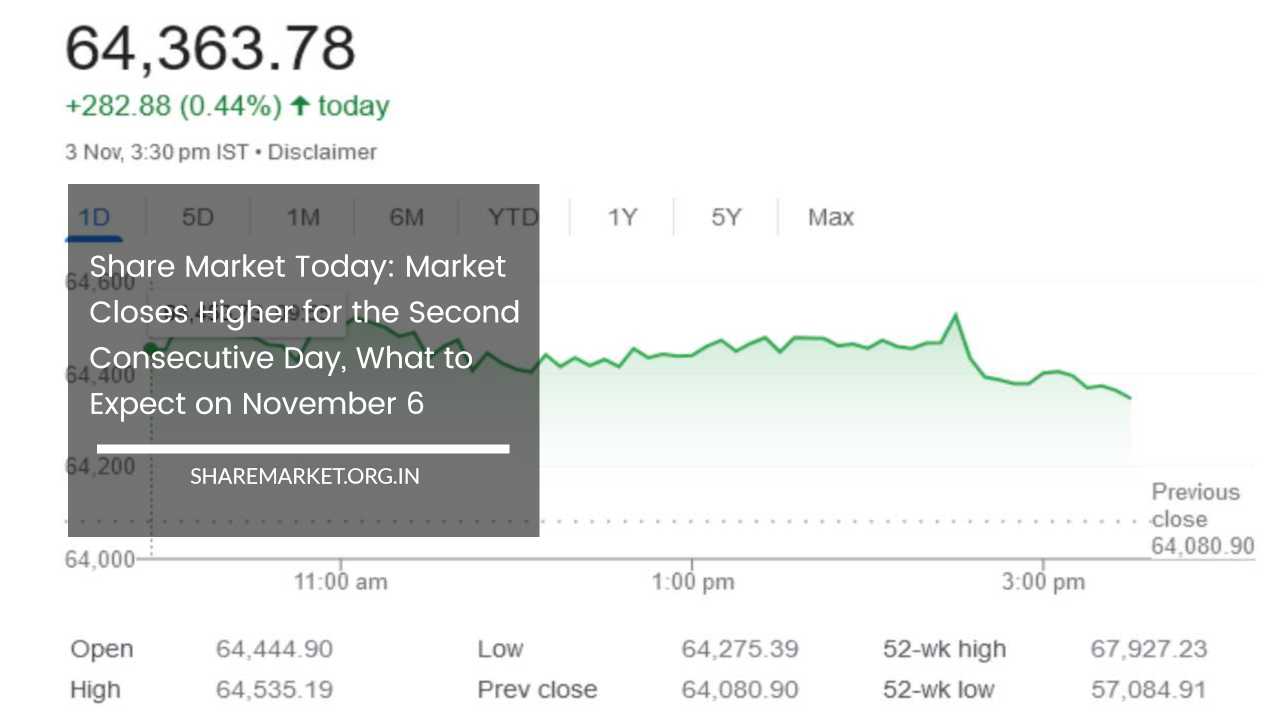

Share Market Today: Market Closes Higher for the Second Consecutive Day, What to Expect on November 6

Share Market Today

In the dynamic world of stock markets, Nifty, India’s benchmark equity index, recently encountered resistance levels in the range of 19250-19300.

Notably, during this period, market analysts observed a substantial amount of put writing at the 19200 level, signaling a potential strong support level for the Nifty.

On November 3, the stock market continued its upward momentum, marking the second consecutive day of gains. Nifty managed to close the trading session above the critical 19200 level, settling at 19230.60.

This gain of 97.30 points represented an increase of 0.51 percent. Simultaneously, the Sensex, India’s prominent stock market index, concluded at 64363.78, registering an impressive gain of 282.88 points, equivalent to 0.44 percent.

In this volatile trading environment, investors closely monitor the performance of individual stocks and the broader market indices.

On November 3, a total of 2215 stocks closed with gains, while 1351 experienced losses. Interestingly, 124 stocks remained unchanged, emphasizing the constant churn of activity in the stock market. It is crucial to analyze the day’s top performers and underperformers to gain insights into the market’s overall health.

Among the top gainers on the Nifty were Apollo Hospitals, Adani Ports, Eicher Motors, LTI Mindtree, and Titan Company.

These stocks exhibited robust price appreciation, contributing significantly to Nifty’s positive performance. On the flip side, the top losers of the day included Bajaj Finserv, Dr. Reddy’s Laboratories, SBI Life Insurance, IndusInd Bank, and Tata Steel. Investors often scrutinize the reasons behind these significant price movements to inform their investment decisions.

One interesting facet of the trading day was the fact that all sectoral indices closed in the green. Notably, the Oil & Gas and Realty Index stood out with gains ranging from 1 to 2 percent, indicating strength in these sectors.

This broad-based rally across various industries is an important market trend, as it highlights the widespread optimism and positive sentiment among investors.

Beyond the large-cap stocks that dominate the headlines, small and mid-cap stocks also played a crucial role in shaping the day’s market performance.

The BSE Midcap Index managed to close 0.7 percent higher, while the Smallcap Index recorded an even more impressive gain of 1 percent.

This underscores the notion that the overall market health isn’t solely reliant on the performance of the largest companies but is also influenced by the success of smaller, often more nimble, firms.

Market experts and analysts provide valuable insights into market trends and investor sentiment. Ajit Mishra, a prominent figure at Religare Broking, observed a persistent bullish trend in the market. He noted that the market achieved a gain of approximately 0.50 percent, demonstrating resilience and optimism.

Nifty opened the day with gains and maintained a narrow trading range for a significant part of the session.

Ultimately, it concluded the day at 19,226.05, emphasizing the broad-based nature of the rally. Every sector contributed to Nifty’s ascent, with realty, oil and gas, and banking sectors exhibiting particularly strong growth.

Despite the recent two-day streak of gains, Nifty now finds itself on the cusp of a potential resistance zone. Immediate resistance is seen at the 100-day Exponential Moving Average (EMA), situated at 19,276. This is a key level to watch, as a decisive breakout above 19,400 would indicate a sustained bullish trend.

However, it’s important for investors to exercise caution, especially if Nifty fails to breach the 19,400 level, as it might signal a return of weakness in the market.

In such circumstances, astute investors often opt for a cautious approach and focus on selected quality stocks, which can offer resilience during volatile times.

Kunal Shah of LKP Securities also shared his perspective on the market’s performance. According to him, Nifty encountered resistance levels in the range of 19250-19300 after opening the day with gains.

This technical observation is crucial, as it provides insight into potential roadblocks for the index’s upward trajectory. Of note, the presence of substantial put writing at the 19200 level implies that this level may act as a robust support for Nifty.

This support level is an essential consideration for traders and investors, as it can provide a reference point for risk management.

Additionally, Kunal Shah highlighted the highest open interest in the call option with a strike price of 19300. This is a significant data point, as it indicates the level at which many options contracts are currently outstanding.

Options traders often pay close attention to such levels, as they can influence market dynamics. To maintain a bullish outlook on Nifty, Kunal Shah suggested that it needs to successfully close above its 100-day moving average, which is currently located at 19,300.

This moving average is a crucial technical indicator that provides a reference point for trend analysis.

The Bank Nifty index, which tracks the performance of the banking sector, also exhibited interesting dynamics. It had a strong start but faced consolidation at higher levels, struggling to surpass the immediate resistance at 43,500.

Remarkably, a significant amount of call writing was observed at this level, indicating that market participants were actively hedging or betting against a substantial rally beyond this point.

For the Bank Nifty, a downside support level is visible at 42,800. If this support level is breached, it may lead to increased selling pressure, potentially influencing the broader market sentiment.

In summary, the stock market’s recent performance highlights the complexity and dynamism of financial markets. While the Nifty and Sensex experienced consecutive days of gains, they are now facing resistance levels that could influence future price movements.

The presence of strong support at the 19200 level and the 100-day moving average at 19,300 are important technical levels to watch.

Additionally, the behavior of individual stocks and sectoral indices, such as realty, oil and gas, and banking, offers valuable insights into market sentiment and trends.

Investors and traders must remain vigilant and adaptable in navigating the ever-changing landscape of the stock market.

The interplay of technical indicators, option open interest, and sectoral performance can provide critical information for making informed investment decisions. As the market continues to evolve, staying informed and responsive to market dynamics is essential for successful trading and investing.