Sensex Surpassed the 83,000-point Mark for the First Time; Tomorrow Nifty Prediction

Tomorrow Nifty Prediction

Why Did the Stock Market Surge? Key Factors Behind the Rally and What to Expect on September 13

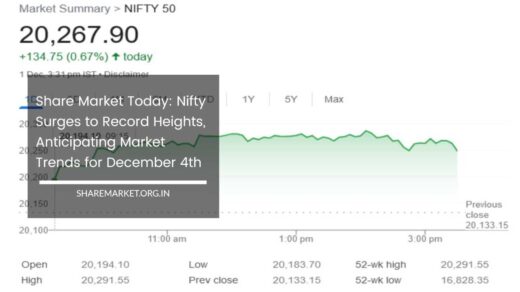

On September 12, the stock market witnessed a remarkable surge during the final trading hour. The Nifty index, which had been trading around 24,941 at 11 a.m., jumped nearly 2 percent by the close of trading, reaching a new record high.

Similarly, the Sensex surpassed the 83,000-point mark for the first time, setting an unprecedented record.

Significant gains were observed across sectors, with notable increases in banking, auto, energy, and IT stocks. This rally has left many investors and market analysts pondering the driving forces behind this surge and what might lie ahead.

Here’s an in-depth look at the three key factors contributing to the stock market’s dramatic rise:

- Decrease in U.S. Inflation: The most significant factor behind today’s market surge was the unexpected drop in inflation in the United States. According to the latest data, the inflation rate for August stood at 2.5 percent, the lowest it has been in three years. This decline in inflation is crucial because it raises the possibility of a more accommodative monetary policy by the U.S. Federal Reserve. Lower inflation reduces the likelihood of aggressive interest rate hikes, which can be a positive signal for markets.

Analysts and investors are now speculating that the Federal Reserve may consider reducing interest rates in their upcoming meeting next week. According to the CME-FedWatch Tool, the probability of a 0.25 percent cut in interest rates has risen significantly. Just a week ago, analysts were anticipating a 60 percent chance of a rate cut, but that figure has now dropped to around 8 percent. This shift in expectations reflects a broader sentiment that the Fed might take a more dovish stance, which is generally seen as supportive of economic growth and, by extension, the stock market.

- Anticipation of Increased Foreign Investment: Another key factor driving today’s market rally is the anticipation that reduced interest rates in the U.S. could lead to an influx of foreign capital into emerging markets like India. When interest rates in developed markets like the U.S. are lower, investors often seek higher returns in emerging markets, which can offer better growth prospects and potentially higher yields.

The prospect of increased foreign investment has generated significant enthusiasm among market participants. The return of foreign investors can drive up stock prices and contribute to a sustained bullish trend in the market. This expectation was clearly evident in today’s trading activity, as investors eagerly bought into Indian stocks in anticipation of a new phase of market growth driven by foreign capital inflows.

- Decline in Crude Oil Prices: A third factor supporting today’s market rally is the continued decline in crude oil prices. Brent crude oil fell below $73 per barrel, marking its lowest level in nine months. The decrease in oil prices has a multi-faceted impact on economies like India’s.

Lower oil prices help to reduce inflationary pressures by decreasing the cost of fuel and energy. This, in turn, can lead to lower overall inflation and improved economic stability. Additionally, reduced oil prices can significantly boost the profitability of government oil companies such as Indian Oil Corporation (IOCL) and Bharat Petroleum Corporation Limited (BPCL). According to foreign brokerage firm Investec, these companies could see record profits as a result of the lower crude oil costs, which is likely to support their stock prices and, by extension, the broader market.

What to Expect on September 13

As we look forward to September 13, the market’s trajectory will likely be influenced by several factors. The bullish sentiment observed today is expected to carry over into the next trading session, but it will be crucial to monitor new economic data and developments. Here’s what investors should keep an eye on:

- Upcoming Economic Data: The next phase of the market rally will be influenced by India’s upcoming economic data, including inflation figures and the Index of Industrial Production (IIP). These indicators will provide insights into the health of the Indian economy and could influence market sentiment. Investors will be particularly attentive to any signs of inflationary pressures or changes in industrial output, as these factors could impact future market performance.

- Corporate Earnings: The core earnings reports for the September quarter will also play a significant role in shaping market expectations. Strong corporate earnings can reinforce positive market sentiment and drive further gains. Conversely, weaker-than-expected results could temper the recent enthusiasm and lead to increased volatility.

- Global Market Sentiment: Global market trends and geopolitical developments will continue to impact investor sentiment. Positive global cues and stability in international markets can bolster domestic market performance, while adverse global events could introduce uncertainty and volatility.

Vinod Nair, Research Head at Geojit Financial Services, noted that the late surge in the market was driven by robust buying interest and favorable global sentiment.

The expectations of a potential interest rate cut by the Federal Reserve have heightened optimism among investors. Nair also highlighted that the upcoming economic data will be critical in determining the market’s next moves.

Ajit Mishra of Ligare Broking observed that today’s strong performance, despite earlier sluggishness, suggests that the Nifty index might test levels above 25,550.

He noted that there is strong support expected in the range of 24,900 to 25,150. Mishra advised investors to focus on sectors or themes that are trending and to prioritize large-cap and prominent mid-cap stocks for new investments.

Final Remarks

Today’s stock market rally was driven by a combination of factors, including lower U.S. inflation, expectations of increased foreign investment, and declining crude oil prices.

These elements contributed to a surge in stock prices and set new records for key indices. As we move into September 13, the market’s performance will be influenced by forthcoming economic data, corporate earnings, and global market trends.

Investors should remain vigilant and consider these factors when making investment decisions.