Sensex Gain 317 Points, Nifty at 23,591; Tomorrow Nifty Prediction

Tomorrow Nifty Prediction

Market Review and Prediction for March 28

On March 27, 2025, the Indian stock market delivered a mixed but optimistic performance as it recovered from a slower start on the monthly expiry.

After some initial weakness, the indices made a strong recovery, with key benchmarks closing in the green.

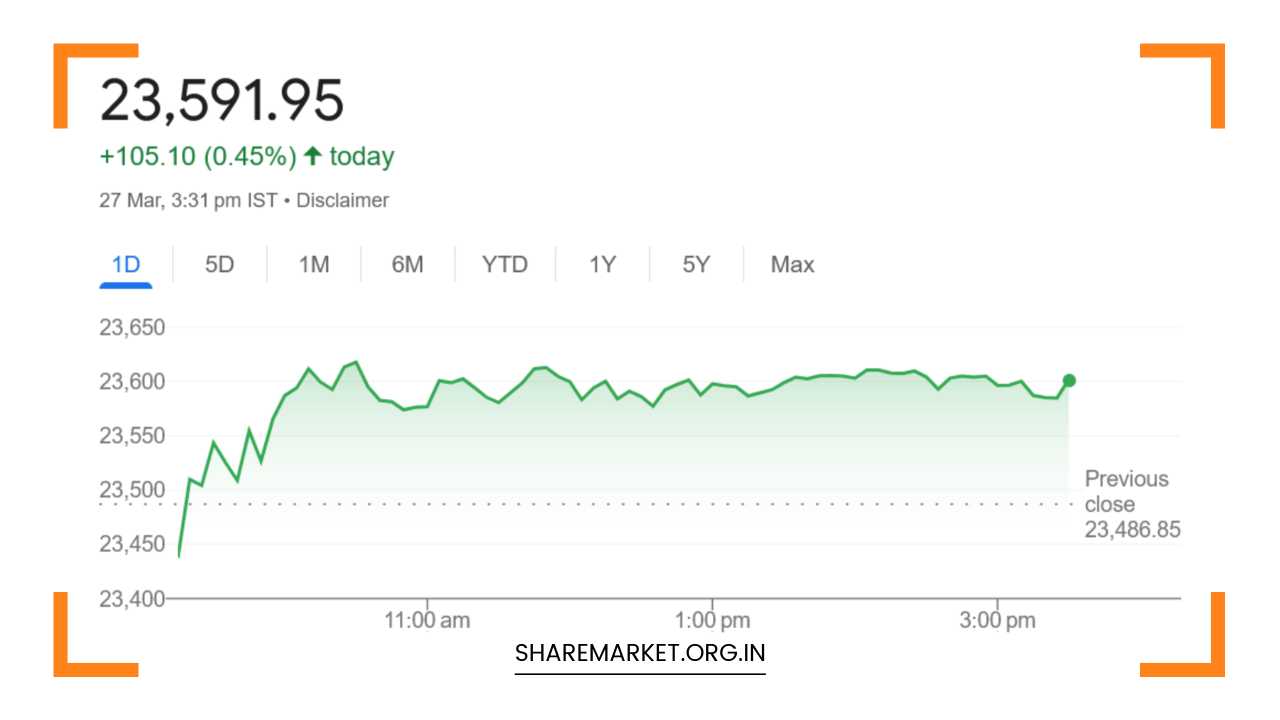

The Nifty ended the day at 23,591.95, up by 105.10 points or 0.45%. Similarly, the Sensex surged 317.93 points, closing at 77,606.43.

Despite a somewhat tepid beginning to the session, the market showed resilience, with sectors fluctuating but ultimately closing on a positive note. Of the 3,875 stocks traded, 1,628 closed higher, while 2,247 ended in the red.

The performance of different sectors was mixed: auto and pharma sectors struggled, while other sectors, especially banking, media, and real estate, showed positive momentum.

The BSE Midcap Index rose by 0.5%, while the Smallcap Index advanced by 1%, with smaller stocks outperforming their larger counterparts.

Notable gainers on the Nifty included Hero MotoCorp, Bajaj Finserv, IndusInd Bank, HDFC Life, and Adani Enterprises.

In contrast, stocks such as Tata Motors, Sun Pharma, Eicher Motors, Kotak Mahindra Bank, and Bharti Airtel witnessed declines.

How Could the Market Move on March 28?

The outlook for March 28 depends on the market’s ability to maintain its momentum and navigate the broader economic factors influencing sentiment.

There are several perspectives from key market analysts that shed light on the direction the market could take in the near term.

Aditya Gaggar’s View (Progressive Shares)

Aditya Gaggar, from Progressive Shares, provided an insightful analysis on the market’s performance on March 27. He noted that the market began the monthly expiry session slowly, but a strong recovery from the lower levels helped propel the indices higher.

However, despite the positive close, the index fluctuated within a narrow range throughout the day.

Ultimately, the Nifty closed at 23,591.95, a gain of 105.10 points, while the broader market saw varied performances across different sectors.

Looking ahead, Gaggar believes the Nifty index has likely completed its corrective phase, suggesting the potential for further upward movement.

He pointed out that the market has filled the bullish gap and is forming a piercing candlestick pattern, which is generally considered a positive signal for future price action.

Gaggar noted that immediate resistance for the Nifty is seen at the 23,800 level, and a breakout above this point could push the index toward the psychological milestone of 24,000.

On the downside, he identified support around the 23,400 level, which could act as a cushion in case of a pullback.

Vinod Nair’s Perspective (Geojit Investments)

Vinod Nair from Geojit Investments highlighted the importance of foreign institutional investor (FII) inflows and their role in sustaining positive sentiment in the Indian markets.

He explained that the continued buying from foreign investors and a strong preference for blue-chip stocks are contributing to optimism in the domestic markets.

This trend is particularly noteworthy as it signals confidence in the stability of the Indian economy, even amid some global uncertainties.

However, Nair also noted the headwinds faced by certain sectors, particularly the auto and pharma industries.

The imposition of a 25% tariff on auto imports by the US has impacted the auto sector, with stocks like Tata Motors and Eicher Motors seeing declines.

The pharma sector also faces challenges, as regulatory concerns and pricing pressures in key markets continue to weigh on stock performance.

Despite these challenges, Nair remains optimistic about the broader market’s potential. He emphasized that the market’s resilience is supported by expectations of double-digit earnings growth in FY26.

This growth is anticipated due to factors such as lower inflation and a reduction in interest rates. The current market outlook is bolstered by the anticipation of a favorable economic environment, which should lead to solid earnings from a range of sectors.

Nair also pointed to the ongoing US-India trade discussions as an important catalyst for market direction.

With the trade meeting having started on March 26, the outcome of these talks could provide more clarity on the future of bilateral trade relations, which could influence market sentiment in the coming days.

Ajit Mishra’s Insights (Religare Broking)

Ajit Mishra from Religare Broking also weighed in on the market’s performance. He pointed out that, despite mixed signals throughout the trading day, the market registered an overall gain of 0.45%.

Mishra noted that, after a flat start, the Nifty gradually rose in the first hour, and this was followed by a more range-bound session in the later parts of the day. By the close, the Nifty ended with a gain of 105.10 points at 23,591.95.

Sectoral performance was varied, with energy and real estate stocks emerging as the best performers. However, the auto and pharma sectors struggled, adding to concerns about the short-term outlook for these industries.

Mishra explained that strength in banking and finance stocks, combined with rotational support from other heavyweight sectors, helped maintain overall positive sentiment.

Looking forward, Mishra noted that the market’s strength has been aided by a change in FII sentiment, which has bolstered stocks in the banking and finance sectors.

However, he cautioned that global news—especially related to the US tariffs—could lead to volatility in the short term.

He advised traders to look beyond the short-term fluctuations and focus on quality stocks that are positioned to perform well in the longer term.

Market Sentiment and Key Levels for March 28

As traders prepare for March 28, the outlook for the market remains cautiously optimistic. Several factors will likely influence the direction of the market, including the continuation of foreign fund inflows, sector-specific developments, and any updates related to global trade negotiations.

Key levels to watch for Nifty are 23,800 on the upside and 23,400 on the downside. A breakout above 23,800 could trigger further bullish momentum, pushing the index toward 24,000, while a fall below 23,400 could signal a deeper pullback, with support potentially coming in around the 23,200 level.

Given the mixed sectoral performance and the ongoing consolidation phase, traders should be prepared for some volatility.

However, with expectations of continued earnings growth and a favorable economic backdrop, the market could continue its upward trajectory, particularly if foreign inflows remain strong and the trade talks between the US and India lead to positive developments.

Final Remarks

The market’s performance on March 27 was a strong reminder of the resilience of the Indian equity markets, even in the face of global uncertainties and sector-specific concerns.

While the auto and pharma sectors may face challenges in the near term, the broader market continues to show strength, particularly in sectors such as banking, finance, and real estate.

Looking to March 28, traders should remain cautious but optimistic. The key levels for the Nifty—23,800 on the upside and 23,400 on the downside—will be critical in determining the market’s direction.

Focusing on quality stocks and maintaining a longer-term perspective will be essential for navigating the current consolidation phase and capitalizing on potential gains in the coming weeks.