Share Market Today: Stock Markets Hit New Record Highs; Nifty Prediction for Tomorrow

Share Market Today

Market Analysis: Mixed Sectoral Trends and Record-Breaking Momentum Continue

In the dynamic landscape of the stock market, December 5th unfolded with mixed sectoral trends, capturing the attention of investors.

The Power index emerged as a standout performer, recording an impressive gain of 6%, while the oil-gas and bank indices closed with more modest but significant gains of 1-1%.

This session marked the sixth consecutive day of a record-breaking rise in the market, creating a buzz among investors and analysts alike.

Market Overview:

As the trading day concluded, the Nifty, a key benchmark, stood at around 20,850. Top gainers on the Nifty included Adani Enterprises, Adani Ports, Power Grid Corporation, NTPC, and ICICI Bank.

Conversely, LTI Mindtree, HCL Technologies, Divis Labs, HUL, and Bajaj Auto found themselves among the top losers.

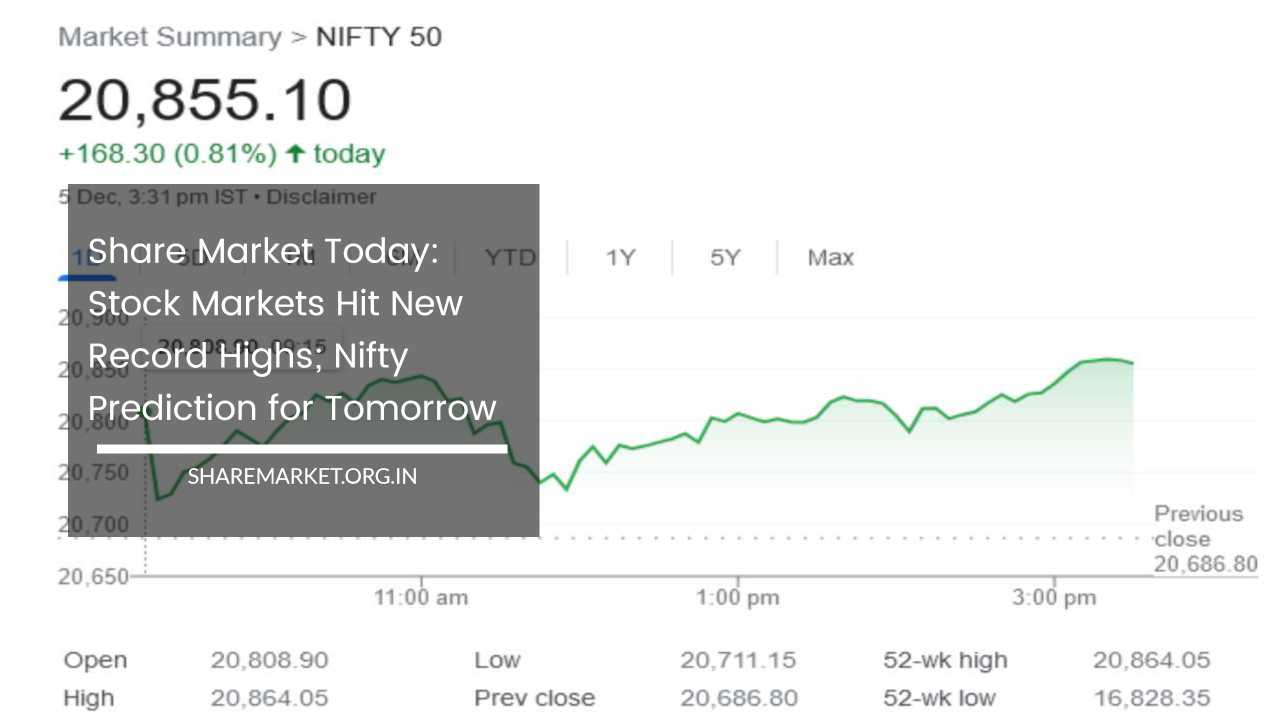

The broader market indices reflected this mixed sentiment, with the Sensex closing at 69,296.14, exhibiting an uptick of 431.02 points or 0.63%, and Nifty closing at 20,855.10, marking a gain of 168.30 points or 0.81%.

The market breadth, as indicated by the number of advancing and declining stocks, revealed that approximately 1611 shares experienced gains, 1833 shares witnessed a decline, while 99 shares remained unchanged.

Sectoral Impact:

Sectoral indices played a pivotal role in shaping the day’s trading narrative. The Power index, buoyed by a 6% gain, underscored the strength and resilience of the power sector within the broader market context.

In parallel, the oil-gas and bank indices registered commendable increases of 1-1%, contributing to the overall positive sentiment.

However, the IT and realty indices faced headwinds, each witnessing a 0.5% decline. Meanwhile, the BSE Mid and Smallcap indices displayed marginal gains, adding further nuance to the overall market dynamics.

Expert Insights:

Vinod Nair, a seasoned analyst at Geojit Financial Services, shed light on the factors propelling the market’s upward trajectory. According to Nair, the week witnessed the domestic market maintaining its upward momentum, reaching new highs.

Factors such as the euphoria surrounding state election results and better-than-expected GDP data played a pivotal role in bolstering market sentiment.

Additionally, the return of Foreign Institutional Investors (FIIs) to Indian markets injected further optimism.

Looking ahead, Nair highlighted the significance of the upcoming Reserve Bank of India (RBI) monetary policy meeting.

While a status quo on interest rates is anticipated, market participants will closely scrutinize RBI’s commentary on economic growth, food prices, and the inflation situation for insights into future market movements.

As investors brace themselves for the upcoming trading day on December 6th, experts in the field offer diverse perspectives on the potential market trajectory.

Aditya Gaggar, Director of Progressive Shares, provides insights into the immediate future of the market. Gaggar notes that the market exhibited forward momentum during the most recent session, with Nifty starting the day at a record high of 20,800.

However, caution is warranted as overbought conditions triggered a sudden reaction in the afternoon trading session.

The resultant rapid correction confined Nifty to a limited range for the remainder of the day. Closing at 20,855.10, with a gain of 168.30 points, Nifty’s technical analysis reveals the formation of a Hanging Man candlestick pattern.

Gaggar suggests the possibility of further corrections, both in terms of price and time. In the event of a price correction, a definitive trend reversal in Nifty would only be confirmed with a close below the critical level of 20,700.

Shrey Jain, Founder and CEO of SAS Online, echoes a sentiment of caution despite the prevailing bullish trend. Notably, Nifty’s entry into the overbought zone is underscored by the Relative Strength Index (RSI) crossing the 80 thresholds.

This technical indicator suggests a potential scenario of profit booking, necessitating a strategic approach. Jain recommends adjusting and trailing stop losses to effectively manage potential risks associated with the current market conditions.

Ajit Mishra, a strategist at Religare Broking, adopts a more optimistic stance. Despite acknowledging overbought readings resulting from rotational buying in heavyweight stocks, Mishra envisions Nifty’s trajectory reaching new milestones, specifically pointing towards the “21,000+” point range.

In light of this, he advises investors to focus on stocks that have been on the sidelines but are now poised to join the mainstream.

Additionally, Mishra suggests that traders adhere to existing positions, incorporating trailing stop losses to capitalize on the prevailing trend.

Final Thoughts:

In conclusion, the market landscape, characterized by mixed sectoral trends and a record-breaking ascent, provides both opportunities and challenges for investors.

As market participants navigate the complexities, the cautious optimism expressed by analysts underscores the importance of vigilance and strategic risk management in the ever-evolving financial markets.

With the RBI monetary policy meeting on the horizon, market watchers eagerly anticipate insights that could potentially shape the course of market movements in the days to come.

As the market continues its streak of breaking records, investors remain vigilant, ready to adapt to the dynamic shifts that define the financial landscape.