Sensex Gain 899 Points, Nifty at 23,190; Tomorrow Nifty Prediction

Tomorrow Nifty Prediction

Market Closes Strongly on March 20: What to Expect on March 21?

The Indian equity markets witnessed strong gains on March 20, 2025, reflecting investor optimism across all sectors.

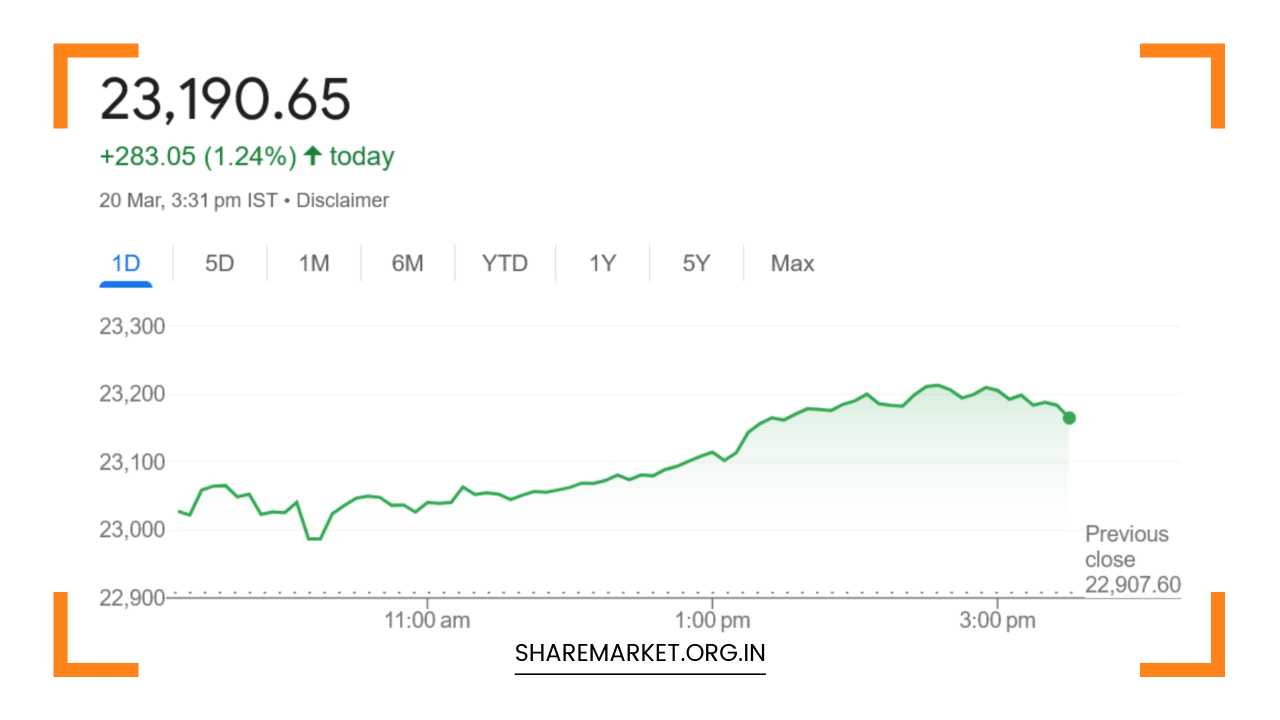

The Nifty, the benchmark index of the National Stock Exchange (NSE), surged past the 23,200 mark and closed at 23,190.65, up by 283.05 points or 1.24%.

Meanwhile, the Sensex, the benchmark index of the Bombay Stock Exchange (BSE), rose by 899.01 points or 1.19%, ending the day at 76,348.06.

The breadth of the market was strongly positive, with a wide majority of stocks ending in the green. A total of 2,296 stocks advanced, while only 1,554 stocks declined, and 124 remained unchanged.

This strong market performance was evident across all sectoral indices, with key sectors such as metals, media, information technology (IT), fast-moving consumer goods (FMCG), automobiles, consumer durables, realty, and telecom all gaining more than 1%.

The mid-cap and small-cap segments also participated in the rally, with both BSE Midcap and Smallcap indices gaining 0.5%.

Key Market Highlights

- Top Performers: The biggest gainers on Nifty were Bharti Airtel, Titan Company, Bajaj Auto, BPCL, and Britannia Industries, which benefited from strong sectoral and stock-specific growth. These stocks have shown resilience in the face of broader market volatility, reflecting positive investor sentiment toward their growth prospects.

- Lagging Stocks: On the flip side, the biggest losers on Nifty included IndusInd Bank, Bajaj Finance, Trent, and Shriram Finance. These stocks faced selling pressure, which pulled down their prices despite the overall market’s strength. The decline in these stocks could be attributed to broader sectoral weaknesses or specific stock-level factors.

Market Analysis and Expert Insights

According to Aditya Gaggar, Director at Progressive Shares, the Nifty started the weekly expiry trade on a strong note and remained bullish throughout the session.

The index experienced a slight dip at the beginning of the trading session, but it quickly regained momentum and surged to end the day with a notable gain of 283.05 points.

All sectors participated in the rally, with the auto and FMCG sectors leading the charge. However, there was a noticeable divergence in performance between large-cap index stocks and mid- and small-cap stocks, with the latter underperforming.

The rally was largely driven by strong buying interest in index-based stocks, particularly in heavyweight sectors such as auto and FMCG, which typically benefit from domestic consumption growth.

However, mid- and small-cap stocks were relatively subdued, possibly due to lower liquidity or profit-taking, which led to their underperformance compared to their large-cap counterparts.

Technical Outlook

From a technical perspective, the Nifty index has shown signs of a potential upward shift. On the daily chart, the Nifty broke out from a falling wedge pattern, a bullish technical formation that typically signals a reversal of a downtrend or the start of an uptrend.

Additionally, the formation of another bullish candle on the daily chart further solidifies the positive shift in market sentiment. This breakout could suggest that the broader market is poised for further gains in the near term.

However, a closer look at the hourly chart reveals that the Nifty is currently in the overbought zone, which indicates that the market may experience some consolidation or a corrective phase in the short term.

Overbought conditions suggest that the pace of the upward movement could slow down, with the potential for a pullback or sideways movement before further upward momentum can be established.

In terms of immediate support and resistance, the Nifty faces resistance at the 23,320 level, while the immediate support is seen at the 23,000 mark.

These levels will be crucial for determining the next move in the market. If the Nifty manages to break through the resistance at 23,320, it could pave the way for further gains.

Conversely, if the index fails to hold above 23,000, a correction may occur, which could test lower support levels.

Broader Market Trends

VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, highlights two significant trends shaping the Indian stock market.

First, the theme of domestic consumption is gaining traction as more investors focus on stocks in the auto, FMCG, and consumer durables sectors, which benefit from increased domestic demand.

With India’s growing middle class and rising disposable incomes, consumer-driven stocks have become increasingly attractive to investors.

Second, there is renewed interest in sectors such as defense and shipping, which had been relatively underperforming in the past few years.

With increasing government focus on defense spending and the expansion of maritime trade, stocks in these sectors are starting to see stronger demand.

Additionally, there has been a surge in interest in consumer-facing digital stocks, as the shift toward e-commerce and digital platforms continues to accelerate.

Vijayakumar notes that these trends are expected to continue in the coming months, driving further market momentum in favor of domestic consumption and certain beaten-down sectors.

However, he also cautions that the broader market may remain in a wait-and-watch mode until April 2, as investors await the implementation of US retaliatory tariffs, which could have significant implications for global trade and investor sentiment.

What to Expect on March 21:

The strong performance of the market on March 20 has set a positive tone for the immediate future.

However, given the overbought conditions on the hourly chart and the upcoming expiry of derivative contracts, the market could face some volatility in the short term.

Traders may see some profit-taking or a consolidation phase as the market digests its recent gains.

While the broader trend remains bullish, especially with the breakout of the falling wedge formation and the continued strength in domestic consumption and certain sectoral themes, traders should remain cautious about potential short-term corrections.

The key levels to watch are 23,320 for resistance and 23,000 for support, which could provide guidance for the next phase of the market’s movement.

Final Remarks

In conclusion, the Indian stock market showed strong momentum on March 20, driven by sectoral gains, particularly in the auto and FMCG sectors, as well as continued buying in index-heavy stocks.

The market has broken out of a falling wedge formation, signaling a potential positive shift in the broader trend.

However, with the Nifty entering the overbought zone, some sideways or corrective movement is possible in the near term.

Investors should keep a close eye on key support and resistance levels as well as broader market trends, especially in sectors like defense, shipping, and digital consumer stocks.

March 21 may bring more volatility, but the long-term outlook remains cautiously optimistic for the Indian equity markets.