Sensex Gain 566 Points, Nifty at 23,155; Tomorrow Nifty Prediction

Tomorrow Nifty Prediction

Market Closes with Gains; What to Expect on January 23: An In-Depth Analysis

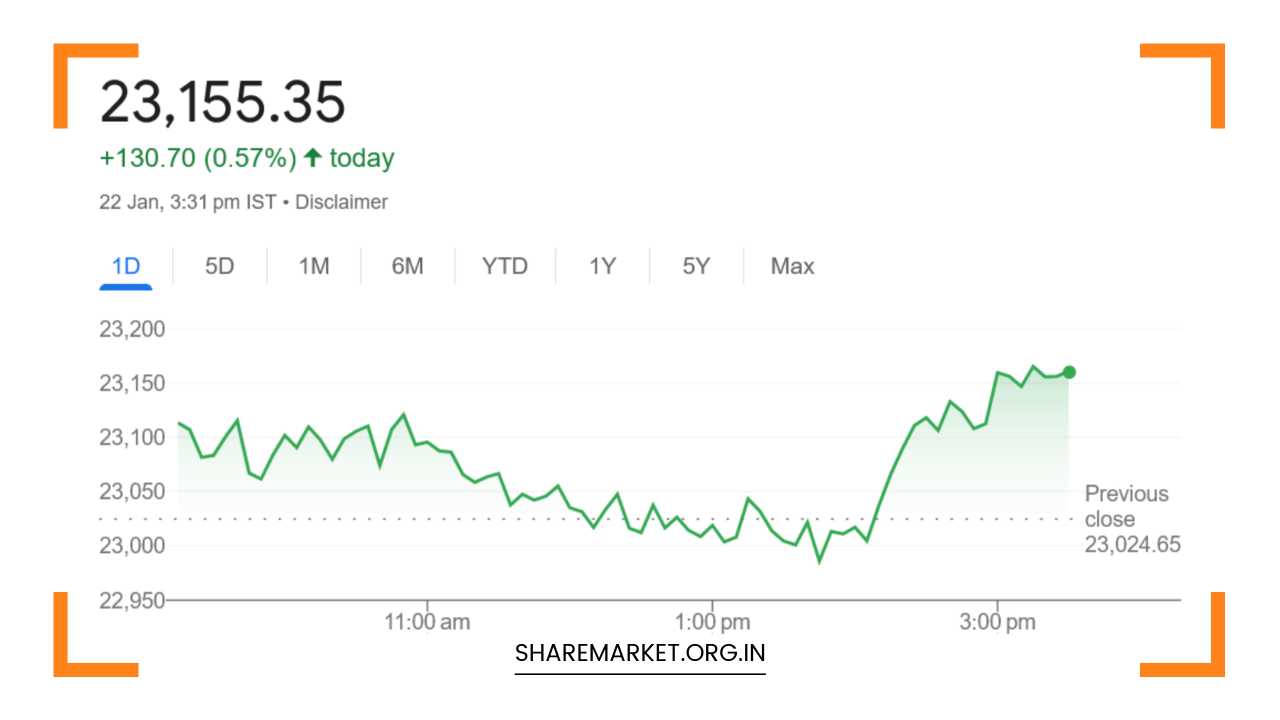

Market Trend Overview: On January 22, the Indian stock market experienced a recovery after significant volatility, with both the benchmark indices, Sensex and Nifty, closing in positive territory.

The market’s rebound was largely attributed to strong performance in the technology sector, despite the broader market indices lagging.

Nifty, in particular, found support near its previous session’s low of 22,980, which led to the formation of a hammer tweezer bottom candlestick pattern on the daily chart.

This technical pattern is typically viewed as a potential reversal signal, indicating that the market could be poised for a recovery.

The hammer tweezer bottom pattern suggests a shift in market sentiment from bearish to bullish, as it represents a possible price reversal after a downtrend.

Analysts believe that this pattern could lead Nifty toward the 23,350 level after the declines seen on January 21, signaling that there may be upside potential in the near term.

However, market participants are advised to exercise caution, as the overall trend will depend on how the index behaves at key levels in the coming days.

Stock Market Overview:

On January 22, Indian equity markets witnessed a notable recovery, albeit amid high volatility. Despite a challenging start, the market closed with gains, marking a reversal from a seven-month low.

The Sensex ended the session 566 points higher (up 0.75%) at 76,404, while the Nifty climbed 130 points (up 0.57%) to close at 23,155.

The rally was primarily driven by strength in the technology sector, particularly after the better-than-expected quarterly results from a major private bank, which lifted investor sentiment.

However, while the broader indices ended in positive territory, there were clear signs of underlying weakness in other segments of the market.

The midcap and small-cap indices significantly underperformed, with both segments seeing declines of more than 1%.

This divergence between large-cap stocks and the broader market indicates a cautionary undertone in the market, with investor appetite for riskier assets such as midcaps and smallcaps remaining subdued due to concerns over valuations.

Market breadth on January 22 was also unfavorable, with 2,677 stocks declining, 1,110 stocks advancing, and 107 stocks unchanged.

This indicates that while a select group of stocks performed well, the broader market sentiment was weak, with more stocks under pressure.

Nevertheless, analysts suggest that as long as the Nifty remains above the psychological 23,000 level, there is potential for further upside in the near term.

Technical Analysis for January 23:

Looking ahead to January 23, technical analysts are cautiously optimistic about the potential for further recovery, but caution that the market’s future direction will depend on key levels of support and resistance.

According to Vatsal Bhuva, Technical Analyst at LKP Securities, the Nifty’s performance on January 22 shows positive signs of a possible recovery.

Nifty found support near its previous session’s low of 22,980, and the formation of the hammer tweezer bottom candlestick pattern indicates that the index could rally towards the 23,350 level.

However, for the uptrend to sustain, Bhuva suggests that Nifty must close above the crucial 23,500 level, which coincides with its 21-day exponential moving average (EMA).

The 21-day EMA is an important technical indicator, often used by traders to assess short-term price momentum.

If Nifty manages to close above this level, it would suggest that the market has gathered enough momentum to continue its upward trajectory.

Until this happens, Bhuva advises traders to remain cautious and monitor how the index behaves around key levels in the coming sessions.

For short-term traders, Bhuva recommends focusing on the 23,000-23,350 range, with 23,000 serving as a strong support level and 23,350-23,400 acting as resistance.

A break above the 23,350-23,400 zone could pave the way for further gains towards 23,500 and beyond.

Conversely, if the Nifty fails to sustain above 23,000, there could be a risk of further downside, particularly if global or domestic factors trigger renewed selling pressure.

Sentiment and Broader Market Factors:

The broader market sentiment on January 22 was influenced by several key developments. The rebound in the IT sector, which had been underperforming in recent sessions, provided a much-needed boost to the overall market.

Strong earnings from a large private sector bank also played a role in lifting investor sentiment, with the banking sector seeing robust buying interest.

However, despite this recovery in select sectors, concerns remained over the broader market’s performance, particularly in the midcap and smallcap spaces.

These segments continue to face challenges due to stretched valuations, leading to ongoing selling pressure.

The realty sector was among the worst-hit on January 22, underperforming the broader market as concerns over rising interest rates and potential policy tightening weigh on the outlook for real estate.

Investors are particularly cautious about this sector, as its performance is closely tied to macroeconomic factors, including inflation, interest rates, and credit availability.

On the global front, there were positive developments that could provide some short-term relief to the markets.

U.S. policymakers were reportedly considering lowering tariffs on Chinese goods, which would help ease trade tensions between the two largest economies in the world.

This news could have a temporary positive impact on global markets, especially in the context of the broader risk sentiment.

However, fundamental concerns persist, and analysts remain cautious, especially considering the recent weakness in the U.S. dollar index, which could have implications for the Indian rupee.

Key Factors to Watch:

- Support and Resistance Levels: Nifty’s immediate support is seen at 23,000, with resistance in the 23,350-23,400 range. A break above 23,500 would signal a stronger continuation of the bullish trend, while failure to hold above 23,000 could lead to further downside.

- Sectoral Performance: The IT sector’s recovery has been a key factor in the market’s rebound. Investors should monitor the performance of other sectors, especially realty and mid/small-caps, which are facing headwinds.

- Global News Impact: Developments regarding U.S.-China trade relations and the strength of the dollar index could influence global risk sentiment and, by extension, domestic markets.

- Banking Sector Strength: The banking sector’s performance, particularly the large private banks, will be crucial in supporting the overall market. Continued strong results from this sector could bolster market confidence.

Final Remarks:

The Indian stock market showed signs of recovery on January 22, but the overall trend remains uncertain.

While Nifty’s formation of a hammer tweezer bottom candlestick suggests a potential reversal, traders and investors should monitor critical support and resistance levels.

For the recovery to gain traction, Nifty must sustain above 23,000 and break through resistance at 23,350-23,500. In the meantime, sector-specific dynamics, global developments, and investor sentiment will play key roles in shaping the market’s direction.

As always, caution is advised, especially in the context of weak breadth and ongoing valuation concerns in certain segments.