Share Market Today: Market Grows 2nd Day – October 12 Outlook

Share Market Today

Stock Market Outlook: Consolidation in Bank Nifty and Broad Market Trends

The stock market has been a center of attention recently, with various factors influencing its performance.

We’ll delve deeper into the recent trends and expert opinions to help you gain a better understanding of what’s happening in the financial world.

Bank Nifty’s Consolidation and Bullish Trend

Bank Nifty, a sub-index of Nifty that comprises banking stocks, experienced a phase of consolidation on the expiry day.

This consolidation period is crucial in the stock market as it often provides insights into the market’s future direction.

During this consolidation, Bank Nifty found support at the 44,400 level and encountered resistance at 44,700.

What’s particularly noteworthy is that the overall trend of Bank Nifty remains bullish. This means that, despite the short-term consolidation, the broader sentiment in the banking sector appears positive.

Investors and traders have their eyes on the prize, anticipating potential growth in the sector.

Experts like Kunal Shah of LKP Securities have suggested that buying on dips could be an effective strategy in this environment.

If Bank Nifty manages to break the resistance level at 44,700, it could potentially move towards 45,000.

This outlook emphasizes the importance of staying attuned to key support and resistance levels, as they can be pivotal in shaping trading strategies.

Market-Wide Trends

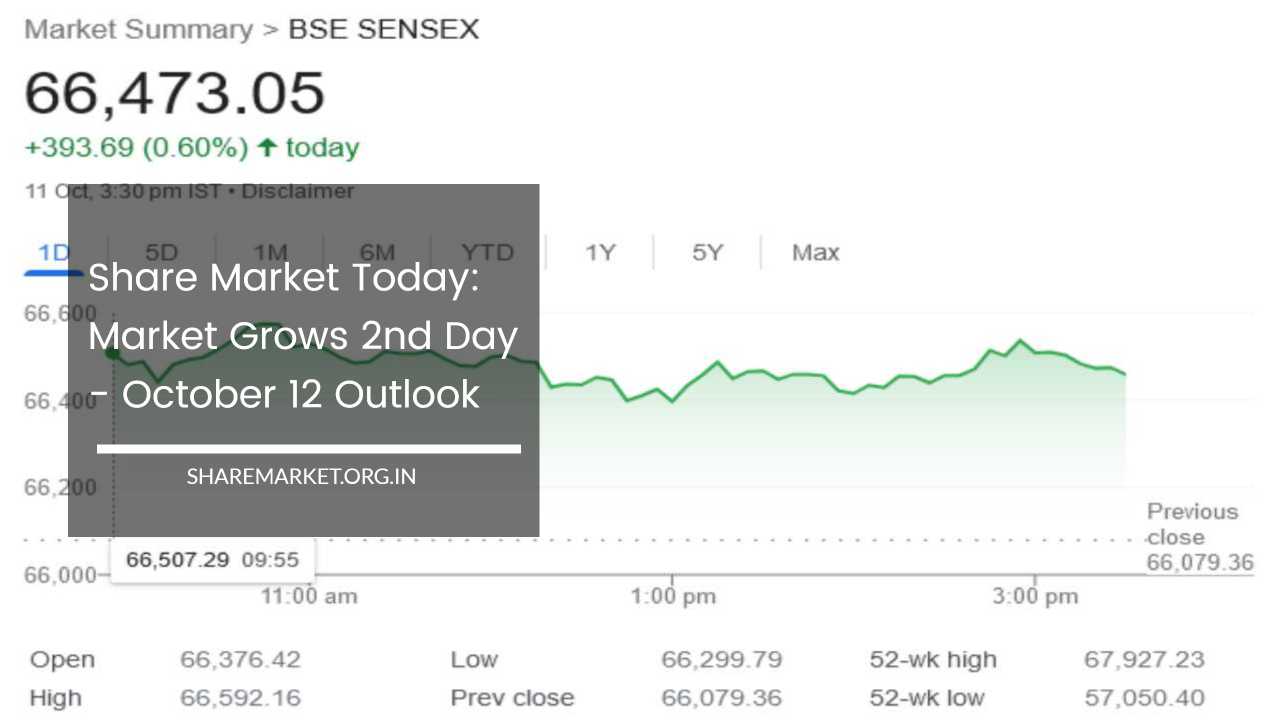

While Bank Nifty was consolidating, the broader market displayed significant movements. On October 11, the market recorded a second consecutive day of growth, bringing optimism to investors.

Nifty, a benchmark index for the National Stock Exchange (NSE), managed to close above the 19,800 mark, primarily due to buying activity across various sectors, excluding PSU banks.

The closing numbers for the day were as follows: Sensex closed at 66,473.05, marking a gain of 393.69 points or 0.60%, while Nifty closed at 19,811.30, with an increase of 121.50 points or 0.62%.

Such movements have a far-reaching impact on investor sentiment and market dynamics.

During the day, the market witnessed 2,275 shares rising and 1,283 shares falling. An additional 132 shares remained unchanged.

This data offers valuable insights into the overall sentiment within the market, as a higher number of rising shares often indicates optimism among investors.

The top Nifty gainers for the day included companies like Hero MotoCorp, Wipro, Grasim Industries, UltraTech Cement, and Dr. Reddy’s Laboratories. Conversely, the top Nifty losers comprised HCL Technologies, Adani Ports, SBI, Coal India, and TCS.

These names are integral to the market’s performance and can serve as a barometer for broader market trends.

One interesting aspect of the market’s recent movements is that, aside from the PSU banks, all other sectoral indices closed with gains.

This suggests that the optimism was widespread across various sectors. The auto, FMCG, metal, pharma, power, oil & gas, and realty sectors experienced gains ranging from 0.5% to 1%. Such a diverse array of sectors experiencing growth is a positive sign for market health.

Additionally, the growth wasn’t limited to large-cap stocks. Small and medium-cap stocks also experienced upward movements.

The BSE Midcap Index closed 0.5% higher, and the Smallcap Index registered a 0.7% increase. This underscores the inclusivity of the market’s recent rally, where both larger and smaller companies participated in the growth.

Expert Opinions and Market Drivers

What are the factors that drove this market performance? Expert opinions shed light on the various dynamics at play.

Vinod Nair, from Geojit Financial Services, observed that the market demonstrated considerable strength. Investors appear to believe that the ongoing conflict in the Middle East will remain localized, without significantly impacting crude oil prices.

This is a significant consideration in the financial world, as oil prices can have far-reaching implications for various industries and economies.

Furthermore, the decrease in US 10-year bond yields was noted. This reduction is attributed to dovish signals from the US Federal Reserve, which can influence the flow of global capital and investments.

Lower yields may lead to more attractive opportunities in equity markets.

Another factor contributing to the positive market sentiment is the anticipation of a decline in India’s retail inflation for September.

This expected decline is linked to reduced inflation in food and fuel, which can ease economic pressures and contribute to a more favorable investment environment.

As we enter the second quarter results season, all eyes are on the IT sector’s performance. While results in the IT sector are expected to be soft, optimism abounds regarding the performance of broader corporates.

Corporate earnings reports often play a pivotal role in shaping market sentiment and direction, making them crucial data points for investors.

Jatin Gedia, an expert from Sharekhan, noted that Nifty started the day with gains and maintained a consolidative stance for most of the day. The fact that Nifty closed with gains for the second consecutive day is a significant development.

Gedia highlighted a positive crossover in the Daily Momentum Indicator, a technical analysis tool. This indicator is widely followed by traders and investors to gauge the momentum in the market.

A positive crossover often signifies an upcoming bullish trend, suggesting that the market may see further upward movement.

In light of these developments, Gedia recommends adopting a buying strategy in case of any market decline. Such a strategy is aligned with the belief that the recent intraday consolidation is a sign of forthcoming bullishness.

As per Gedia’s analysis, Nifty may reach levels as high as 19,883 in the upcoming trading sessions. For those keeping an eye on potential downturns, support for Nifty is visible in the zone of 19,718 to 19,757.

Bank Nifty, too, witnessed a day of gains and consolidation, according to Gedia. The important daily moving average levels at 44,655 to 44,840 acted as resistance for the index.

However, it’s expected that the index could soon reach levels between 45,050 and 45,350. This forecast, in conjunction with the broader bullish trend, suggests potential opportunities for investors and traders in the banking sector.

As market participants look to make informed decisions, Kunal Shah of LKP Securities provides valuable insights.

He notes that the consolidation seen in Bank Nifty on the day of expiry was accompanied by specific price levels to watch. Bank Nifty experienced support at 44,400 and resistance at 44,700.

Crucially, Shah reiterates the overall bullish trend in Bank Nifty. Given this perspective, Shah advocates a buying strategy, particularly during market dips.

The potential for Bank Nifty to reach 45,000 upon crossing the 44,700 level underscores the optimism surrounding the banking sector.

Final Remarks

The recent market trends, with a focus on Bank Nifty’s consolidation and broader market movements, offer investors and traders valuable insights into potential opportunities and challenges.

While consolidation can serve as a short-term market phenomenon, the overarching bullish trend indicates optimism among market participants.

Factors such as the Middle East conflict, US bond yields, and retail inflation in India play a crucial role in shaping market sentiment.

Experts’ opinions underscore the importance of staying informed about key support and resistance levels, closely monitoring indicators like the Daily Momentum Indicator, and devising strategic plans, such as buying on dips.

With the second quarter results season on the horizon, corporate earnings reports are anticipated to influence market dynamics significantly.

As you navigate the intricate world of stock markets, it’s essential to remain vigilant, adaptable, and well-informed about the evolving financial landscape.

Keep in mind that market conditions are dynamic and can change rapidly, so staying updated and seeking guidance from financial experts are essential practices for prudent investing.