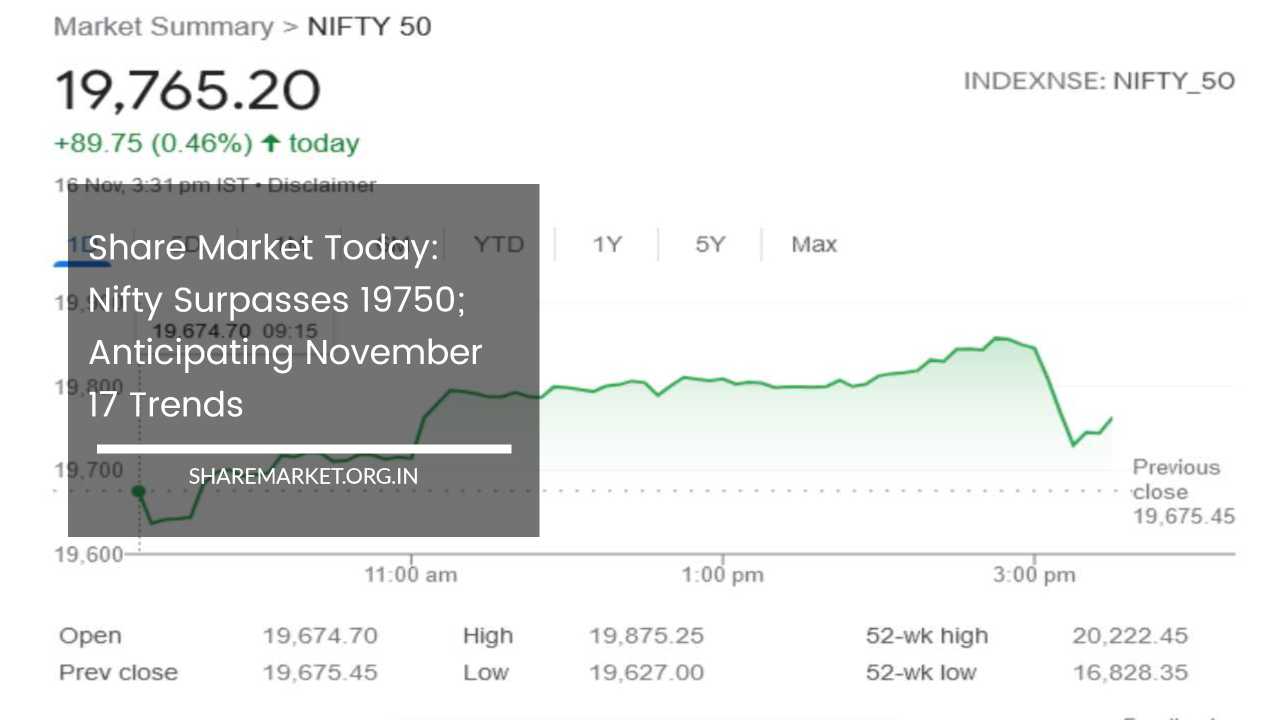

Share Market Today: Nifty Surpasses 19750; Anticipating November 17 Trends

Share Market Today

Market Dynamics Unveiled: Navigating Nifty’s Recent Surge and Anticipating Future Trends

The current market scenario provides an intriguing mix of optimism and caution as Nifty continues its upward trajectory, forming a strong bullish candle on the daily chart.

The recent two-day surge, culminating in Nifty’s closure above 19,750, has sparked both excitement and speculation among investors.

Market Recap on November 16:

On November 16, the stock market witnessed a consecutive two-day rise, with Nifty managing to close above the psychological mark of 19,750.

Sensex, the benchmark index, closed at 65,982.48, gaining 306.55 points or 0.47%. Similarly, Nifty closed at 19,765.20, marking a gain of 89.70 points or 0.46%.

This positive momentum was reflected in the performance of individual stocks, with 1,964 witnessing an increase, 1,665 recording losses, and 109 remaining unchanged.

Examining the gainers and losers, notable performers included Hero MotoCorp, Tech Mahindra, TCS, HCL Technologies, and Infosys on the positive side.

Conversely, Axis Bank, Coal India, Power Grid Corporation, Tata Consumer Products, and Adani Enterprises found themselves among the top losers on the Nifty index.

Sectoral Analysis:

Delving into sectoral indices, the Information Technology (IT) sector emerged as a standout performer, registering an impressive 3% increase. Meanwhile, realty, oil-gas, and auto sectors contributed to the overall positive sentiment with a growth of 1%.

This broad-based upward movement was not confined to large-cap stocks; mid and small-cap stocks also experienced a notable uptick, as reflected in the 1% increase in both the BSE Midcap and Smallcap indices.

Insights from Market Experts:

Aditya Gaggar, Director of Progressive Shares, sheds light on the dominance of tech stocks in shaping Nifty’s performance on the given day.

The impact of this dominance was instrumental in driving Nifty’s gains. However, it’s essential to exercise caution, as Nifty relinquished half of its gains in the final hour of trading, closing at 19,765.20 with an 89.75 point gain.

Gaggar points out that alongside the IT sector, realty and pharma sectors also demonstrated robust performance, each securing a 1% gain.

The day’s trading activity resulted in Nifty forming a strong bullish candle on the daily chart. Yet, prudence is advised, considering the substantial gains in the past two trading sessions.

This raises the possibility of profit booking in the market, potentially leading to a downturn in Nifty.

Technical Analysis and Future Projections:

In the realm of technical analysis, Avdhoot Bagkar, a derivatives and technical analyst at Stockbox, offers valuable insights into the potential future movements of Nifty.

Bagkar suggests that for Nifty to gain new momentum and establish a trajectory toward new historical highs, it must secure a strong closing above 19,850.

While immediate support for Nifty is identified at 19,500, maintaining an optimistic outlook as long as this level holds, the medium-term support is positioned at 19,300.

As long as this support remains intact, the likelihood of a major decline is considered minimal. The technical analysis hints at the critical importance of these support levels in navigating the market in the days to come.

Bagkar introduces the concept of an inverted head and shoulders pattern, sparking interest among investors. However, he emphasizes that it is too early to conclusively state its formation.

The potential upside, as indicated by this pattern, could present a significant opportunity, but market participants are advised to approach it with caution until further confirmation.

Bank Nifty Analysis:

Shifting focus to Bank Nifty, a key player in the broader market dynamics, the 100-Simple Moving Average (SMA) emerges as a crucial resistance level at 44,510.

Bagkar notes that overcoming this hurdle is essential for Bank Nifty to regain strength. Until this milestone is achieved, Bank Nifty may exhibit signs of weakness.

Bank Nifty’s immediate support is identified in the range of 43,500-43,600, and a potential decline is on the horizon if it breaches the 43,000 mark.

Investors and traders closely monitoring Bank Nifty are urged to pay heed to these support and resistance levels, as they could serve as decisive indicators of the index’s future trajectory.

Investment Strategy and Risk Mitigation:

As investors navigate the evolving market landscape, a balanced investment strategy and risk mitigation become paramount.

The recent gains in Nifty, coupled with the prevailing uncertainties, underscore the need for a cautious approach.

Investors are encouraged to remain vigilant, closely monitor key support and resistance levels, and adapt their strategies based on evolving market dynamics.

In conclusion, the recent market movements provide a mix of opportunities and challenges. The bullish trend exhibited by Nifty, coupled with sectoral performances, has generated optimism.

However, the potential for profit booking and the importance of key technical levels necessitate a careful and informed approach.

Market participants should stay abreast of expert analyses, monitor unfolding patterns, and remain adaptable in response to the dynamic nature of the financial markets.

The coming sessions, particularly on November 17, will likely offer further insights into the direction of the market, providing investors with valuable information to inform their decision-making processes.