Sensex Gain 809 Points, Nifty at 24,708; Tomorrow Nifty Prediction

Tomorrow Nifty Prediction

Market Boom Before RBI Policy: What to Expect on December 6th

The Indian stock market has been experiencing an exciting rally ahead of the Reserve Bank of India’s (RBI) monetary policy announcement on December 6th.

This surge has been driven by strong investor sentiment, with Foreign Institutional Investors (FIIs) contributing significantly to the buying momentum.

However, while the overall market trend appears bullish, given the powerful gains over the past few days, a short-term correction is also a possibility.

As Nifty moves closer to the critical psychological resistance of 25,000, traders and investors are keeping a close eye on the unfolding developments.

Market Performance and Key Movements

Today’s trading session saw a notable upswing, reflecting optimism in the market before the RBI’s policy announcement.

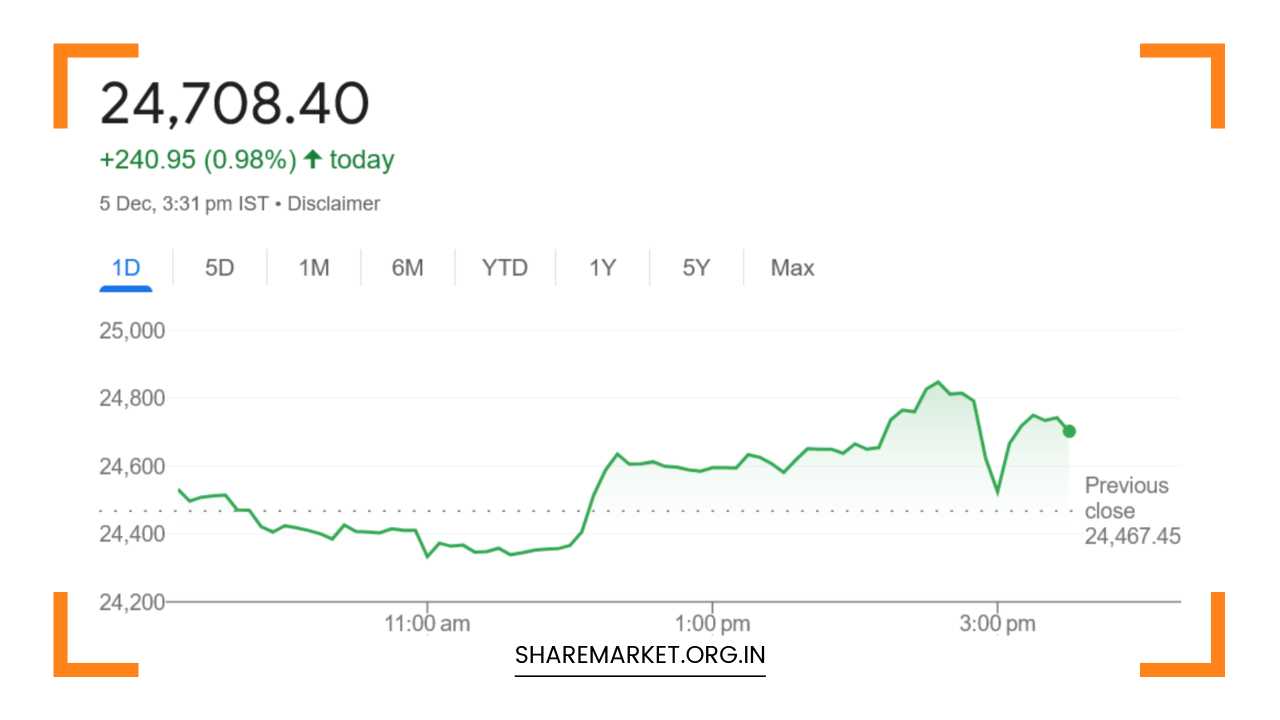

The Nifty closed at 24,708, a level not seen in some time, marking an increase of 240.95 points, or 0.98%.

Similarly, the Sensex surged by 809.53 points, or 1.00%, closing at 81,765.86. This rally was underpinned by the strong performance of major blue-chip stocks. Information technology (IT) stocks, in particular, stood out, with heavyweights like TCS, Infosys, and Bharti Airtel among the top gainers.

Other major contributors included Titan Company and Dr. Reddy’s Laboratories, both of which added to the overall bullish momentum.

On the downside, some stocks faced selling pressure. SBI Life Insurance, Bajaj Auto, HDFC Life, NTPC, and Grasim Industries were among the top laggards on the Nifty index.

These losses, however, were not enough to drag down the broader market, with most sectoral indices closing in the green.

The IT sector, in particular, posted impressive gains, climbing around 2%, which helped fuel the market rally.

Meanwhile, Realty and PSU Bank stocks experienced a decline, with investor sentiment in those sectors remaining subdued.

The BSE Midcap and Smallcap indices, however, ended flat, signaling a lack of significant movement in smaller stocks.

Overall, 2,050 stocks advanced today, while 1,758 stocks declined, and 113 stocks remained unchanged. This breadth of the market indicates that the rally was broad-based, with many sectors participating in the upward move.

Expert Views on the Market Sentiment

VK Vijaykumar, Chief Investment Strategist at Geojit Financial Services, provided his insights into the current market rally.

He emphasized that the market had recovered sharply from its low points today and closed with strong gains, driven in part by expectations of a softer monetary policy from the RBI. FIIs have been returning to the Indian market over the last few days, bolstered by the belief that the RBI may opt for a dovish stance in its upcoming policy decision. This renewed foreign investment has helped lift overall market sentiment.

In addition to the RBI’s anticipated policy stance, Vijaykumar also pointed to the positive impact of November’s Services PMI data, which showed continued strength in the services sector despite rising inflation.

This indicates that business activities remain stable, which further supports a positive market outlook.

Aditya Gaggar, Director at Progressive Shares, highlighted the volatility present in today’s trading session. The market experienced fluctuations of up to 1,000 points in both directions before ultimately closing higher.

Gaggar noted that the IT sector saw the largest gains, driven by strong performances from stocks like TCS and Infosys.

The auto sector followed closely behind, while Realty and PSU Bank stocks were among the top underperformers. Midcap and Smallcap stocks saw limited movement, with most of the action concentrated in large-cap, index-based stocks.

Gaggar also pointed out that, despite the market’s positive close, the overall volatility during the session suggests that investors should remain cautious, as fluctuations could continue in the short term, especially with the RBI policy announcement looming.

Technical Analysis and Market Outlook

The technical picture for the market also supports the optimistic sentiment. A strong candlestick pattern has formed on the daily chart, reflecting investor confidence.

The formation of this pattern above the moving average, with a long upper shadow and a short lower shadow, suggests that there is significant buying interest at higher levels, but volatility remains high. This indicates that while the market is trending upward, short-term corrections are possible.

The Nifty has already surged significantly over the past four days, which raises the likelihood of a brief consolidation or minor pullback.

The key psychological resistance level for Nifty stands at 25,000, a level that traders will be closely monitoring.

If Nifty manages to break through this level, it could pave the way for further gains, but any failure to breach this resistance could result in some selling pressure and a correction.

On the downside, the immediate support level for Nifty has shifted to 24,550. A pullback towards this level could provide a buying opportunity for investors looking to enter at a relatively lower price point.

However, any correction from current levels is expected to be mild, given the strong underlying market sentiment and the likelihood of continued buying support ahead of the RBI policy announcement.

Impact of the RBI Monetary Policy on the Market

The RBI’s monetary policy decision on December 6th will be crucial in determining the next phase of the market’s movement.

If the central bank maintains an accommodative stance and signals that it is ready to support the economy with continued low-interest rates, it is likely to reinforce the positive momentum in the market.

This could lead to further buying, especially in rate-sensitive sectors such as real estate, automobiles, and infrastructure.

On the other hand, if the RBI adopts a more hawkish tone or signals concerns about rising inflation, the market could face some headwinds. In such a scenario, investors may reassess their expectations, leading to increased volatility and a potential pullback.

The market is also closely watching global macroeconomic trends, particularly the interest rate decisions of major central banks like the U.S. Federal Reserve and the European Central Bank.

Any shift in global monetary policy could influence investor sentiment in India, particularly in terms of foreign investment flows.

Final Remarks: What to Expect on December 6th

Looking ahead to December 6th, the market is in a strong position, but the likelihood of short-term volatility remains high.

The rally over the past few days has brought the Nifty closer to the critical resistance level of 25,000, and the upcoming RBI policy decision will play a pivotal role in determining whether the market can break through this level or if a correction is in store.

Investors should be prepared for potential fluctuations, especially considering the high volatility observed in recent sessions.

However, the overall trend remains positive, and any correction is likely to be short-lived, providing opportunities for long-term investors to enter the market at more attractive levels.

As always, it’s important to stay informed, track global and domestic economic indicators, and align investments with your risk tolerance and financial goals.

The next few days will be crucial for setting the tone for the market in the lead-up to the New Year.