Sensex Gain 349 Points, Nifty at 25,151; Tomorrow Nifty Prediction

Tomorrow Nifty Prediction

Market Update: Nifty Extends Winning Streak to 11 Days—What to Expect on August 30

Market Summary:

The Indian stock market continued its impressive rally today, with the Nifty Index recording its 11th consecutive day of gains.

This extended run of positive performance reflects a resilient market, even amidst global uncertainties. Both major indices, the Sensex and Nifty, closed significantly higher, marking a notable achievement in the current market cycle.

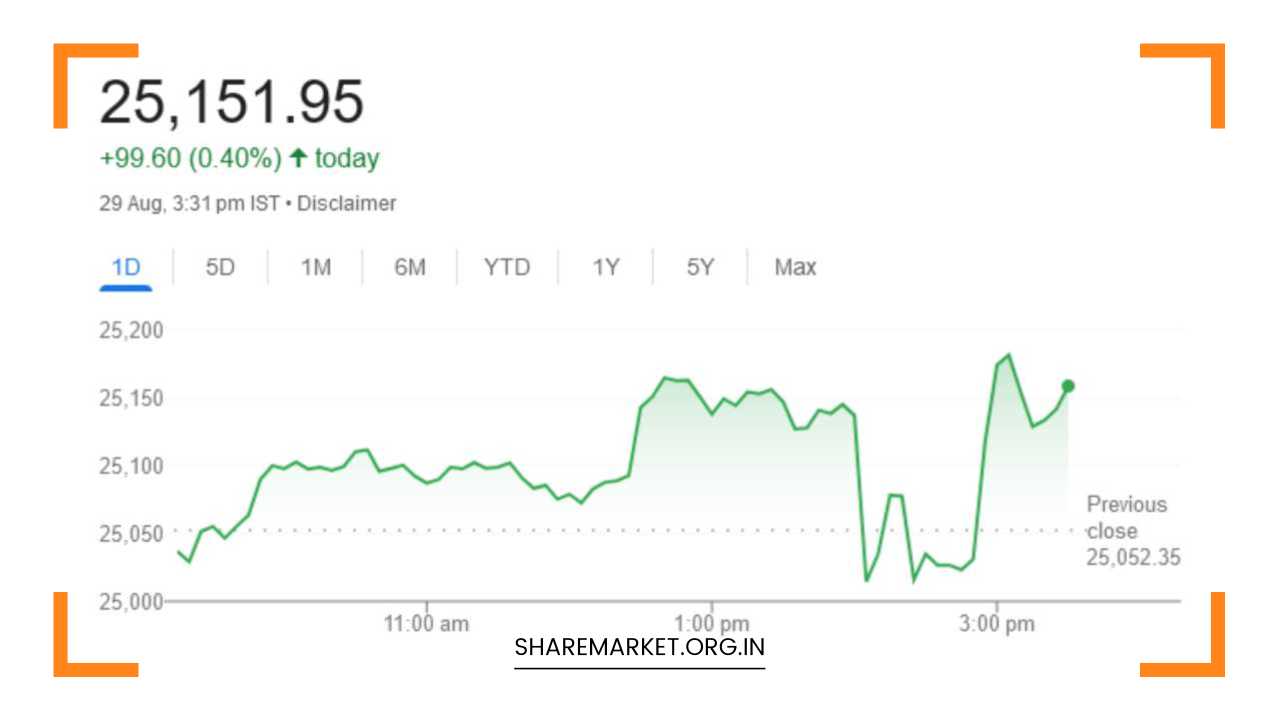

The Sensex ended the day at 82,135, up by 349 points, signaling a robust upward momentum. Meanwhile, the Nifty Index closed at 25,152, marking a gain of 100 points.

The Nifty Bank Index, which tracks the performance of the banking sector, closed at 51,153, up by 9 points. In contrast, the Midcap Index, a barometer for smaller companies, ended at 58,883, a decrease of 262 points.

In terms of individual stock performance, 19 out of the 30 Sensex stocks closed higher today. This broad-based rally was mirrored in the Nifty Index, where 30 out of 50 stocks posted gains.

The banking sector also showed positive movement, with 7 out of 12 Nifty Bank stocks finishing in the green.

Additionally, the Indian Rupee closed stronger against the US Dollar, appreciating by 8 paise to end at Rs 83.87 per dollar.

Market Prediction for August 30:

Looking ahead to August 30, market experts offer various perspectives on how the indices might perform. Here’s a detailed analysis from key financial analysts:

VK Vijaykumar, Chief Investment Strategist at Geojit Financial Services:

VK Vijaykumar provides an insightful analysis, noting that the Indian market has shown resilience despite weak global signals.

He points out that the market’s ability to absorb global uncertainties and still deliver consistent gains is indicative of strong domestic fundamentals.

Vijaykumar highlights that the ongoing bullish trend is providing buying opportunities within the domestic market, as evidenced by the steady rise in the Nifty Index.

He also emphasizes that the recent uptick in IT stocks is a positive indicator. The rise in IT stocks could be attributed to expectations of a softer landing for the US economy, which might lead to increased orders for these companies.

The large-cap segment of the market appears stable and well-balanced, reflecting a broader confidence in major corporations.

However, he notes that the SME (Small and Medium Enterprises) segment is experiencing a mix of risk and enthusiasm, suggesting that investors should be cautious and strategic when considering smaller, more volatile stocks.

Jatin Gedia, Technical Analyst at Sharekhan:

Jatin Gedia offers a technical perspective on the market’s performance. He observes that the Nifty Index started the day on a flat note, but experienced sharp volatility throughout the trading session.

According to Gedia, the current upward movement in the Nifty Index is supported by sector rotation, which is a common phenomenon where different sectors take turns leading the market’s performance.

Gedia’s analysis suggests that the Nifty Index may continue its upward trend, with a target of reaching 25,250. He identifies the 25,000 – 24,970 range as a key support zone, which could help cushion any potential declines.

The divergence between the daily and longer-term momentum indicators implies that the market might continue to oscillate within a range for the time being.

This range-bound movement could provide opportunities for traders to capitalize on fluctuations while maintaining a cautious approach.

Aditya Gaggar, Director at Progressive Shares:

Aditya Gaggar highlights the strong bullish sentiment in today’s trading session. He notes that the Nifty Index closed above 25,100 with a solid bullish candle, which is a positive technical signal suggesting that the market is likely to remain in an upward trend.

Gaggar is optimistic that the Nifty Index could advance towards the 25,370 level, reflecting continued investor confidence.

On the downside, Gaggar identifies 25,000 as a crucial support level. If the index falls below this level, it could signal a potential reversal in the upward trend.

However, given the current momentum, Gaggar remains bullish and expects the market to maintain its positive trajectory in the near term.

Market Factors to Watch:

As we approach August 30, several factors could influence market movements:

- Global Economic Indicators: Global economic data and geopolitical developments can impact market sentiment. Investors should keep an eye on any significant economic reports or international events that could affect market stability.

- Sector-Specific Developments: The performance of key sectors, such as technology and banking, will be crucial in determining the overall market direction. Sector-specific news, earnings reports, and policy changes could drive market volatility.

- Technical Indicators: Traders and investors will be closely monitoring technical indicators for signals of trend reversals or confirmations. Key levels of support and resistance will be important in guiding trading decisions.

- Domestic Economic Policies: Any announcements or policy changes by the Indian government or central bank could impact market sentiment. Investors should stay informed about fiscal and monetary policies that could influence economic growth and market performance.

- Corporate Earnings: Upcoming corporate earnings reports could also play a significant role in shaping market expectations. Strong earnings results from major companies could boost investor confidence, while disappointing results could lead to market corrections.

Final Remarks:

The Indian stock market has demonstrated impressive resilience and positive momentum, with the Nifty Index achieving its 11th consecutive day of gains.

As we move towards August 30, the outlook remains cautiously optimistic, with experts providing varied but generally positive forecasts.

Investors should stay vigilant and informed, considering both global and domestic factors that could impact market performance.

By paying attention to key support levels, sector movements, and broader economic indicators, traders and investors can better navigate the evolving market landscape.