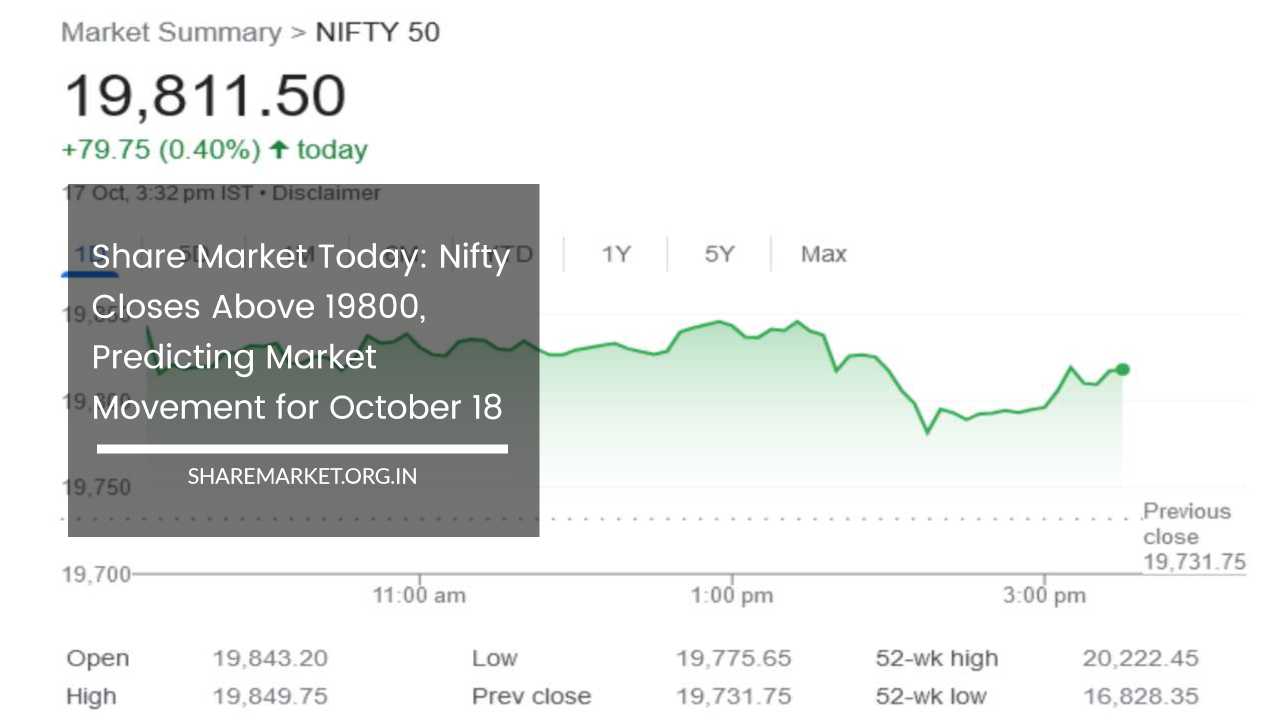

Share Market Today: Nifty Closes Above 19800, Predicting Market Movement for October 18

Share Market Today

The Indian stock market exhibited a positive trajectory during the trading session, bolstered by a confluence of factors that drove investor sentiment.

Market participants were heartened by encouraging global cues and robust financial results from the banking sector, which collectively contributed to an overall buoyant mood.

The performance of key indices, Sensex and Nifty, was indicative of the market’s exuberance.

Index Performance

The Sensex, often regarded as the barometer of the Indian stock market, closed the trading session with notable gains, marking an increase of 261 points.

This brought the Sensex to a closing level of 66428.09, signifying a gain of 0.39 percent. The Nifty, another pivotal index, mirrored the positive sentiment, concluding the day’s trading beyond the crucial 19800 mark.

Specifically, the Nifty stood at 19811.50 at the closing bell, representing a gain of 79.70 points or 0.40 percent.

Small and Medium-Sized Stocks

A distinguishing feature of the day’s trading was the widespread buying enthusiasm that extended to small and medium-sized stocks.

This was evident in the performance of the BSE Midcap Index, which advanced by 0.4 percent, and the Smallcap Index, which witnessed a more substantial upswing of 0.7 percent.

This uptrend across different segments of the market demonstrated broad-based optimism among investors.

Stock Gainers and Losers

Several individual stocks made significant gains during the trading session. On the Nifty index, the top gainers included BPCL, Power Grid Corporation, SBI Life Insurance, HDFC Life, and Coal India.

These companies saw their stock prices rise, reflecting their positive performance and investor confidence.

Conversely, some stocks on the Nifty index faced declines. Tata Motors, L&T, UPL, IndusInd Bank, and TCS were among the top losers, which might have been influenced by company-specific factors or broader market dynamics.

Sectoral Indices

Notably, all sectoral indices exhibited positive momentum, further contributing to the overall market enthusiasm.

The power index was a standout performer, registering a substantial gain of 1 percent. This was indicative of the strength in the energy sector. Additionally, the FMCG (Fast-Moving Consumer Goods), PSU Bank (Public Sector Undertaking Bank), Metal, and Oil and Gas sectors also fared well, recording gains of 0.5 percent.

Outlook for October 18

Market experts provided insights into what investors can potentially anticipate for the market’s movement on the following trading day, October 18. Their analyses shed light on potential price levels and key support and resistance levels.

Jatin Gedia, Sharekhan: On the daily chart, Nifty exhibited a positive sign by breaking the upward inside bar pattern, indicating a bullish trend.

Furthermore, there was a positive crossover in the daily and hourly momentum indicators, suggesting that investors should consider buying on market dips.

The Nifty was seen as primed to move upward, with potential targets at 19883 and 20030. On the downside, strong support levels were identified at 19770 to 19750.

Bank Nifty: Bank Nifty opened the trading session with gains but faced intraday corrections. However, buying interest emerged in the zone of 44350 to 44300, with the Hourly Moving Average acting as a crucial support level.

In the short term, a potential pullback was anticipated in Bank Nifty toward the 45000 level. In case of a decline, significant support was foreseen at 44100 to 44000.

Aditya Gaggar, Progressive Shares: Aditya Gaggar opined that the Indian markets initiated trading with a positive bias, primarily driven by favorable global signals.

After the initial uptick, the Nifty moved within a relatively narrow range of 19800 to 19840 before settling at 19811.50, registering a gain of 79.75 points.

Notably, all sectoral indices closed in the green. The Energy and PSU Bank sectors outperformed, while the broader market exhibited mixed trends.

On the daily chart, Nifty was on the brink of breaking out from a continuation pattern known as the Cup and Handle formation, with the 19850 level representing a significant breakout point. Should Nifty surpass this level, it could potentially move toward the target of 20350.

Rupak Dey, LKP Securities: Rupak Dey emphasized that the market commenced the day with strong global trends and concluded with gains, reaffirming the short-term bullish trend.

Crucially, the index remained above all of its key moving averages on the daily time frame. As long as Nifty remained above the 19550 level, Dey recommended employing a “buy on dips” strategy.

This strategy implied that investors should consider purchasing stocks when prices dip during market fluctuations.

Looking forward, Nifty was predicted to potentially reach the levels of 20000 to 20200, provided it maintained its position above the 19550 support level.

Closing Thoughts

In summary, the Indian stock market witnessed an overall positive trend driven by global cues and robust performances in the banking sector.

Key indices, including the Sensex and Nifty, closed with substantial gains, indicating the market’s buoyancy. Small and medium-sized stocks also saw strong buying interest, leading to notable gains in respective indices.

Sectoral indices across various industries contributed to the positive momentum, with the power sector being a standout performer.

Market experts expressed optimism for the market’s future movements, emphasizing potential targets and key support levels.

These analyses provide valuable insights for investors and traders looking to navigate the complex and dynamic world of the stock market.