Sensex, Nifty Down 1%: Nifty Prediction for Tomorrow

Nifty Prediction for Tomorrow

Sensex, Nifty Under Pressure: Profit Booking and Global Woes Weigh on Markets

Sensex and Nifty, the twin barometers of the Indian equity market, experienced a notable reversal on Friday, July 19, as profit-booking and global uncertainties triggered a significant retreat from their recent record highs.

The euphoria that characterized the market’s upward trajectory in preceding weeks gave way to a sharp correction, reflecting a cautious sentiment among investors.

The BSE Sensex, which had earlier scaled a new peak of 81,587.76, closed the trading session with a substantial decline of 738.81 points, settling at 80,604.65.

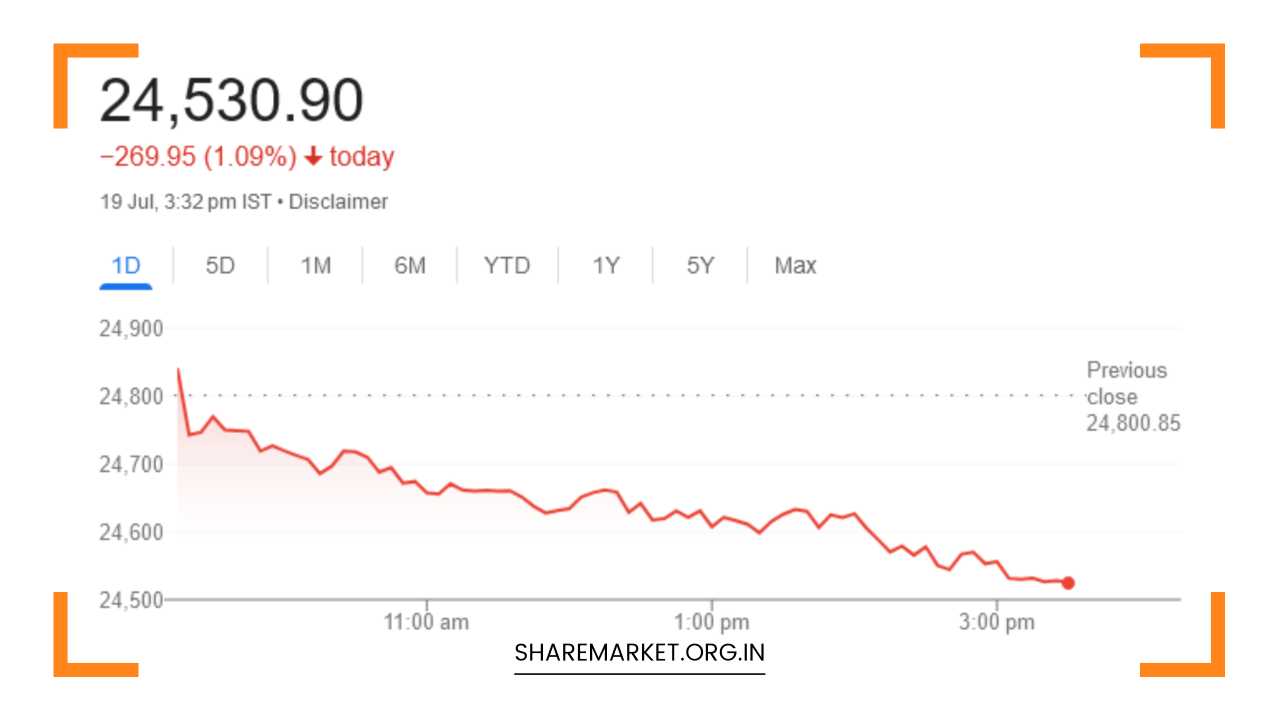

Similarly, the NSE Nifty 50 index, after reaching an all-time high of 24,854.80 during the day, retreated by 269.95 points to conclude at 24,530.90.

This retreat marked a decline of 0.91% and 1.09% for Sensex and Nifty respectively, underscoring the swift turnaround from the peak levels.

Factors Driving the Market Down

1. Profit Booking: The primary catalyst behind the market’s downturn was profit booking by investors who had enjoyed substantial gains during the prolonged rally.

The surge in stock prices had driven many securities to lofty valuations, prompting investors to cash in on their profits.

2. Global Concerns: External factors, particularly geopolitical tensions such as the ongoing US-China trade dispute, loomed large over global markets.

The uncertainty surrounding international trade relations and fears of an economic slowdown weighed heavily on investor sentiment, influencing their decisions in the domestic market.

3. Cybersecurity Incident: Adding to the uncertainty, a widespread cyberattack disrupted operations across various sectors within India.

Industries including banking, airlines, and telecommunications faced disruptions, further unsettling investors and contributing to the cautious mood.

Sectoral Performance

The downturn in the Indian equity market was broad-based, impacting a wide array of sectors. Key sectors such as metals, automobiles, financial services, and energy experienced significant selling pressure, reflecting the overall bearish sentiment.

In contrast, the IT sector managed to outperform amidst the broader sell-off, buoyed by strong quarterly earnings from major players like Infosys.

Market Breadth

Market breadth during the session was notably negative, with declining stocks outnumbering advancing ones by a substantial margin.

This disparity was particularly evident in mid-cap and small-cap indices, which underperformed their larger counterparts.

The shift in investor preference towards larger, more established companies underscored a flight to safety amidst market volatility.

Impact on Investor Wealth

The sharp decline in stock prices resulted in a considerable erosion of investor wealth. Preliminary estimates indicated substantial losses amounting to billions of rupees within a single trading session, highlighting the financial toll of the market correction.

Expert Views

Market analysts attributed the market’s downturn to a combination of factors, including overvaluation following the prolonged rally, profit-booking activities, and global uncertainties.

They advised investors against panic selling, advocating instead for a long-term investment perspective and a diversified portfolio strategy.

Shrikant Chouhan, Head of Equity Research at Kotak Securities, emphasized the importance of maintaining a balanced investment portfolio across different asset classes to mitigate risks in volatile market conditions.

Road Ahead

Looking forward, market analysts anticipated continued volatility in the near term. Factors such as the upcoming Union Budget and developments in the global economic landscape were expected to influence investor sentiment and market direction.

Many analysts suggested that the market could consolidate at current levels before potentially resuming its upward trajectory, contingent upon favorable economic indicators and corporate earnings.

Investor Advice

Investors were advised to exercise caution and refrain from making hasty investment decisions amidst market fluctuations.

A disciplined approach and a long-term investment horizon were deemed essential for navigating the current market uncertainties.

The importance of seeking personalized financial advice tailored to individual risk profiles and investment goals was reiterated to ensure informed decision-making.

Disclaimer

It’s important to note that the information provided is for general knowledge and informational purposes only. It does not constitute financial advice, and individuals are encouraged to conduct their own research or consult financial professionals before making any investment decisions.

In conclusion, the retreat of Sensex and Nifty from record highs on July 19 underscored the vulnerability of equity markets to profit-taking and global uncertainties.

While the correction marked a departure from recent bullish trends, it also presented opportunities for prudent investors to reassess their portfolios and adopt strategies aligned with long-term financial objectives amidst evolving market conditions.