Share Market Today:The Market Closed with a 1% Gain, Predicting Its Movement on 7th November

Share Market Today

The stock market report provides a comprehensive overview of the recent developments in the market, highlighting both the specific stock movements and the overall market outlook for November 6th.

Stock Movements

The report starts by examining the movements of specific stocks and sectors on November 6th. It notes that there was a long build-up observed in Aarti Industries, JK Cement, and Metropolis Healthcare.

Conversely, there was a short build-up in Bank of Baroda, Zee Entertainment Enterprises, and Vodafone Idea. This information is crucial for investors as it provides insights into the sentiment surrounding these stocks and sectors.

Among the top gainers on Nifty were Divis Laboratories, Hero MotoCorp, Eicher Motors, Larsen & Toubro, and Axis Bank.

These stocks recorded significant gains during the trading session, reflecting positive sentiment and investor interest.

On the other hand, SBI, HUL, Tata Motors, Cipla, and Titan Company were among the top losers of Nifty. This indicates that some stocks faced selling pressure on the same day.

The report also highlights the performance of various sectoral indices. Notably, except for the PSU Bank sector, all sectoral indices closed in the green. The PSU Bank index closed with a decline of 1 percent, suggesting challenges within this sector.

In contrast, the Pharma, Capital Goods, Metal, Oil and Gas, Power, and Realty sectors all experienced an increase of one percent or more, showing strength and positive movement.

It’s also noteworthy that Aarti Industries, Bharat Forge, and Bata India saw a significant increase in their trading volumes, with growth exceeding 500 percent. This heightened trading activity indicates increased investor interest and participation in these stocks.

Moreover, over 240 stocks hit their 52-week high on BSE, including names like Amber Enterprises, Kalyan Jeweller, Zomato, Suzlon Energy, Esab India, Crisil, Brigade Enterprises, Phoenix Mills, and Godrej Properties. This suggests that these stocks have been performing exceptionally well and reaching new highs, which may attract more investor attention.

Market Outlook

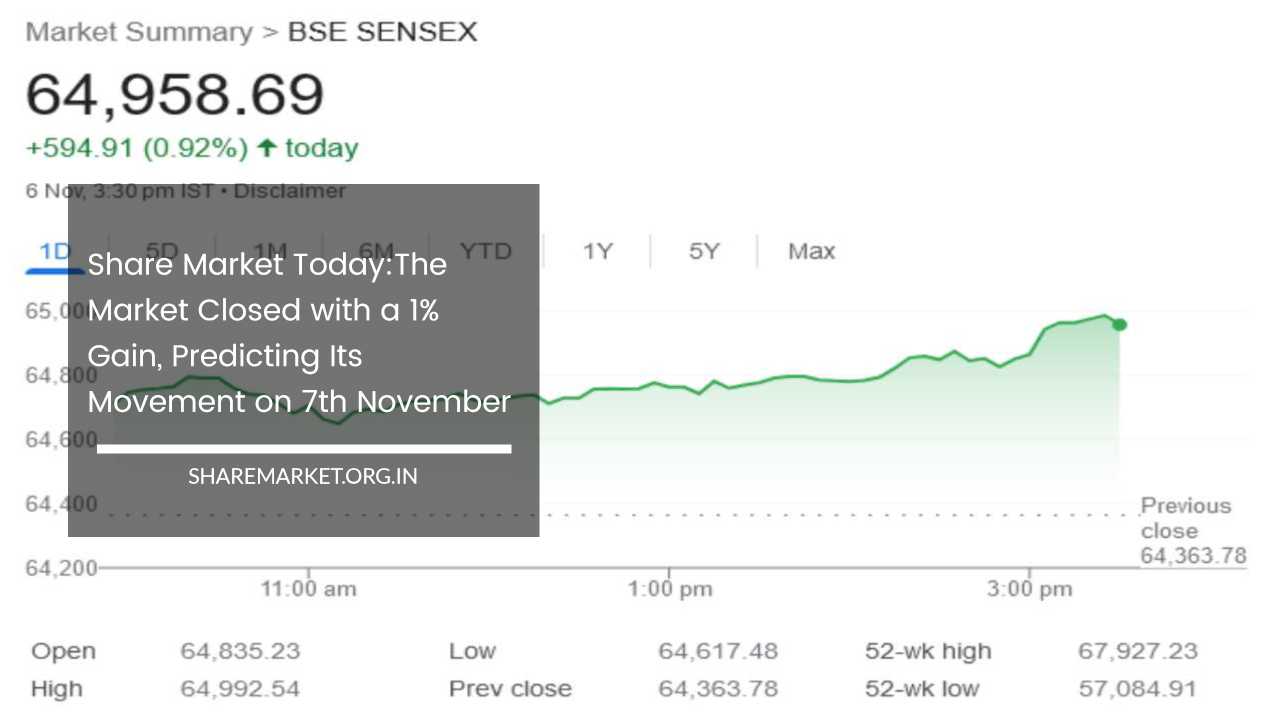

The report paints a positive picture of the market outlook for November 6th. It mentions that the market witnessed a rise for the third consecutive day, with the 3-share index Sensex closing at 64,958.69, marking a gain of 594.91 points or 0.92 percent.

Simultaneously, the Nifty closed at 19,411.80, with a gain of 181.20 points or 0.94 percent. This reflects a bullish trend in the market, indicating that investors were confident about the outlook for the day.

The day’s trading session began with a bullish start, and as it progressed, the market gained momentum. In the last hour of trading, Nifty crossed the 19,400 mark, driven by buying activity in various sectors, except for PSU banks.

The positive sentiment was not limited to large-cap stocks; small and medium-cap stocks also performed well, with BSE Midcap and Smallcap indices closing one percent higher.

The report highlights the specific sectors that contributed to the positive market performance. Notably, Metal, Energy, and Pharma sectors each recorded gains of more than one percent.

These sectors were instrumental in driving the overall market higher. It’s evident that investors were favoring these sectors on that particular day.

The report goes on to identify the top gainers and losers in the market. The top gainers included Divis Laboratories, Hero MotoCorp, Eicher Motors, Larsen & Toubro, and Axis Bank. On the flip side, SBI, HUL, Tata Motors, Cipla, and Titan Company were among the top losers.

This information is valuable for investors as it helps them understand which stocks were performing well and which were facing challenges.

Market Momentum and Future Outlook

The report suggests that the market’s positive momentum can be attributed, in part, to the strength in the American market. The global context and international market trends play a significant role in influencing Indian stock markets.

If the American market is performing well and shows signs of stability, it tends to boost investor confidence in other markets as well.

The report provides an outlook for Nifty, suggesting that it may be on its way to the next resistance level of 19,500. Resistance levels are important technical indicators that can help traders and investors make informed decisions.

If Nifty can surpass this level, it could be seen as a bullish signal, potentially attracting more buyers to the market.

Furthermore, the report emphasizes the importance of monitoring global market movements and the participation of banking stocks in determining the market’s future direction.

This is a key consideration for investors and traders, as banking stocks often have a significant impact on the overall health of the market.

In conclusion, the stock market report for November 6th paints a positive picture of the market’s performance on that day. It highlights the movements of specific stocks and sectors, providing insights into investor sentiment.

The overall market outlook was bullish, with the Sensex and Nifty both recording gains. The report also identifies top gainers and losers and emphasizes the role of global market trends and banking stocks in shaping the market’s future direction.

Investors and traders can use this information to make informed decisions and adjust their strategies accordingly.

However, it’s important to remember that the stock market is subject to fluctuations, and past performance is not always indicative of future results. Staying informed and conducting thorough research is essential for successful investing in the stock market.