Sensex Gain 239 Points, Nifty at 23,518; Market Prediction for 21 November

Market Prediction

Stock Market Update: November 19 – Market Gains Eroded Amid Late-Session Sell-Off; What to Expect on November 21

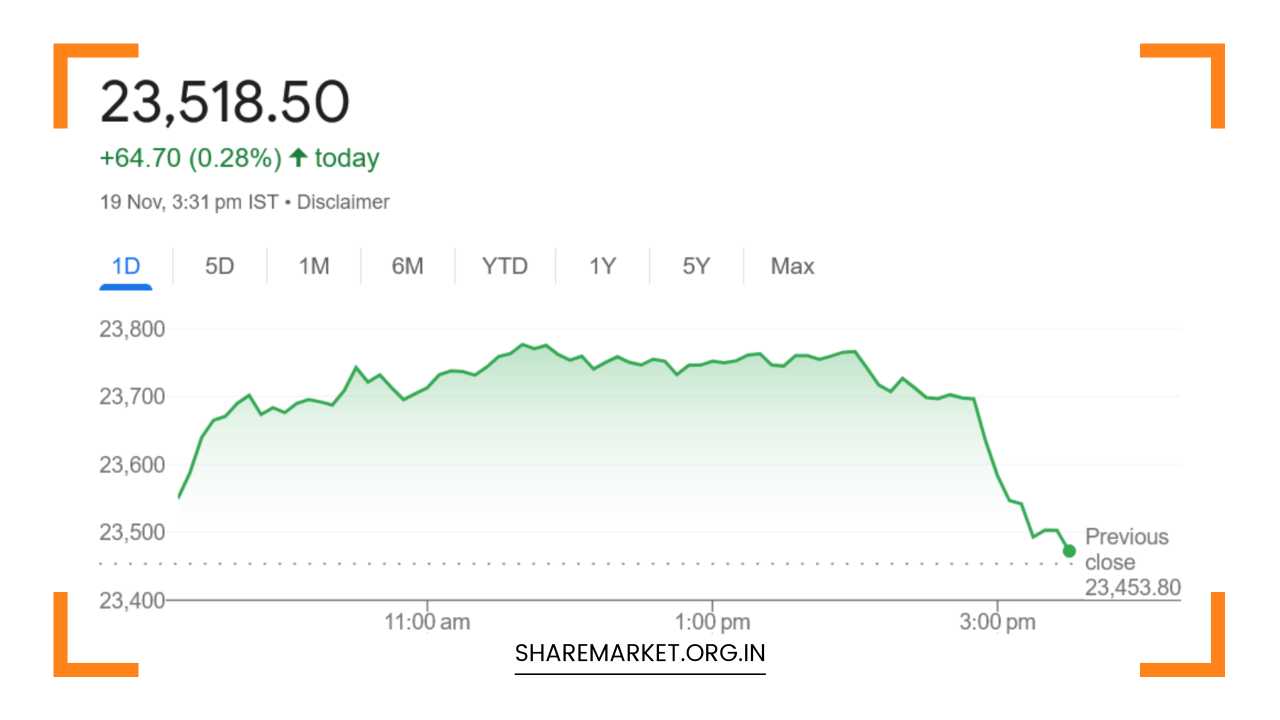

The Indian stock market displayed a mix of resilience and volatility on November 19, with bulls holding a commanding position for much of the trading session.

However, as the day progressed, a sudden sell-off in the final hours of trading significantly eroded earlier gains, leaving the indices to close with modest upticks.

Despite the late pullback, market breadth was largely positive, with several sectors posting gains, while some key stocks saw notable movement.

Market Overview: Sensex and Nifty Close Higher Amid Volatility

At the close of trading on November 19, both major Indian equity indices ended the session in positive territory, albeit with a subdued finish.

The Sensex closed at 77,578.38, rising by 239.37 points, or 0.31%, while the Nifty settled at 23,518.50, up by 64.70 points, or 0.28%.

This represented a modest recovery from the sharp decline witnessed in the previous sessions, but a late sell-off curbed the extent of the gains.

In terms of market breadth, 2,197 stocks advanced, 1,591 stocks declined, and 95 stocks remained unchanged.

This suggests that while the broader market remained in the green, the action was selective, with volatility affecting the performance of various sectors.

Key Stock Performances and Sectoral Trends

The top gainers on the Nifty included some of India’s largest companies, with M&M, Trent, Tech Mahindra, HDFC Bank, and Eicher Motors leading the charge.

These stocks were buoyed by sector-specific trends, with sectors such as automotive, IT, and banking performing better amid a mixed market backdrop.

On the flip side, the biggest losers included SBI Life Insurance, HDFC Life, Reliance Industries, Tata Consumer, and Hindalco, which all saw sharp declines.

The underperformance of these stocks reflects a combination of sector-specific challenges, as well as broader market factors weighing on sentiment.

Sectoral performance showed a diverse picture. Media, auto, realty, IT, and pharma sectors were the primary gainers on the day, rising between 0.5% and 2.5%, with stocks like Trent, Tech Mahindra, and Dr. Reddy’s Laboratories leading the charge.

The auto sector benefitted from strong earnings reports from key players like M&M and Eicher Motors, while the IT and pharma sectors remained relatively resilient despite the broader market volatility.

Conversely, metal, oil & gas, and PSU banks were the worst performers, with all these sectors seeing losses of around 0.5%.

Reliance Industries and Hindalco, two heavyweights in the oil & gas and metal sectors respectively, dragged the broader indices down as investors showed caution amid global economic uncertainty, including concerns over crude oil prices and commodity demand.

The BSE midcap and smallcap indices fared relatively better, gaining around 1%, as investors showed a preference for mid-tier stocks with strong growth potential, despite the overall market fluctuations.

Expert Opinions: Market Outlook Amid Geopolitical Tensions and Volatility

Ajit Mishra, Vice President at Religare Broking, observed that the Indian market witnessed significant volatility throughout the session.

Although the Sensex and Nifty managed to close with slight gains, the late sell-off towards the close of the trading session resulted in a notable decline from the day’s highs.

Mishra pointed out that despite the initial optimism, the sharp pullback in the latter part of the session reflected heightened caution among investors, driven by factors such as global geopolitical tensions and concerns over domestic economic growth.

Mishra also highlighted that the sectoral performance was mixed, with the realty, auto, and pharma indices showing positive movement, while sectors like metal, oil & gas, and PSU banks struggled.

He noted that mid- and small-cap stocks outperformed the large-cap stocks, which could indicate a shift in investor sentiment towards stocks with potentially higher growth but also higher risk.

Aditya Gaggar, Director at Progressive Shares, emphasized the dominance of the bulls for much of the trading day.

However, geopolitical shocks, particularly in the global market, led to a sharp pullback in the final hours, which erased most of the earlier gains.

Gaggar pointed out the formation of a DOJI candlestick pattern around the 200-day moving average (200DMA) on the Nifty, indicating indecision in the market.

The 200DMA is often seen as a key support or resistance level, and the formation of a Doji suggests that traders are uncertain about the direction of the market in the short term.

Gaggar further suggested that a strong and sustainable move above the 23,800 level on the Nifty would be needed to confirm a trend reversal.

Conversely, he expects the 23,300 level to provide significant support for the index, and a breach below this could signal further downside.

Strategic Approach: Navigating the Volatility

Given the market’s current volatility, experts recommend a cautious but strategic approach. “Buy on bounce” is a strategy that many analysts are suggesting, with investors advised to focus on quality stocks in select sectors rather than trying to time the market.

This approach allows investors to take advantage of short-term rallies while being prepared for potential pullbacks.

For those with a longer-term investment horizon, the ongoing volatility presents an opportunity to selectively accumulate stocks that have strong fundamentals and potential for future growth.

Sectors such as auto, pharma, and IT are expected to remain in focus, particularly if they continue to show relative strength amid broader market uncertainty.

Additionally, while the Nifty’s recent performance reflects a somewhat bearish undertone, the market’s trend is not yet firmly established.

Investors should be patient and wait for a clearer confirmation of the trend before making large-scale moves. As the 23,800 resistance and 23,300 support levels remain pivotal, these price points will likely serve as key indicators in determining the market’s direction in the coming days.

Final Remarks: What to Watch for on November 21

As the market heads into November 21, investors should remain cautious but prepared for further volatility.

The global geopolitical landscape, along with domestic economic data and corporate earnings reports, will continue to play a crucial role in shaping investor sentiment.

While select sectors may show resilience, overall market performance will largely depend on how the global economic picture unfolds.

The key levels to watch on the Nifty are 23,300 on the downside and 23,800 on the upside. A clear breakout above 23,800 could indicate the start of a new uptrend, while a fall below 23,300 would suggest that the bearish phase may continue.

As always, maintaining a diversified portfolio with a focus on quality stocks and sectors that are less sensitive to global shocks can help investors navigate the current market environment.

In the coming days, investors are advised to stay nimble, monitor global events closely, and remain alert to any changes in market sentiment.

The current market conditions offer both challenges and opportunities, and with a prudent approach, investors can potentially capitalize on the market’s fluctuations.