Sensex, Nifty End at a New High; Nifty Prediction for Tomorrow

Nifty Prediction for Tomorrow

Indian Stock Market Soars: Sensex and Nifty Hit Record Highs, But What’s Next?

A Bullish Run with Underlying Questions

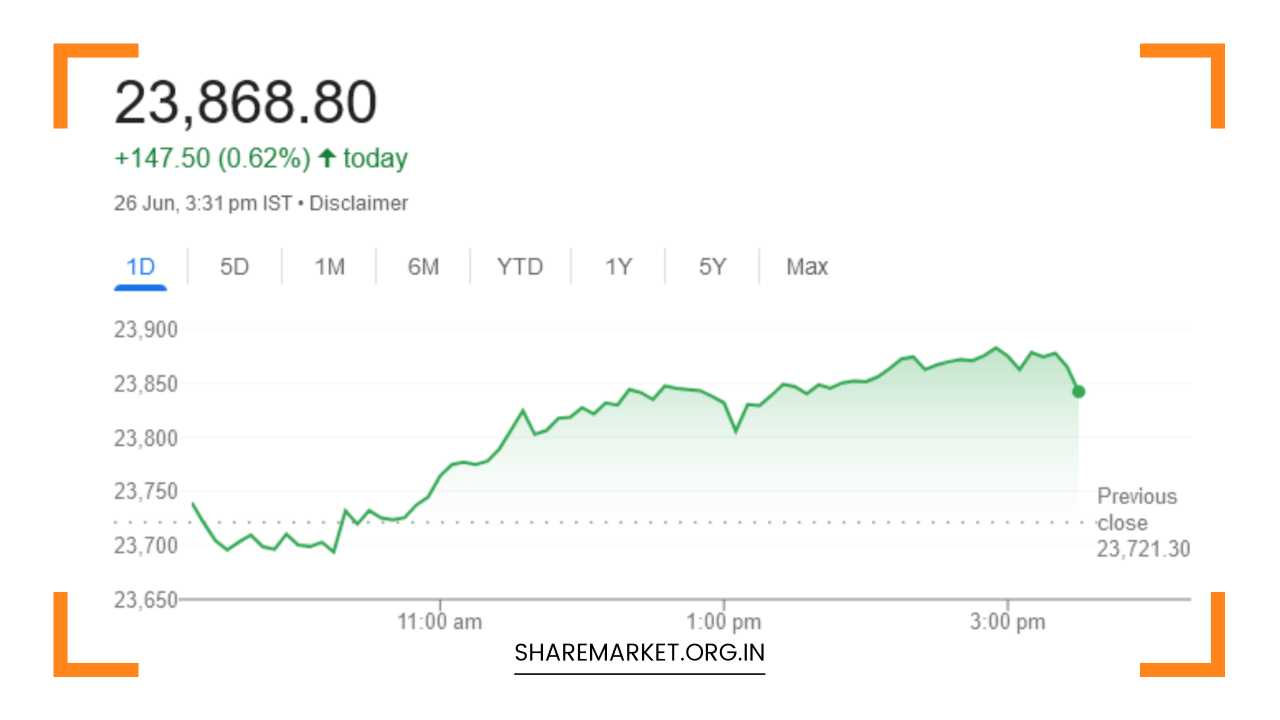

The Indian stock market witnessed a momentous occasion on June 26th, 2024. Both the benchmark indices, the Sensex and Nifty, scaled new heights, marking a historic day for investors.

This bullish surge was primarily driven by heavyweight giants like Reliance Industries and banking stocks. The Sensex climbed a significant 620.73 points (0.80%) to settle comfortably at 78,674.25, while the Nifty showcased similar positive momentum, gaining 147.50 points (0.62%) to close at 23,868.80.

Dissecting the Market Movers: Leaders and Laggards

The positive sentiment permeated across various sectors, with banks, oil & gas, telecom, media, and FMCG leading the charge, witnessing gains ranging from a healthy 0.3% to a robust 2%.

However, a closer look reveals a more nuanced picture. Sectors like auto, metal, and realty couldn’t quite keep pace with the overall rally, experiencing declines of 0.7-1.5%.

Within the Nifty 50, specific companies emerged as the clear winners. Investor enthusiasm was evident in the strong performance of Reliance Industries, UltraTech Cement, Bharti Airtel, ICICI Bank, and Grasim Industries, which emerged as the top gainers.

However, the flip side of the coin showed Apollo Hospitals, Bajaj Auto, Mahindra & Mahindra, Tata Steel, and Hindalco Industries facing the brunt of profit-booking or company-specific concerns, leading to their positions as the biggest losers of the day.

Market Breadth: A Mixed Bag with Underlying Cautiousness

While the large-cap space dominated the positive sentiment, the broader market displayed a mixed performance.

Although there was a net increase, with around 1634 stocks advancing compared to 1763 declining ones, it’s important to note the presence of 85 stocks that remained unchanged.

This highlights a cautious approach from a segment of investors, possibly due to concerns about the rally’s sustainability and potential profit-booking opportunities.

Further bolstering this cautiousness is the performance of the mid-cap and small-cap indices. The BSE Midcap index dipped by 0.30%, showcasing a slight decline.

The Smallcap index, on the other hand, remained flat. This suggests that investor focus remained largely on established blue-chip companies, with less participation in the broader market.

Expert Insights: Navigating Potential Profit Booking and Support Levels

Market analysts have offered valuable insights to help navigate the potential future trajectory of the market. Aditya Gaggar, Director of Progressive Shares, sheds light on the possibility of profit booking.

He believes the ongoing rally might be vulnerable to this phenomenon, considering it’s primarily driven by select heavyweight stocks. The limited participation in mid and small caps further strengthens his argument for a cautious approach.

However, Kunal Shah of LKP Securities maintains an optimistic outlook for the Bank Nifty index, which continues its upward trend.

He identifies a crucial support level for Bank Nifty at 52,500-52,400 and interprets the recent “put writing” activity as a sign of strong underlying support in the index.

Looking Ahead: Charting the Course for June 27th and Beyond

Predicting the market’s direction with absolute certainty is a challenging feat. However, by analyzing key factors, we can gain valuable insights that might influence the market’s movement on June 27th and beyond:

- Global Cues: International markets, particularly the performance of Wall Street and major Asian indices, will be closely monitored. Positive cues from these markets could act as a catalyst, further propelling the Indian market. Conversely, negative developments on the global front might trigger profit-booking from investors.

- Foreign Institutional Investor (FII) Activity: The movement of FIIs plays a significant role in shaping the Indian market. If FIIs continue to be net buyers, it can fuel the rally further. However, any significant selling pressure from FIIs could lead to a correction. Closely monitoring FII activity is crucial for understanding potential market movements.

- Macroeconomic Data Releases: Upcoming economic data releases, such as inflation figures or industrial production numbers, can significantly influence investor sentiment. Positive data could bolster confidence and propel the market further. Conversely, negative data might dampen the mood and lead to a cautious approach from investors.

- Corporate Earnings Season: The upcoming earnings season for Indian companies is a critical factor to consider. Strong corporate earnings reports, showcasing healthy profits and growth potential, could bolster investor confidence and propel the market further. Disappointing earnings reports, on the other hand, could lead to stock price corrections for those companies.

- Profit Booking: As highlighted earlier, the possibility of profit booking after the recent rally cannot be ignored. Investors who entered the market at lower levels might be tempted to secure their gains, particularly if there are no strong positive triggers on the horizon. This profit-booking activity could lead to a temporary pullback in the market.

Navigating the Uncertainty: Strategies for Investors

Given the current market scenario, investors are advised to adopt a prudent approach:

- Thorough Research: Conducting thorough research on individual companies and the overall market environment remains paramount. This involves analyzing financial statements, understanding industry trends, and keeping up-to-date with relevant news and data.

- Diversification: Diversifying one’s portfolio across different asset classes and sectors is crucial. This helps mitigate risk by reducing exposure to any single stock or sector. Consider including bonds, gold, or real estate in your portfolio alongside equities.

- Long-Term Perspective: Investing should be viewed as a long-term endeavor. While short-term fluctuations are inevitable, focusing on a long-term investment strategy can help weather market volatility and achieve your financial goals.

- Risk Tolerance: Understanding your risk tolerance is essential. Aggressive investors might be comfortable with a higher allocation to equities, while conservative investors may prefer a more balanced approach with a larger allocation to fixed-income assets.

- Discipline and Patience: The market is susceptible to emotional swings. Maintaining discipline and avoiding knee-jerk reactions based on short-term fluctuations is crucial. Patience is also key; successful investing often involves a long-term commitment to your investment strategy.

Beyond the Numbers: A Look at Geopolitical and Social Factors

While economic data and corporate earnings play a significant role, it’s important to acknowledge the influence of external factors.

Geopolitical tensions, upcoming elections, and social unrest can all impact investor sentiment and market movements.

Staying informed about these developments and understanding their potential implications is crucial for making informed investment decisions.

Final Remarks: A Cautious Optimism for the Indian Stock Market

The Indian stock market’s recent performance has been undeniably impressive. However, a cautious approach is warranted given the mixed signals and potential for profit booking.

By closely monitoring global cues, FII activity, macroeconomic data releases, and the upcoming earnings season, investors can gain valuable insights into the market’s future trajectory.

Implementing a well-defined investment strategy that emphasizes thorough research, diversification, a long-term perspective, risk management, and discipline will equip investors to navigate the current market environment effectively.

While some uncertainty remains, the Indian stock market holds the potential for continued growth, offering attractive opportunities for investors who approach the market with prudence and a well-defined investment plan.