attempt to push beyond this level will require substantial buying power to confirm that the market is on a sustainable uptrend.

Chavan further suggests that unless the Nifty manages a decisive breakout above 24,200, the index may struggle to maintain its upward trajectory.

A breakout above 24,200 would indicate that the bulls have regained control, potentially triggering more buying activity and lifting the market toward new highs.

Until this happens, however, the market could remain in a sideways or choppy phase, with potential for further pullbacks as it tests lower support levels.

Sectoral Performance: Mixed Sentiment

The market showed mixed sectoral performance on January 7. Most sectors, except for IT, ended the day in the green.

Among the top performers were the oil and gas, real estate, energy, banking, metal, and pharmaceutical sectors, each of which saw gains ranging from 0.5% to 1%.

The BSE Midcap index rose by 0.7%, and the BSE Smallcap index outperformed with a gain of 1.7%. These indices are often seen as more sensitive to market risk and sentiment, which suggests that smaller stocks could be experiencing some buying interest, particularly in the wake of the recent market correction.

On the flip side, the Information Technology (IT) sector faced significant pressure, with several large-cap IT stocks such as HCL Technologies and TCS suffering heavy losses.

The underperformance of the IT sector is largely attributed to global macroeconomic factors, including fears of a global recession and continued weakness in demand for IT services, especially in developed markets like the US and Europe.

Stocks such as ONGC, SBI Life Insurance, Tata Motors, HDFC Life, and Reliance Industries were among the biggest gainers on the Nifty, benefiting from the broader sectoral strength.

However, the notable losers included HCL Tech, Eicher Motors, Hero MotoCorp, and Trent, all of which saw significant declines.

The overall market breadth was positive, with 2,527 stocks advancing, 1,286 stocks declining, and 103 stocks remaining unchanged, reflecting a relatively optimistic sentiment despite the challenges faced by specific sectors.

Foreign Institutional Investor (FII) Flows Remain a Key Concern

One of the most significant headwinds facing the Indian market remains the continued selling by Foreign Institutional Investors (FIIs). Raj Deepak Singh of ICICI Securities pointed out that FII outflows have been a major obstacle for the market since September, and there has been no substantial change in this trend yet.

For the market to experience a sustainable rise, the return of FIIs is crucial. However, with global factors such as a stronger dollar and attractive yields in US Treasury bonds, it appears unlikely that FIIs will be eager to reinvest in Indian equities in the short term.

The US dollar index has been strengthening, and with US Treasury yields at elevated levels, investors are being drawn to US assets, which are seen as a safer bet in the current global environment.

Singh mentioned that while there is widespread belief that the dollar index may not exceed the 110 level, its current strength continues to pose a challenge for emerging markets like India.

A rise in the dollar index makes foreign investments in Indian equities less attractive, as it increases the cost of capital and raises concerns over inflationary pressures in India.

A decline in the dollar index could provide some relief for the Indian market, as it would lower the outflow pressures and potentially improve foreign investor sentiment.

The Impact of Global Health Concerns

Another risk factor that investors need to monitor closely is the growing uncertainty surrounding the new virus strains that have emerged globally.

As Sameet Chavan noted, the threat from new variants of the virus is increasing, and investors must stay vigilant.

While the situation is still developing, any significant escalation could lead to increased market volatility, particularly if the new variants are perceived to cause further global economic disruptions.

The resurgence of health-related fears could exacerbate market volatility, especially if it leads to renewed lockdowns or travel restrictions in major global economies.

Until there is greater clarity on the virus situation, market participants may remain on edge, which could weigh on investor sentiment.

Midcap and Smallcap Stocks: Caution Advised

The recent decline in midcap and small-cap stocks has been notable, with these segments facing more severe losses compared to large-cap stocks.

The midcap and small-cap indices have been among the worst hit in the recent market downturn and continue to show weakness.

Given the higher risk profile of these stocks, traders are advised to remain cautious when navigating these segments.

While the midcap and small-cap stocks have the potential for higher returns in a strong market, they also carry greater risk during periods of market uncertainty.

With the current macroeconomic and geopolitical risks, including the strong dollar and global health concerns, investors are advised to avoid taking on too much risk in these segments until the broader market trend becomes clearer.

Prediction for January 8: Caution Prevails

While the Indian markets closed with gains on January 7, the outlook for January 8 is still uncertain.

Technical resistance at the 23,900-24,000 range for Nifty remains a key hurdle, and unless a breakout above 24,200 occurs, the market could remain range-bound or face further downside risk.

Additionally, the persistence of FII outflows and global uncertainties, including the rising dollar index and the potential threat from new virus strains, could limit the market’s upside potential in the near term.

Investors are advised to remain cautious and monitor key technical levels for signs of further weakness or strength.

For those with a longer-term perspective, a sustained decline in the dollar index or positive developments around the virus could offer better opportunities for entry into Indian equities.

Until then, maintaining a selective approach and focusing on high-quality, fundamentally strong stocks remains a prudent strategy.