Share Market Today: Sensex and Nifty Close with Gains, Anticipating Market Movements on November 22nd

Share Market Today

Aditya Gaggar, representing Progressive Shares, delves into the intricacies of the current market scenario with a specific focus on the Nifty index.

Gaggar’s analysis provides a roadmap for investors and traders by anticipating potential resistance at 19,840 and identifying crucial support at 19,700.

This comprehensive examination includes a review of the market’s performance on November 21, sectoral dynamics, individual stock movements, and expert opinions on future market movements.

Market Performance on November 21: A Rebound After Decline

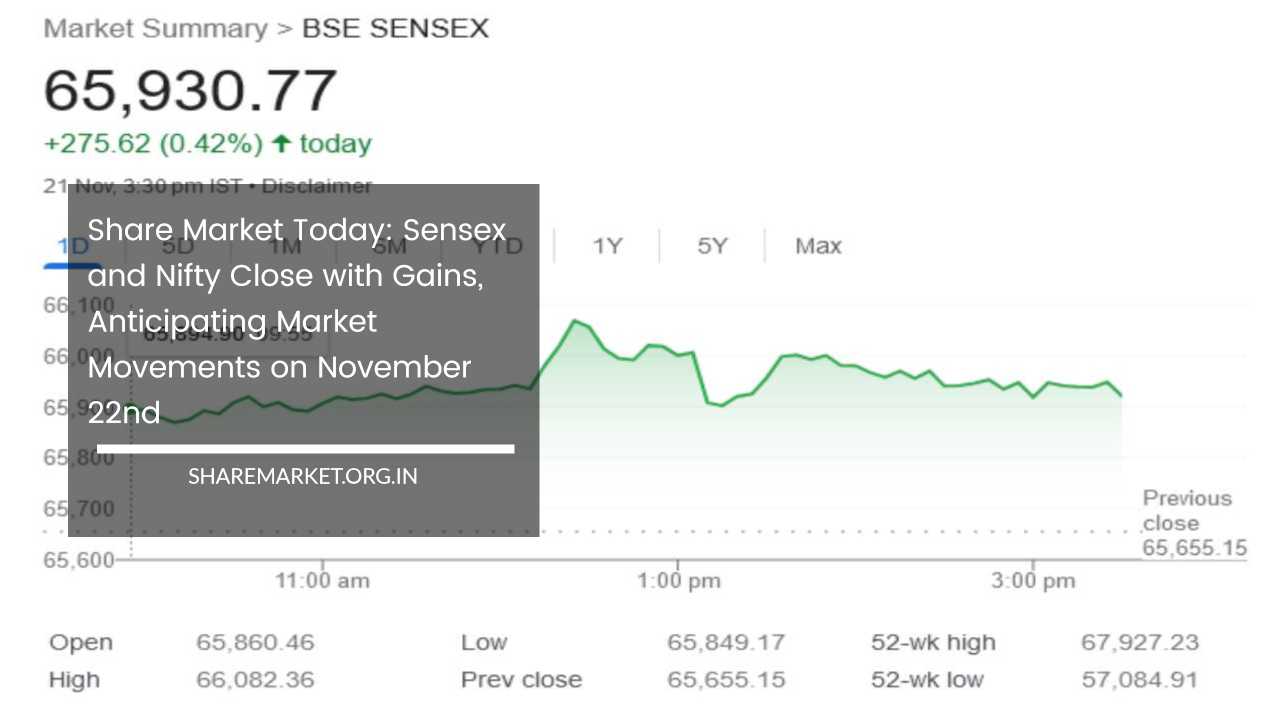

The equity market on November 21 showcased a positive rebound following a two-day decline. The Sensex closed at 65,930.77, recording an increase of 275.62 points or 0.42%, while the Nifty closed at 19,783.40, up by 89.40 points or 0.45%.

The day commenced with a gap-up opening above 19,750, influenced by positive global cues. The bullish sentiment persisted throughout the day, leading to Nifty crossing the 19,800 mark and Sensex crossing 66,000 intraday.

Stock Movements: Gains and Losses on Nifty

A closer look at specific stocks reveals divergent performances on Nifty. Notable gainers included SBI Life Insurance, HDFC Life, Adani Enterprises, Hindalco Industries, and JSW Steel.

On the flip side, declining shares encompassed Coal India, ONGC, BPCL, Tech Mahindra, and LTIMindtree. This variance in individual stock performance underscores the diverse dynamics within the market, providing investors with insights into sector-specific movements.

Sectoral Analysis: Unraveling Market Trends

The sectoral indices offer a nuanced understanding of market trends. The Pharma, Realty, and Metal sectors witnessed a 1% rise, indicating positive momentum.

Conversely, the Oil & Gas and Capital Goods indices experienced a decline of 0.5%. This sectoral analysis unveils the sectors contributing to the overall market movement, guiding investors in making informed decisions based on sector-specific trends.

Market Capitalization Insights: Balancing Midcap and Smallcap Performance

The BSE Midcap and Smallcap indices closed with marginal gains, suggesting a balanced performance across different market capitalizations. Notably, 350 shares in the market touched their 52-week high during trading.

These included companies such as New India Assurance Company, KNR Construction, KEI Industries, PCBL, Prism Johnson, Oberoi Realty, Narayana Hrudayalaya, Latent View, BASF, and Gujarat Pipavav. This highlights the presence of individual stocks exhibiting robust performance and achieving significant milestones.

Previewing November 22: Expert Perspectives on Nifty Movements

Jatin Gediya of Sharekhan by BNP Paribas provides a technical perspective on Nifty’s potential movements on November 22.

He observes a gap-up opening followed by consolidation throughout the day, ultimately closing up by 89 points.

Over the last four trading sessions, Nifty has been trading within the range of 19,875 – 19,627. Notably, it has found support above the zone of 19,650 – 19,600.

Gediya expects Nifty to hold this support zone and move upwards in the next few trading sessions, provided it does not break the mentioned range.

Crucial Support and Resistance Zones: Navigating Future Movements

The crucial support zone for Nifty is identified as 19,610 – 19,650, while the immediate resistance zone stands at 19,900 – 19,930.

These key levels, as highlighted by Gediya, serve as essential markers for traders and investors, providing a strategic framework for potential entry and exit points in the market.

Banking Sector Outlook: Strengths and Cautions

In the banking sector, Bank Nifty closed with a gain of 110 points, showcasing strength. Gediya anticipates a continued pullback towards 44,000 – 44,050 levels in the short term.

However, he cautions that a breach below 43,400 could weaken the structure, leading to further decline. This cautionary note emphasizes the importance of monitoring critical levels for informed decision-making.

Aditya Gaggar’s Market Assessment: Positive Sentiment and Technical Patterns

Aditya Gaggar echoes a positive sentiment regarding the market’s performance on November 21. He notes a strong start to the session, with the index rising consistently throughout the day, driven by the metals sector and select heavyweight stocks.

Nifty closed at 19,783.40, marking a gain of 89.40 points. While the realty segment experienced growth, PSU banking closed in the red.

A noteworthy observation by Gaggar was the regular profit-taking activity in the technology sector, contrasting with a boom in the pharma sector.

He highlighted that Nifty formed a shooting star candlestick pattern near its important resistance level of 19,840. This pattern typically indicates potential trading against the prevailing trend.

Identifying Critical Levels for Nifty: Resistance and Support

Aditya Gaggar emphasizes critical levels for Nifty, identifying a strong resistance at 19,840 and support at 19,700 at higher levels.

These insights are crucial for traders and investors, providing a roadmap for potential entry and exit points in the market. Gaggar’s analysis combines technical patterns with a deep understanding of market dynamics, offering a comprehensive perspective for decision-makers.

In Conclusion: Navigating Market Dynamics

In summary, the market on November 21 exhibited a positive rebound after a brief decline, with specific sectors and stocks driving the upward movement.

The technical analyses provided by Jatin Gediya and Aditya Gaggar offer valuable perspectives on the current market dynamics and potential future trends.

Investors and traders can use these insights to make informed decisions, navigating the market with a nuanced understanding of key support and resistance levels.

As the market continues to evolve, staying attuned to expert analyses becomes paramount for strategic decision-making in the ever-changing landscape of financial markets.